China's new bank lending and total social financing (TSF) exceeded market expectations in January. Net new RMB loans totaled 1.32 trillion yuan (UBSe 1.25 trillion, BBG average 1.1 trillion), while new TSF hit a record of RMB 2.58 trillion (UBSe and BBG average 1.9 trillion). While it is usual that new credit picks up in the beginning of each year as pent-up demand from the end of the previous year is satisfied and banks rush to front-load lending, the strength of this year's initial credit growth is still somewhat surprising. Clearly, market worries about excessive credit tightening due to rising interest rates or trust problems appear unwarranted for now.

New bank yuan lending saw the most growth compared with January 2013, while the rest of TSF was marginally weaker. Within the latter, off-balance sheet entrusted loans rose the most, by about 190 billion yuan; new issuance of bill acceptance was also high. In contrast, new trust loans weakened relative to last month and a year earlier, perhaps partly due to weakening investor confidence attributed to recent reports on troubled trust products. New corporate bond issuance also softened, possibly due to tighter liquidity conditions and higher interbank bond market rates.

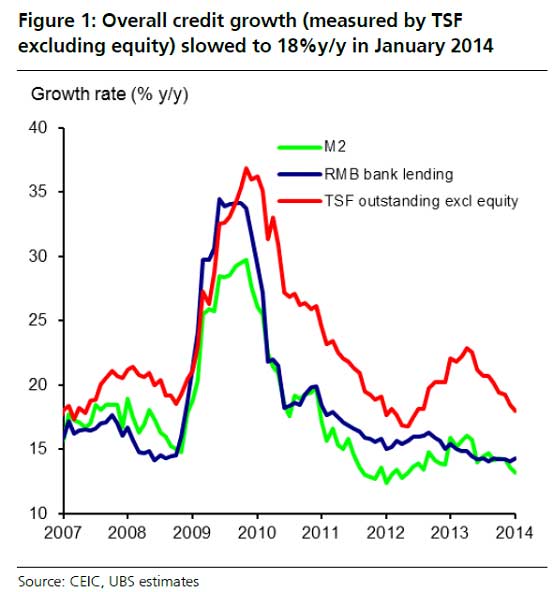

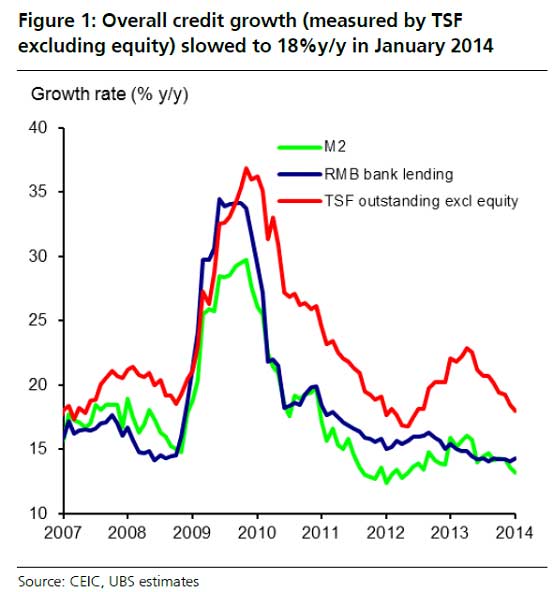

Due to last year's high base, overall credit growth (as measured by TSF excluding equity fund raising) slowed marginally from 18.4 percent year-on-year in December to 18 percent year-on-year in January (Figure 1). However, from a flow perspective, new credit growth accelerated sequentially, as our credit impulse measure picked up from about 25 percent to 30 percent in January on a 3mma basis (Figure 2).