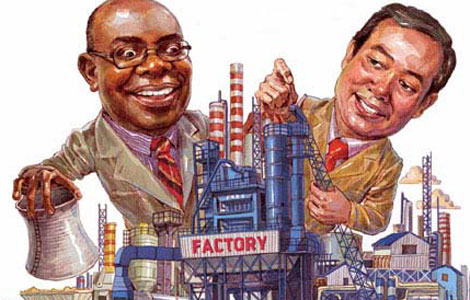

The elephant and the dragon

Updated: 2013-09-23 06:53

By Giles Chance (China Daily)

|

|||||||||||

International investors have their eyes on two emerging economic giants

India is facing its worst financial crisis since 1991. After the rupee started to fall sharply against major currencies in May and June, the Indian central bank raised interest rates and imposed emergency capital controls on Aug 14 to prevent capital leaving the country.

Since then, at the time of writing, the Indian rupee had fallen a further 10 percent. Sensex, India's main equity stock exchange index, is down nearly 5 percent year-to-date. What is going on? Does it affect China?

Part of the answer lies on the other side of the world, in the United States. The role of the dollar as the global currency has been much discussed since the 2008 crash, not least by China's central bank governor Zhou Xiaochuan. But with two-thirds of the world's foreign exchange reserves still held in dollars, and most global trade still invoiced and paid for in dollars, the US currency continues to be the world currency, at least for the moment. The decisions regarding the availability and cost of dollars taken by the Federal Reserve at its headquarters in Washington still affect the global economy profoundly, particularly those countries where economies are still developing and where currencies rest on relatively weak foundations.

The current problem dates back to the mid-1990s, when Western multinationals started buying labor-intensive products such as clothing from the developing world, where labor costs were much lower. As measured consumer price inflation fell as a result, the Fed, misunderstanding the fundamental cause of price disinflation, and fearful of deflation, provided itself and the world with an oversupply of dollars.

Later, after the 2008 crash, this oversupply continued, but for a different reason: as an offset to the negative impact of bank and household debt deleveraging. In 2013, as the US economy entered its fourth year of weak economic recovery, the possibility of unwelcome economic side effects started to outweigh the need for artificial economic support. The Fed signaled, at last, that it should bring its monetary support policy to an end. World financial markets, which price the supply of US dollars hourly, immediately started to take the statements of the Fed chairman, Ben Bernanke, into account. The annual return, or yield, demanded by buyers of US Treasury 10-year bonds rose from 1.86 percent at the beginning of January this year to 2.5 percent by the end of June. Since then, the 10-year US bond yield has continued to rise, reaching 2.82 percent in the last days of August. But, against a long-term average annual return of 6.58 percent, the yield is still very low. Two questions in the markets now are: How much higher will US bond yields go? How much tighter will world money get?

Longer-term US bond yields have a large impact on global economic activity. They are used as the starting point in calculating all kinds of asset prices, including housing and stock as well as the future benefits of investments made today. When the cost of money rises, asset prices tend to fall. The value of loan collateral shrinks. As money becomes more expensive, borrowers' costs rise. Individuals, companies and countries that depend on borrowing have to use more of their income to repay their lenders as interest rates rise.

Sometimes the repayment costs become too great. Individuals and companies can declare bankruptcy and either liquidate their assets to repay their lenders or restructure their affairs. Countries, though, cannot declare bankruptcy. They just stop paying their lenders, and default on their debts. Such national, or sovereign, defaults are quite common. For example, a case today in front of the law courts in New York concerns a default by Argentina in 2001. The financial institutions that lent to Argentina before the country defaulted want their money back.

When the Fed decided to reverse its easy money policy, the impact around the world was bound to be important. As the prospective return on dollar investments rises, investors consider buying financial securities in US dollars. To buy dollars, they sell currencies that appear relatively risky or offer low returns.

India imports more than it exports and runs a large deficit on its account with the rest of the world. This current spending deficit means that each year India has to import capital from overseas to balance its foreign accounts. The Indian capital requirement for the next 12 months is estimated at $250 billion, only a little less than the country holds in foreign reserves in its central bank. In good times, this situation would not cause serious alarm, but two current factors make India's situation worse: the nervousness of the world's financial markets, which hate uncertainty, and, within India, the inefficiency of the government and falling economic growth. With a relatively young and dynamic labor force and with the advantage of the English language, much has been expected of India, the "I" in BRICS. But badly needed economic reform has not happened, and the Indian government has failed to break its bad habits of political infighting and corruption.

Will India's crisis affect other emerging countries, like China? Changes in the external value of a traded currency are a good indicator of confidence in a country. We can see that since June, when the Fed started to signal its policy change, a crisis of confidence has affected most emerging markets. Since June 30 the Thai baht has fallen 5.5 percent and the Malaysian ringgit 7.5 percent, against a fall in the Indian rupee of more than 15 percent. Over the same time the Chinese yuan is down less than 2 percent.

Like India, China's economic growth rate has fallen. As in India, questions are being asked about China's real appetite for economic reform as well as the off-balance sheet debt Chinese local governments have incurred and how this debt, when it goes bad, will affect China's banks. But in other ways China's position is very different to India's. China runs a big surplus on its trading with the rest of the world, its foreign exchange reserves are very large, its foreign debt is low, and its currency is still only partly convertible into other major currencies. China's strong economic record since 1980 has given it credit with the markets. At a time of crisis the markets sell India, but give China the benefit of the doubt.

China should be happy, indeed proud, that, at a time of rising tension in the financial markets, its currency still trades near its highs against the world's strongest currencies, such as the Swiss franc and the Norwegian kroner. But given China's strong external financial position and the recent history of a strong yuan, the fact that the Chinese currency has not fallen at all since June is a warning of potential trouble ahead. As the yield on US Treasury bonds continues to rise, investors will go on selling securities in countries where they feel less comfortable and confident. India heads the list of these countries because, with large current account and budget deficits, inflation around 7 percent, and falling growth, it has failed to inspire the confidence of international investors.

At present, China's strong external position and partly closed currency enable it to weather comfortably the storms emanating from US monetary tightening. Before long, though, the markets will begin to wonder about future Chinese growth and to look for the fundamental economic reforms that can bring this about.

The author is a visiting professor at Guanghua School of Management, Peking University. The views do not necessarily reflect those of China Daily.

(China Daily 09/23/2013 page20)

Today's Top News

China to inaugurate Shanghai FTZ on Sept 29

93 killed as 7.7 magnitude quake hits SW Pakistan

China expects to complete space station by 2023

China's investment a 'job-saver' in Europe

UN General Assembly starts debate

China aims to attract more foreign students

Company head admits bribe charges

China rebukes US drone reports

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|