No clear rules for family trusts: UBS

Updated: 2013-10-31 07:14

By Yu Ran in Shanghai (China Daily)

|

|||||||||||

|

An increasing number of wealthy Chinese are seeking to make better use of their assets and get them properly protected in order to pass them on to the next generation, according to a senior official at UBS Securities Co Ltd. Provided to China Daily |

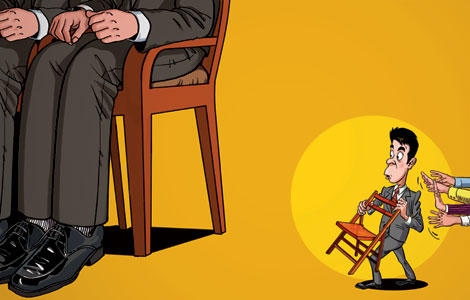

Setting up a family trust using wealth management services on the Chinese mainland is still not an option, as existing laws don't have clear rules to protect the interests of clients, said a senior official at UBS Securities Co Ltd.

An increasing number of wealthy Chinese are seeking to make better use of their assets and get them properly protected in order to pass them on to the next generation, UBS Securities added.

"We've been receiving continuous inquiries from our Chinese clients on family trusts in the past two to three years, as they realized that they have to consider how to pass on the assets to their children securely, but unfortunately we still cannot help them out," said Tan Yuan Kueh, managing director and wealth management CEO at UBS Securities China.

She added that most wealthy businessmen in China use her firm's services in overseas locations.

Family trusts are a common and efficient wealth management method in many countries to keep assets in the family and minimize taxes.

However, the scenario is different in China.

Zhang Qiong, UBS Securities' executive director of investment products and wealth management services, said that current Chinese laws don't clarify the final ownership of family trusts and that the registration of trust assets is not yet allowed.

Therefore, trust companies in China are still providing wealth management services via low-risk financial products and trust products instead of setting up family trusts.

"As we don't want to bring any obvious risks to our clients, we currently don't have any family trust services in China," Zhang said.

Meanwhile, wealthy local residents are looking forward to having their assets properly protected for the second generations.

"If family trusts are legalized and have clear regulations, I would definitely choose to set up one to ensure that my children will access a certain amount of money as they grow up," said Chen Xiuqing, a property developer in Wenzhou, Zhejiang province.

UBS Securities said that most local businessmen are wisely allocating their financial assets.

"Fewer people are putting their money in the stock market and in the real estate market. At the moment, most of them are waiting for better investment opportunities, while they choose to buy low-risk financial products from banks and other financial institutions," said Jason Liu, head of the corporate advisory group at UBS Securities.

Liu added that trust products with controllable risks also are becoming quite popular among Chinese businessmen.

Meanwhile, more local businessmen are also choosing to make direct investments.

Asia Pacific's wealthiest investors are moving money into direct investment opportunities and away from capital markets as they see greater opportunities in other businesses and in real estate, rather than in the equity and bond markets, according to the second annual UBS/Campden Wealth Asia Pacific Family Office Survey.

The survey showed that real estate investing receives the biggest asset allocation among all the markets in the region.

In addition, Chinese businessmen are also eyeing enhanced educational opportunities for their children when they place their assets overseas.

"More clients are willing to send their children overseas to high schools and universities, which they see as an opportunity to see the world and bring some knowledge back to help run the family businesses," said Liu.

yuran@chinadaily.com.cn

Today's Top News

Firms heading home as benefits wane in China

US urged to explain phone taps

Disclosure of WTO report rebuked

Vaccine gets nod for global use

Freer RMB 'can answer US claims'

'Dangerous provocation' condemned

Promoting baby formula prohibited in hospitals

Police told to protect medical workers

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|