Trade winds put protectionism on agenda

Updated: 2013-10-28 00:37

By ALFRED ROMANN in Hong Kong and BEN YUE in Bali (China Daily)

|

|||||||||||

Efforts made to remove export, import barriers as Asia's intra-regional commerce evolves

Tucked away in a corner of Malaysia is the sultanate of Brunei Darussalam, a tiny country along 161 km of coast with just 415,000 people who enjoy some of the highest standards of living in the region.

Thanks to plentiful oil and gas, Brunei has the second-highest per capita GDP among the 10 countries of the Association of Southeast Asian Nations (ASEAN).

But Brunei has a problem. The oil and gas that make the country rich account for two-thirds of its economic output. That is ultimately not sustainable, as the Brunei Economic Development Board points out in its latest vision statement for the country.

Instead, Brunei is looking to increase trade with its neighbors to both diversify and build a more stable foundation.

With global demand still slack, many Asian economies such as Brunei are counting on intra-regional trade, powered by greater domestic demand, to sustain and drive economic growth.

ASEAN's experience is a case in point. The bloc's intra-regional trade and trade with China now accounts for about 37 percent of its total, up from 26 percent in 2000. On the other hand, the proportion of ASEAN's trade with the US has fallen from 20 percent in 2000 to 10 percent in 2011 while trade with Europe has dropped from 15 percent to 11 percent.

Freer trade, at least for the foreseeable future, is likely to happen on a regional basis. "Any move to create free trade is always positive," says Matthew Circosta, an economist at Moody's Analytics. "There are certainly some political tensions… (but) in the longer term, it will certainly create growth."

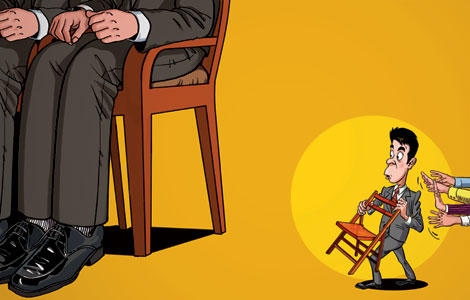

With the Doha Round of World Trade Organization (WTO) negotiations all but stalled and a resurgence of protectionism in the wake of the global financial crisis of 2008, it has been left to partners and neighbors to lower barriers to trade by creating regional blocs. Nowhere are these trade blocs more visible than in Asia.

The WTO estimates that Asia's trade with the rest of the world will top $5.5 trillion by 2020, up from $3 trillion in 2009. Intra-Asia trade, on the other hand, could jump to almost $11 trillion from $3.7 trillion. Regional trade is expected to grow by more than 10 percent per year, compared with 6 percent for trade between Asia and other parts of the world.

"We are seeing a tendency of regionalism and bilateralism, which is why we are not seeing the spirit of a multilateral trade system striving as much as we would want it to," said Gita Wirjawan, Indonesia's trade minister, during a CEO Summit held on the sidelines of the Asia-Pacific Economic Cooperation (APEC) forum in Bali earlier this month.

This push toward greater regional free trade is very visible in Asia and stands in stark contrast with the re-emergence of global protectionism in the last half-decade. The slow progress of the Doha Round, underway since 2001, is an example.

In 2009, the year after the global financial crisis, global trade dropped by 12.5 percent according to the Organization for Economic Cooperation and Development (OECD).

The drop put pressure on countries to adopt protectionist measures, despite the potentially negative impact on national and global economies. Most of this drop was because of a lack of demand, according to the OECD, but countries were quick to put up new barriers to trade such as tariffs and restrictions to protect jobs.

The United States created the Recovery and Reinvestment Act of 2009, which required companies to buy domestic rather than foreign products. Similar campaigns were launched in countries including Indonesia and Australia.

India and Indonesia were among the nations that put in place new import licensing systems, according to a report by the United Nations Conference on Trade and Development.

Many countries, including Malaysia and Indonesia, boosted standards and certification requirements to limit imports. Thailand made it harder to get product certificates from its standards regulator in May 2009. In the second half of 2008, the WTO reported 120 anti-dumping investigations, 35 more than in the first half.

All these measures, while not tariffs, create barriers to trade.

Countries are now working to get back to free trade and focusing on regional agreements to do so. APEC in itself is a giant regional grouping that accounts for 55 percent of global GDP and 44 percent of global trade. Although not based on a trade agreement, the goal of APEC since it was founded in 1989 is trade liberalization. Tariffs in APEC members have dropped from an average of 15 percent in 1994 to 5 percent this year.

An ASEAN summit in Brunei immediately after the APEC meeting underscored this shift toward regional — rather than global — free trade. The summit included leaders from across ASEAN as well as a host of other countries with which ASEAN has free trade or wants to have it.

China's Premier Li Keqiang was on hand. He held a series of meetings with Brunei's Sultan Hassanal Bolkiah and called for negotiations for the proposed Regional Comprehensive Economic Partnership (RCEP) to be completed quickly, ideally by 2015. China and ASEAN, he said, should expand free trade and boost trade to $1 trillion by 2020.

The RCEP is a proposed trade agreement that would include ASEAN along with China, Australia, New Zealand, India, Japan and South Korea. ASEAN already has free trade agreements (FTAs) with all these countries. First proposed in 2011, the bloc would represent 49 percent of the global population and about a third of global economic output, 29 percent of global trade and 26 percent of global foreign direct investment.

All this talk to speed up the development of free trade in the region should be good news for Asian countries. Regional trade is definitely getting freer and is a priority for leaders across the region.

"The (Indonesian) economy is mainly backed by relatively strong investment … from countries we have free trade agreements with," said Wirjawan during the APEC CEO Summit.

"Taiwan, South Korea, the Chinese mainland, Japan: Those are the early (economies) to sign free trade agreements with anybody in the world because they have a very strong supply side narrative."

Studies by the Asian Development Bank Institute (ADBI) suggest few countries are willing to unilaterally liberalize trade or lower tariffs without some kind of reciprocity, so a multilateral push towards free trade should be welcome — and it has been.

The number of FTAs among countries in the region has skyrocketed in the past decade. With 20 FTAs in place at the end of 2012, Singapore has the most agreements of any country in the region. China had 12 at the end of 2012, compared with one in 2000. Indonesia had nine, versus one at the turn of the century.

ASEAN is key to freer regional trade. Although progress is not always fast, the bloc still intends to launch the ASEAN Economic Community by 2015. Members are already working to streamline regulations and unify red tape, working under the idea that better governance should lead to more trade.

Freer trade can spur regional economic integration, said Hiromasa Yonekura, chairman of Sumitomo Chemical, who called on APEC members to build a trade system in the region while strengthening supply chains so that goods, services, people and capital can move across national borders more smoothly and efficiently.

A couple of trade agreements underway might spur this regional push.

Besides the RCEP, another regional agreement is the Trans-Pacific Partnership (TPP), backed by the US. The TPP has been in the works since March 2010 but membership would be limited because it calls for a greater degree of openness, according to ADBI.

In turn, these regions are linked by a "spaghetti bowl" of trade agreements that, while increasingly complicated, is also increasingly comprehensive. An APEC-wide agreement — which has been proposed under the name Free Trade Agreement Asia-Pacific (FTAAP) — could be accomplished by linking the RCEP and the TPP.

ADBI says that a FTAAP could lead to gains in trade of $1.9 trillion by 2025, compared with gains of $644 billion under the RCEP and $295 billion under the TPP. Ultimately, says ADBI, the larger the grouping, the larger the gains.

In theory, all this is good news for developing Asia, which could see trade powered forward by the growth in FTAs.

Brunei, a tiny economy looking to diversify, could be a big beneficiary of its participation in ASEAN and all these agreements.

The ADB expects Brunei's economy to grow by 1.8 to 2 percent through this year and the next but, significantly, the growth is coming from non-energy sectors, which expanded by 3.4 percent in the first three quarters of this year.

This growth, says ADB, highlights the "progress in the government's drive to diversify the economy before hydrocarbon reserves get depleted".

But for FTAs to work, countries will have to look beyond their own concerns and consider the regional economy.

As Philippine President Benigno Aquino said: "There is still a tendency (for countries) to protect their economies, to put up barriers, which lessens economic activity."

Karl Wilson in Sydney contributed to this story. Contact the writers at benyue@chinadailyhk.com.

Related Stories

Protectionism dims China's ceramic industry 2013-10-05 17:34

Xi urges G20 members to fight against protectionism 2013-09-07 13:58

China-Switzerland FTA a 'strong signal' against protectionism 2013-07-08 10:11

'Protectionism harmful for all' 2013-06-15 07:56

Trade protectionism a 'blind alley': Li 2013-06-14 23:29

Today's Top News

Storm wrecks havoc in S Britain, leaving 4 dead

'Prime time' for Chinese firms to invest in EU

China providing space training

Antiquated ideas source of Abe strategy

Women's congress aims to close gap

Accident in Tian'anmen kills 5

Media giant comes of age

Miscommunication source of conflicts

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|