Time to reduce dollar's hold

Updated: 2013-10-14 06:32

By Giles Chance (China Daily)

|

|||||||||||

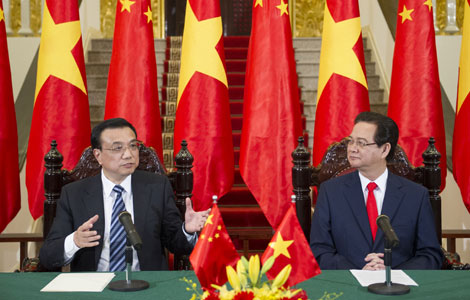

United States government shutdown could cost China dearly: Experts

China holds a significant portion, about $1.1 trillion, of its foreign reserves in debt issued or guaranteed by the US government. As the US' largest foreign debtor, China has every right to be concerned about the US government shutdown that started in Washington on Oct 1 and which shows no sign of ending.

After a short period of calm, debt markets started to show signs of nerves on Oct 5, with short-term US borrowing of one month's maturity offering a significantly higher yield than a week earlier. The increased return on short Treasury bills was necessary to persuade investors to lend money for one month to the US government.

A higher bond yield means a fall in bond prices that for debt maturities of more than five years can mean a loss on paper of 5 to 10 percent or more. Just a tremor in the US debt market can give China a paper loss of hundreds of billions of US dollars. A political earthquake in Washington could cost China a lot more.

According to the US Treasury Secretary, Jack Lew, Oct 17 is the date when the government can no longer pay its bills, without exceeding the debt limit set in 2011 by Congress, of $16.7 billion.

The possible outcome worrying the bond market is that no agreement will be reached between the Democrats and the Republicans by that date. Then, the US government would have to depend entirely on cash inflows from tax receipts and cut spending immediately by about 4 percent of GDP to balance its budget. The sudden pullback in government spending would amount to about $1.1 trillion, or 1.6 percent of world GDP - a big enough shock to cause another world recession. With debt repayments amounting to more than 5 percent of current government spending, the US could stop making payments to its debt-holders. In other words, it could default on its debt.

The news of the government shutdown in Washington has been greeted by most onlookers and the global investment community with dismay. It has been described as irresponsible and childish. Yet the issues concerned are serious ones. Many Americans object strongly to the steady rise in US debt, which has risen from 55 percent of GDP in 2000 to 106 percent last year. Wars are expensive. The US military commitments in Iraq and Afghanistan are estimated to have cost $3 trillion.

But it was the financial crash in 2008 that really did the damage to the US balance sheet. The combination of an economic recession, which shrunk the economy and reduced tax receipts, and additional government spending to boost the US economy and rescue the banking system drove the annual US public deficit from 2.8 percent of GDP in 2007 to 13.3 percent in 2009. Even at today's historically low interest rate levels, the US payments of interest this year will amount to 2 percent of GDP. As interest rates rise, interest payments could double or triple.

What has saved the US, until now, has been the role of the US dollar as the world's major reserve currency, meaning that other central banks hold dollars as backing for their own currencies. The dollar plays a key role in the global financial system. It is still used in the majority of global trading transactions and is the currency used to quote the prices of commodities such as oil and gold. The US Federal Reserve can print as many dollars as it wants, something it has been doing since the crash of 2008. But if the US defaults, the dollar and the price of US debt will both collapse and China, which holds about $1.1 trillion of US debt, will suffer. How could the US remain at the heart of the financial system?

Ironically, the US government shutdown has been caused by politicians in the Republican Party who want to reduce spending and cut the US debt - actions that help to restore the US' position as the keystone of the global financial system.

Many of the Republican politicians behind the shutdown come from the South, and they want to neutralize and destroy Obama. That is the reason why they object to Obama's 2010 Affordable Healthcare Bill, which is aimed at bringing medical care to 40 million poor Americans, and which came into force on Oct 1.

An irreconcilable divide lies at the heart of the breakdown between the two political parties. The US Constitution gives the Senate and House of Representatives considerable power over lawmaking. As Republicans control the lower house in Washington, they can force the government to shut down because they can deny it the authority to borrow more.

There have been many government shutdowns before in the US, as the parties have struggled with each other to agree on spending priorities and government borrowing. None has lasted more than a few days. This time, though, the shutdown could last much longer. The Republicans want to force Obama to give in to their demands - and they could go to extreme lengths to do that. They even welcome the idea that the US could default on its debts, if it helps them achieve their goals.

The US is still the country of the immigrant, a person who rejects established values and leaves his country to find a new home where he can enjoy freedom and independence. The balances inside the Constitution, whereby Congress can hold the president to account while the president can veto laws passed by Congress, were designed to prevent any one element of government from becoming over-powerful. The founding fathers succeeded in that aim, but they also created a foundation for constant struggle between the president and the two houses of Congress. At a time of economic weakness and decline, when firm leadership is needed both for the US and the world, political struggle may signal the end of the US' position as the dominant global financial power.

The issue for the major lenders who have a stake in the US' financial position, such as China, is whether the US is a trustworthy borrower and, beyond that, whether the US should occupy the dominant position in global finance that it does today. The made-in-America financial crash of 2008 was a direct result of the dollar's role as the global currency. This role forces the Federal Reserve to print dollars for export to other countries for use as a store of value and for business transactions. The creation of dollars far beyond its own needs encourages the US to over-borrow and overspend.

In 1945, the US was the only large country left standing with enough strength to support a world recovery after World War II. The principal architect of the post-war financial system, the British economist John Maynard Keynes, foresaw the dangers of having one country's currency used by the whole world. Instead, he wanted a world currency and imagined the International Monetary Fund to be the organization that could issue and manage it. But the US, then in the driving seat, wanted the dollar to reign supreme. Now, 70 years later, the dollar's supreme role is out of date. The guardian of the system has become too weak economically and financially to support the system.

China should gradually reduce its current dollar holdings as a matter of financial prudence and steadily work with others toward a new global financial architecture. Progress will be gradual and slow, because the US will not give up its dominant financial role without a struggle. But the government shutdown in Washington demonstrates that now is the time to start that process.

The author is a visiting professor at Guanghua School of Management, Peking University. The views do not necessarily reflect those of China Daily.

Today's Top News

Senate leader 'confident' fiscal crisis can be averted

China's Sept CPI rose 3.1%

Li Peng's daughter denies 'rumors'

No new findings over Arafat's death: official

Working group to discuss sea issues

Nobel economists rarely get to influence policy

Trending news across China

Chinese firm joins UK airport enterprise

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|