China's globalization 2.0 version

Updated: 2013-10-08 07:17

By Zhang Monan (China Daily)

|

|||||||||||

Shanghai free trade zone heralds new strategy of reform and opening-up and goes with global economic trends

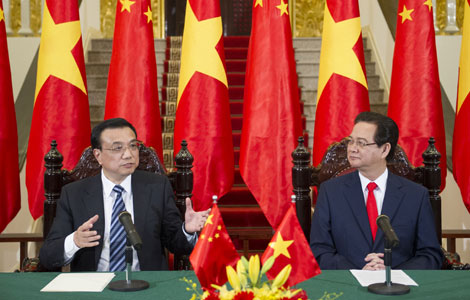

The China (Shanghai) Pilot Free Trade Zone, which was officially launched on Sept 29, is another strategic move in China's latest round of efforts to boost its process of opening-up through further reform.

Since China embarked on the voyage of reform and opening-up more than 30 years ago, every decade has witnessed a growth cycle. The 1980s saw all the key economic factors pay dividends. The second cycle, the 1990s, reaped dividends in system reform, and the third decade, the first of the 21st century, brought dividends from globalization.

Today, a new reform and opening-up strategy symbolized by the Shanghai FTZ is beginning and promises another round of fresh dividends from economic growth, deeper reform and globalization.

Currently there are six types of special economic zones on the Chinese mainland, including bonded zones, bonded logistics zones and bonded port zones. The Shanghai FTZ is believed to be equal in strategic significance to the establishment of the Shenzhen Special Economic Zone in 1980 and the nation's accession to the World Trade Organization in 2001.

China is in the second round of reaping "dividends from globalization". Instead of depending heavily on the low cost of key economic factors in the international distribution of labor, the nation's economic upgrade will be driven mainly by a new global value chain with China's vast domestic market attracting high-value key economic assets, such as technology and overseas talent. And the Shanghai FTZ is tasked with making the plan work as a strategic testing ground.

The Shanghai FTZ's mission is expected to demonstrate how the national value chain should be constructed, to allow the country's processing trade sector to occupy a higher spot in the international distribution of labor. The Yangtze River Delta region is one of China's leading foreign trade bases. Because of its over-reliance on imports for parts and components, the country's processing trade operates with both the R&D and sales ends located overseas. The processing section of the value chain is thus left at home because it is too short to power the supporting industries as much as it should.

This means that the country needs to restructure its processing trade and extend the home section of the value chain by encouraging companies involved in the processing trade to keep forging and sharpening their competitive edge. Multinational corporations will then become confident enough to place their research, production, circulation and service operations in China, thereby optimizing the distribution of labor among mother companies and affiliates, and enabling the processing trade to turn from production to a worldwide operation combining all-round servicing.

The Shanghai FTZ will also serve as an example for regional processing trade centers around the country in extending the industry chain and increasing the ratio of value-added operations. Such efforts will require the coordinated development of foreign-funded and home-grown processing trades, a highly categorized assessment of the processing industry, a clear and detailed industry catalog system in line with international standards, and an increased competitive core strength by means of better guidance on accounting, taxation and brand certification, to name just a few.

As the global influence of China's mainland market has grown over the past 10 years, more and more multinationals have been seeking to set up their Asia-Pacific regional headquarters or even corporate headquarters and global R&D centers in Shanghai. Such shifts will lead to the relocation of complete value chains.

The Shanghai FTZ strategy is not only a response to the pressing demand for a fresh round of reform, but also the result of pressure from another round of globalization in the post-financial crisis era. In light of the overall international situation, we find current negotiations equally focused on trade and investment, while service trade tends to be tied to an investment agreement more than ever. The gathering pace of the Trade in Services Agreement, the Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership negotiations is particularly noteworthy.

Because international free trade agreements are now held to a higher standard, the parties involved are required to provide the framework and content, as well as the be-all and end-all of the agreements, with matching professionalism. For example, most TISA negotiations no longer put limits on the ratio of foreign holdings and business scopes in financial, securities and legal services. But China's policies still maintain measures that limit foreign investment in the industries concerned under the framework of multilateral trade adopted by WTO members. This means China is not yet qualified to join TISA.

As for the TPP and TTIP talks, China is excluded for reasons born of international politics. Once concluded, the TPP and TIPP agreements will change world trade rules, standards and structure, and challenge the system of setting those trade rules.

Western developed economies will raise the bar in rules over intellectual property right protection and labor standards, which will no doubt make it harder for other economies to enter the markets of member states.

The same applies to China in the form of growing pressure for competition internationally. Thus, the decision to speed up the establishment of the Shanghai FTZ apparently makes a great deal of sense from the globalization perspective.

The author is a researcher at the Strategic Studies Department of the China International Economic Exchange Center. www.chinausfocus.com

(China Daily 10/08/2013 page8)

Today's Top News

Senate leader 'confident' fiscal crisis can be averted

China's Sept CPI rose 3.1%

Li Peng's daughter denies 'rumors'

No new findings over Arafat's death: official

Working group to discuss sea issues

Nobel economists rarely get to influence policy

Trending news across China

Chinese firm joins UK airport enterprise

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|