Good governance good for growth

Updated: 2013-10-28 07:26

By Alfred Romann in Hong Kong (China Daily)

|

|||||||||||

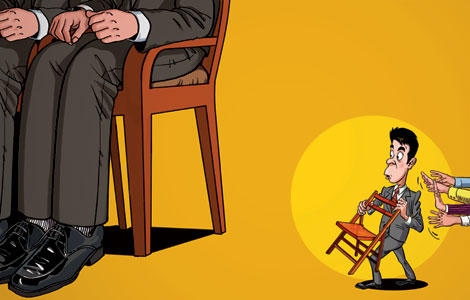

Trade rule transparency, political stability are needed for progress

Weak governance structures, particularly across developing Asia, are creating bumps along the road to fast economic growth.

While there has been some progress, both in public and corporate governance, this progress has been spotty. Over the past couple of decades, there have been visible slides in the quality of governance across Asia, often linked to one crisis or another. The quality of governance dropped in 1997 during the Asian financial crisis and again in 2008 during the global financial crisis.

This is counterintuitive. A number of studies suggest better governance can lead to faster economic growth and more trade. Advanced economies in Asia have better prospects than most of the world's economies but, according to the Asian Development Bank (ADB), weak governance curtails a positive economic outlook by scaring away investment and limiting trade.

|

Good governance is not easy to define but includes elements such as political stability, the absence of violence, corruption controls, a voice and accountability.

By most measures, the progress in governance across developing Asia has lagged behind economic growth by a long way.

"One area of reform that we believe Asian policymakers have to pay more attention to is the area of governance," says Changyong Rhee, chief economist of ADB.

On one hand, most countries in the region have been rapidly closing the economic gap that exists between them and the most advanced economies in the world. On the other, they have been much slower at closing a similar governance gap.

In the early 1990s, the average per capita incomes across developing Asia amounted to about 5 percent of incomes across members of the Organization for Economic Cooperation and Development (OECD), a rich-country club. Incomes in developing Asia are now about 18 percent of those in the OECD. In other words, Asia is catching up.

The same cannot necessarily be said of governance.

ADB says most indicators on the International Country Risk Guide - a monthly collection of detailed data provided by the PRS Group, a US risk rating agency - have shown only "modest gains" in the last two decades. In fact, through the 1997-1998 Asian financial crisis, efforts to control and limit corruption dropped visibly.

Developing Asia also trails countries at similar levels of development. The 2011 World Governance Index indicators suggest Latin American countries with similar GDP per capita levels typically perform better in terms of government effectiveness, political stability, quality of regulations, rule of law and voice and accountability.

Better governance matters because, as empirical studies show, better governance creates the conditions for faster growth, higher investment and faster poverty reduction.

This is particularly true for areas such as government effectiveness, rule of law, regulatory quality and corruption control. These are all areas in which East Asian countries are relatively stronger at than South Asian countries - which are, in turn, stronger at accountability and voice.

The quality of governance matters for business and affects their willingness to invest and trade with a particular country. A case in point, says Michael Ducker, president and international chief operating officer at FedEx Express, is the quality of rules and enforcement of rules and regulations related to customs.

Related Stories

No policy tightening by PBOC: HSBC economists 2013-10-25 17:18

72-hour visa-free policy in China 2013-10-23 18:38

Draft requires environmental reviews of govt policy 2013-10-22 09:08

Central bank says housing credit policy unchanged 2013-10-17 10:06

Policies to boost FTZ capital market 2013-09-30 11:29

Today's Top News

Storm wrecks havoc in S Britain, leaving 4 dead

'Prime time' for Chinese firms to invest in EU

China providing space training

Antiquated ideas source of Abe strategy

Women's congress aims to close gap

Accident in Tian'anmen kills 5

Media giant comes of age

Miscommunication source of conflicts

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|