FTZ to be template for change

Updated: 2013-10-30 23:51

By Li Jiabao (China Daily)

|

|||||||||||

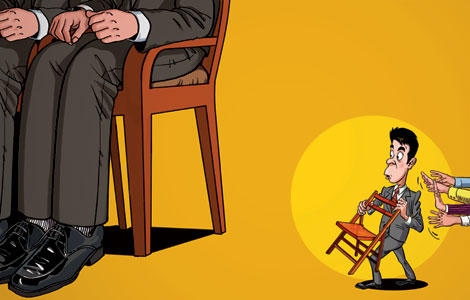

The month-old China (Shanghai) Pilot Free Trade Zone will propel domestic reforms, while restrictions on foreign investment in the FTZ will be shortened, a senior government adviser said on Wednesday.

The government will be "prudent" in introducing policies in the zone, said Long Guoqiang, director-general of the General Office of the Development Research Center of the State Council.

Long said that the approval of new zones elsewhere in the nation "will not be related to the progress" of the Shanghai FTZ.

"The Shanghai FTZ will be the pilot and explorer of China's economic upgrading," Long said. "In addition to liberalization of trade and tariffs, a very important part of the pilot is the opening of the service sector.

"Government functions will also be transformed to gain experience (for new free trade zones). We hope the opening of the service sector will push forward reforms at home," Long said.

The official launch of the FTZ on Sept 29 has been hailed as a major reform initiative of the nation's new leadership.

Long added that the pilot zone is taking off amid a changing domestic and global economic landscape.

The world's second-largest economy is losing its low-cost manufacturing advantage and attempting to establish a new advantage in higher value-added activities.

The nation's service sector lags behind those in other countries, he said. Meanwhile, regional economic integration among developed economies is establishing new parameters for global trade and investment and posing challenges for China.

"The pilot zone perfectly melds the central government's intention of further opening up with local governments' drive to accelerate economic growth. Investors are optimistic about China's future and the pilot zone," Long said.

As of Tuesday, 21 foreign enterprises had been established in the zone, with a total investment of $525 million.

Domestic investors had set up 213 businesses with total registered capital of $2.75 billion yuan ($450 million).

Among the new enterprises, 60 percent are in the trade sector while 33 percent are in the service sector, according to the Shanghai government.

Doubts have arisen about the long "negative list" of activities banned in the zone, as well as the conservative approach being taken to financial liberalization.

"The first month of the pilot zone did not see many policies to open up the finance sector, although many were listed in the approval (for the zone) by the State Council.

"As time passes, the ‘negative list' will be shortened. A very short list cannot be expected in such a short period," Long said.

He added that the zone is pioneering totally new innovations. Thus, related policies should be thoroughly deliberated and systematically designed, rather than hastily introduced, to maintain authority and stability.

He added the opening of the capital account within the zone won't create shocks in the domestic market, as it's aimed at better connections between China's financial markets and those elsewhere in the world.

Shanghai Mayor Yang Xiong said during a weekend meeting that financial services are intended to facilitate trade rather than to serve the financial sector.

Since the Shanghai zone became a reality, local governments from Guangzhou to Tianjin have also applied to set up their own FTZs.

"New free trade zones will be approved when the conditions are ripe. I don't think the pace of approving new zones is linked to the progress of the Shanghai zone, because different zones have different aims and purposes," Long said.

He added that the Shanghai FTZ won't directly compete with Hong Kong. Instead, Hong Kong will gain opportunities from the Chinese mainland's economic transformation.

Related Stories

First month report from FTZ 2013-10-30 18:42

Shanghai FTZ 'serves as pilot for economic upgrading' 2013-10-30 15:11

FTZ viewed with hope, skepticism 2013-10-30 07:33

More firms register in Shanghai pilot FTZ 2013-10-30 07:33

Today's Top News

Firms heading home as benefits wane in China

US urged to explain phone taps

Disclosure of WTO report rebuked

Vaccine gets nod for global use

Freer RMB 'can answer US claims'

'Dangerous provocation' condemned

Promoting baby formula prohibited in hospitals

Police told to protect medical workers

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|