|

|

||||

|

China's sovereign wealth fund banks on diversified investment approach for assured returns At first glance, the nondescript building in downtown Beijing does not even merit a second look. But very few know that behind the glass facade is the office of China Investment Corp, the country's sovereign wealth fund that has $575 billion (427 billion euros) in assets and invests predominantly in overseas markets. There is no sign of wealth or rich trappings, and the sparsely furnished walls, or the corner office of the chairman and the spartan furniture that dot the premises give the distinct feel and flavor of an ordinary government office in China. On any given day it is common to see groups of people dressed in suits huddled over piles of balance sheets and maps of Europe and Africa holding forth on the state of the economy, investment options and pricing strategies. Within these walls lie the rich talent pool or the real wealth that is helping CIC achieve stable, assured returns through its diverse investment mix. Ding Xuedong, the new chairman of the sovereign wealth fund, had recently remarked that these are indeed tumultuous times for the global financial markets, as there are several uncertainties. While most of the sovereign wealth funds such as Temasek of Singapore and the Government Pension Fund of Norway still prefer asset-backed investments, CIC goes for a more pragmatic approach and diverse investment portfolio. According to fund officials, CIC's main objective is to make more money from its overseas investments and generate additional capital for investment. Adjustment of the investment portfolio and the higher equity prices saw the fund post robust returns last year, especially from the long-term assets in global markets. CIC posted a 10.6 percent gain on its global investments last year, compared with a 4.3 percent loss in 2011, according to the company's annual report. The cumulative annualized return of CIC's overseas investments rose to 5.02 percent by the end of last year, from 3.8 percent in 2011. Net income rose to $77.4 billion from $48.4 billion in 2011, the report said. New frontiers

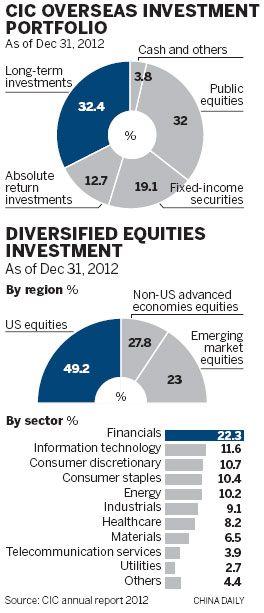

Since its inception in 2007, CIC has strived to generate higher returns on China's huge foreign exchange reserves. Most of its investments have been spread across a range of countries such as Australia, Brazil, France, Russia and the United Kingdom. Last year, nearly 27.8 percent of the equity investments CIC made overseas were in advanced economies other than the US, with Europe being the mainstay. The corresponding figure for such investment in 2011 was 20.6 percent.

A look at the direct investment projects of CIC last year shows that five out of the six projects were in Europe, including France, Russia and the UK. In 2012, 23 percent of CIC's equity purchases came from the emerging markets, especially in the Asia-Pacific region. The proportion was 29.6 percent in 2011. But that seems to be changing, as Africa and Europe are slowly becoming new destinations for the fund. In November last year, CIC invested 450 million pounds ($720 million; 535 million euros) for a 10-percent stake in Heathrow Airport Holdings Ltd, a prominent airport operator in the UK and one of the busiest international air hubs in Europe. It also invested 276 million pounds in January last year for an 8.68 percent stake in Thames Water Utilities Ltd, a London-based private utility company responsible for public water supply and waste water treatment. Russia is another region in Europe where the fund has invested in several resource projects. Last year, the CIC signed a memorandum of understanding with Vnesheconombank in Moscow for investment cooperation in infrastructure construction and development programs in the Russian Far East. The fund also injected $425 million into Polyus Gold International Ltd, the largest gold producer in Russia. CIC is also planning to expand its investments into West and East Africa. Different role

In 2011 the company suffered a loss of 4.3 percent on its overseas investment projects, compared with a profit of 11.7 percent in 2010, raising serious doubts over its investment measures and risk control system. A research note from Zero Power Intelligence Co Ltd, a Chinese market research firm, indicates that CIC's returns are directly related to the performance of the global financial market. The loss in public equities and direct investment projects was the main reason for CIC's negative return in 2011, when the MSCI World Index dropped 7.4 percent, the research note said. The sovereign wealth fund was launched five years ago with registered capital of $200 billion. Of this, $90 billion was transferred to domestic financial institutions through CIC's wholly owned subsidiary Central Huijin Investments, and the balance $110 billion went for overseas investment. Last year, the State Council injected another $19 billion into the sovereign wealth fund after raising $30 billion in 2011. Liu Shangxi, deputy director of the Research Institute for Fiscal Science under the Ministry of Finance, says that unlike other sovereign wealth funds, the State Council has clearly specified the duties and functions of CIC. "The main task of CIC is to manage the foreign exchange given by the central government and use it on behalf of the state to invest in overseas markets," Liu says. About 49.2 percent of equity purchases overseas have been from the US markets, compared with 27.8 percent in other advanced economies and 23 percent in emerging markets, the CIC annual report said. In addition CIC has invested 22.3 percent of its fund in the overseas financial sector, while 11.6 percent is in the information technology sector and 10.7 percent in the consumer discretionary industry, it said. [Full story] |

|

CIC has changed in size and shape Despite its present size and scale, China's first sovereign wealth fund had relatively humble beginnings. The Beijing-based wealth fund started off as a state-owned enterprise on Sept 29, 2007, with an initial corpus of $200 billion (148 billion euros).

In the early days, its role was mainly to diversify China's foreign exchange holdings and maximize returns for shareholders within acceptable levels of risk. That role has evolved over the years to other corporate services such as equity participation in global firms, providing capital for cash-strapped enterprises and even investment in foreign utility services. CIC now has assets worth about $575 billion under its management. [Full story] |

2007 CIC was set up in September in Beijing. In December, the fund made its first investment of $5.6 billion in Morgan Stanley. 2008 The fund set up its investment and risk management panels and became a member of the International Working Group of Sovereign Wealth Funds and co-drafted and signed the Santiago Principles. 2009 In July the fund made an investment of $1.5 billion in Canadian metal firm Teck Resources. 2010 In March, CIC invested $1.6 billion in Vancouver-based metals and mining company AES. In November the fund opened CIC International (Hong Kong) Co Ltd. 2011 In January, the fund decided to extend its investment horizon to 10 years. CIC representative office was set up in Toronto. In December, the fund invested $3.15 billion in France's GDF Suez Exploration & Production International SA and $850 million in Atlantic LNG Co of Trinidad and Tobago. 2012 In February, the fund published its 2012-16 Strategic Plan of Development. In June it set up the Russia-China Investment Fund with the Russia Direct Investment Fund. |

|

Europe has been one of the major destinations for China's sovereign wealth fund Though there is no firm yardstick to gauge its real impact, China Investment Corp has in many ways been the most representative face of Chinese investment in Europe. Apart from its regular activities such as equity and other investments, the fund has also played a key role by teaming up with other sovereign wealth funds for joint investments on the continent. Fund officials say the multi-pronged approach has helped CIC post reasonable returns on investment, despite the volatile and often deteriorating financial climate in Europe. As part of that game plan CIC bought equity stakes in European utility companies, sectors seen as risky and unattractive in the short term. Last year, the fund invested $2.3 trillion (1.7 trillion euros) in infrastructure construction projects across Europe, making it the highest investment outlay for the region since CIC was set up in 2007. CIC's equity purchases from the European markets rose to 27 percent last year from 20.6 percent in 2011. The proportion was 21.7 percent in 2010 and 20.5 percent in 2009. A more friendly investment environment compared with other developed economies and the slower-than-expected recovery from the debt crisis has made Europe an ideal destination for CIC as it constantly looks for global opportunities to preserve and increase the value of China's more than $3.5 trillion foreign exchange reserves. [Full story] |

| Two views |

|

By Giles Chance The author is a visiting professor at Guanghua School of Management, Peking University. Sovereign wealth fund is turning China into a strong force in global financial investment

There are good reasons for the size of China's foreign reserves, which since 2000 have ballooned into the world's largest. Although China is the world's largest importer of soybeans, crude oil and iron ore, the country's industrial processing, carried out mostly for large foreign multinationals by the huge, hard-working and skilful Chinese labor force, still dominates its foreign trade. This fact makes China's trade surplus quite insensitive to rises in the value of the yuan because of the large import content (of raw materials and components) in China's exports. Per head of population, China's foreign reserves are smaller than those of several other major surplus countries, such as Japan, the Middle Eastern oil exporters, Norway and Singapore, but China's capital needs for modernization over the next 50 years are much larger. Although much of these needs will be borrowed on the international markets, or invested by foreign companies, China needs to preserve its capital strength to underpin its long-term development. Its large foreign reserves bring China credibility in the world's financial markets. Their successful management is of critical importance to China. |

European investment takes on a new shine By Zhu Ning The author is deputy director of the Advanced Institute of Finance at Shanghai Jiao Tong University. With emerging markets harnessed, another, older, option beckons The recently published annual report of China Investment Corp, the Chinese sovereign wealth fund, had encouraging news for all Chinese. The fund had a return of 10.6 percent last year, greatly outstripping its performance the previous year, when it was -4.3 percent. Given that CIC has billions of dollars of assets under management, even a 1 percent difference in investment returns can make a lot of difference in absolute terms. So the fund's performance last year is reassuring, particularly given the size of assets under its management. Of course, the returns on any investment can be cyclical and subject to changes in global macroeconomic situations, and the fund's risk exposure. Further, given that CIC holds many illiquid assets, whose returns cannot be accurately evaluated in the short term, it is not out of the question that some one-time item contributed to the fund's performance last year. Nevertheless, many believe CIC's improving performance may indicate that China's sovereign wealth fund has become more mature and its early investment is gradually paying off. Starting with a few controversial private-equity type investments in international financial institutions during the 2007-08 global financial crisis, the Chinese sovereign wealth fund's investments have become more diversified in asset classes, geography, duration and exposure to risk. |