Focus on economic undercurrents necessary

Updated: 2014-01-22 16:25

By Xin Zhiming (chinadaily.com.cn)

|

|||||||||||

Policymakers from the National Development and Reform Commission expressed optimism toward China's stable growth for the year on Wednesday, a tone earlier shared by the top National Bureau of Statistics official at a press conference on Monday.

Based on newly released economic statistics, officials are within reason to have a positive view of the world's second-largest economy.

Although China's GDP growth slowed to 7.7 percent in 2013, in stark contrast with two-digit growth figures from two years ago, the country remains one of the best performers in the crisis-laden world.

The economy's structure, in particular, is starting to improve, with consumption overtaking the role of investment and foreign trade to become a main pillar of economic expansion.

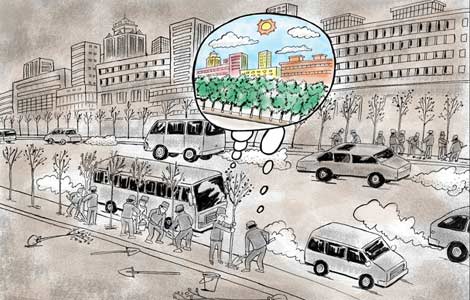

While some headway has been made in economic restructuring and growth stabilization efforts, policymakers should brace themselves for economic undercurrents, such as mounting local government debt and housing price bubbles.

The potential risks can be dealt with as the economy expands at a fast pace. But as Anders Aslund, senior fellow at the Peterson Institute for International Economics has argued, growth of emerging-market economies, including China, could experience a decrease while moving forward.

If he is right (I hope he isn't), China, and other emerging-market economies, would have to cope with the dual challenges of maintaining a decent growth rate while pushing restructuring reforms, tasks that inherently conflict with each other.

The situation would experience further complications as the US Federal Reserve tapers its quantitative easing program, a move set to bring about capital flow abnormalities to Asian financial markets, China included.

A subtle touch is needed for effective policymaking, so that proper stimulus measures can be taken to maintain stable growth when the economy weakens while control of local government debts and real estate prices would not lead to serious financial disruptions.

All of this would prove a much more challenging task than simply stimulating growth.

Related Stories

Premier confident over economic growth 2014-01-22 09:56

Vice-minister calls for new economic growth model 2014-01-03 07:42

China starts four-dimensional mode of economic growth 2013-12-18 11:24

China sets sights on reform, stable economic growth 2013-12-16 07:21

China’s astounding economic growth 2013-11-12 14:20

Today's Top News

Man, 36, executed for rape, murder of sex slaves

Beijing court accepts GM spat defamation case

Obama, Putin discuss Olympics security in call

Japan seeks US understanding about dolphin hunt

Belarus expects more from Silk Road

Suspected cyberattack on China

China, EU talking investment

Li hails work of foreign experts

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|