China's economic 'expectation management' unique, flexible

Updated: 2013-09-26 17:21

(Xinhua)

|

|||||||||||

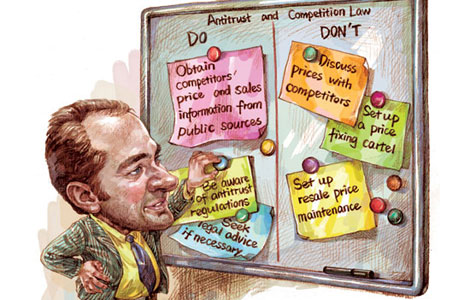

BEIJING - Decades after the so-called "expectation management" was born in the West, China is now adopting the concept in economic policies in a flexible way that shows its own characteristics.

In mid-September, Chinese Premier Li Keqiang convened the State Council, or China's cabinet, stressing the importance of enhancing government information transparency so as to stabilize market expectations.

In the first half of this year, the Chinese government carried out a series of new policies to upgrade various industries and made explanations to the public in time through different channels.

As for hot social topics such as money shortage, cutting tax of small-sized and micro businesses, relevant government agencies have also made timely statements to ease market concerns.

By contrast, the US Federal Reserve often provides the markets with the tool of forward guidance mainly in the field of currency policy.

After the outbreak of the financial crisis, Fed maintained a comparatively low rate and affirmed that the data of inflation, employment rate, as well as capacity utilization will be the three main indices to indicate adjustment.

To temper worldwide concerns about the US phaseout of its quantitative easing (QE), Fed Chairman Ben Bernanke, on various occasions including the congressional hearings, implied repeatedly that Fed is ready to begin the great taper.

In recent years, forward guidance seems like a popular whim that sweeps the world. Even the European Central Bank that used to be rejective to beforehand commitment declared in July that key rates would stay at the current or lower level for a long period of time.

In Japan, Abecomics is also wielding influence on economy by means of expectation management. Abe pressed the Central Bank to put 2 percent inflation as its target and put forward a loose monetary policy that helped boost business and consumers' confidence.

In response to the outside worries about China's slowing growth, Premier Li said in July that macro adjustment will keep the economy running within a rational range, that is, economic growth and employment level will not slip below a minimum limit, while price hiking will exceed the upper limit.

Economists believe that China's commitment is a very effective forward guidance and a robust signal which need to be repeated again and again.

To give the public an in-depth understanding of the macro-economic situation, China's National Development and Reform Commission, the National Bureau of Statistics of China, together with other government agencies, opened online chats with netizens.

Premier Li demanded that government agencies increase interaction with the public, not only explaining new policies but also responding to people's attention and concerns.

Certainly, expectation management is not a panacea since all kinds of potential risks still exist.

Graeme Wheeler, head of New Zealand's central bank, said: "When market expectations adjust smoothly and efficiently, it can diminish the need for larger policy adjustments."

Adam Posen, president of the Washington-based Peterson Institute for International Economics (PIIE), said the practice of countries like Canada and Sweden show that forward guidance can not replace real monetary policy and can hardly produce endurable and reliable results.

Fed has had problems with communications with the market. If central banks take communications as their main tool rather than putting words into action, the tool will not work any more, he said.

Related Stories

Economy, ODI and currency bring opportunities 2013-09-26 08:53

China's commitment to growth will drive global economy 2013-09-17 09:03

Confidence in Chinese economy 2013-09-17 08:19

China's growth to drive global economy: Brown 2013-09-14 13:44

Today's Top News

China, Russia issue joint statement on Syria

UN resolution on Syria's chemical weapons urged

Death toll rises to 328 in SW Pakistan's quake

China, UK set to resume high-level dialogue

China reduces market intervention

Xi promotes 'mass line' campaign

China gaining military drones' share

Trending news across China

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|