|

Testing times for G20 leaders

The meeting, which comes at a time when the currencies of all participating nations, barring China, have taken a major hit, will also be an important platform for Chinese President Xi Jinping to reassure the global community that the economic climate and growth pipeline still remains robust in China, experts say. "China is way ahead of other economies in competitiveness and productivity, and still has the best credentials for sustained long-term growth," says Gregory Chin, associate professor of political economics at York University in Canada. Xi, is expected to reassure global leaders that the recent growth blips are part of an industrial transformation and not a sign of waning confidence. He will also use the opportunity to assure global leaders that China will come out with more policies to facilitate long-term growth. At the same time, Xi, will also be an active participant in the global deliberations aimed at restoring investor confidence and making the current international trade, investment and financial system more fair, open and inclusive. The discussions are also expected to touch upon the plans by the US Federal Reserve to wind down its quantitative easing program and its resultant impact on other nations.

Gregory Chin "The challenging world conditions and even tensions within the Asian region are prompting the Chinese leadership to take bold, careful and calculated global measures," says Chin, a Chinese-Canadian scholar who specializes in evolving global governance and China's role. "I expect this new spirit of boldness to continue at the G20 level also." Chin says that Xi has been at the forefront of several recent important global engagements like the recent US-China Strategic and Economic Dialogue. "The close interaction shared by the two presidents during that meeting is an example of the new thinking in Chinese foreign policy. State Councilor Yang Jiechi's recent remarks about the need for a "new diplomacy" for China also highlights the new boldness," he says. Based on his observations, Chin expects Xi to focus on encouraging growth in the world economy, and also on securing financial stability, international banking and other related financial reforms to enhance the role of emerging economies in the system. | ||||||

|

Experts like Chin, however, don't see any cause for concern yet. "China is taking several steps to reduce its reliance on exports and to boost domestic demand along with various steps for sustaining domestic growth. To achieve this it is also important to foster and support innovation," Chin says. According to Chin, this does not mean spurring just technological innovation. "China really needs to consider other aspects like environmental protection. It is not only about saving the planet physically but also about protecting the conditions for human beings so that they can enjoy a good, healthy life and for the long-term survival of the human species and the biosphere." From a policy perspective, it is obvious that the new government is already taking steps in that direction. There are already enough indications that when it comes to policymaking, China is focusing more on environmental protection than development. |

Martin Schoenhals, adjunct professor, Columbia University, School of International and Public Affairs, and chair of Department of Anthropology, Dowling College in New York, however, has a different outlook on economic prospects for China. "A large number of apartments are being bought by speculators. This is a familiar pattern and a dangerous one. If and when the price of apartments starts to fall, as it happened during the 2008 economic crisis in the US, speculators will start selling and the declines will become unsustainable," Schoenhals says. "I'm surprised that some experts feel that China can somehow escape this situation, when others like Japan, the US and Europe could not escape it." Schoenhals is also worried about the employment challenges when 300 million people, equal to that of the US population, move to big cities. "I'm worried about this trend. Yes, wages are higher in big cities. But does this mean that all the peasants who move to big cities can earn more money?" He says that the government should consider more balanced development of big cities, townships and rural regions. Paul De Grauwe, professor of finance at the London School of Economics and Political Science, also believes that a slowdown is inevitable in China due to its excessive reliance on bank credit and also due to the huge overcapacities in many sectors. |

Chi Fulin, president of the China Institute of Reform and Development, says China can sustain annual growth rates of 7-8 percent during the next decade if the government speeds up urbanization, boosts domestic consumption and implements a radical market-oriented reform agenda. Even more upbeat is Justin Lin Yifu, former chief economist of World Bank. Currently a professor at Peking University, Lin says China can maintain an annual growth rate of 8 percent for another 20 years. "This is potential and China needs to strengthen reforms to turn it into a reality," Lin says. De Grauwe of the London School of Economics and Political Science says that global markets are generally guided by euphoria or fear. "Both of them are bad guides. The government should not be swayed by the guide swings," De Grauwe says. "China is already breaking the idea of letting the market decide everything."

... | ||||

|

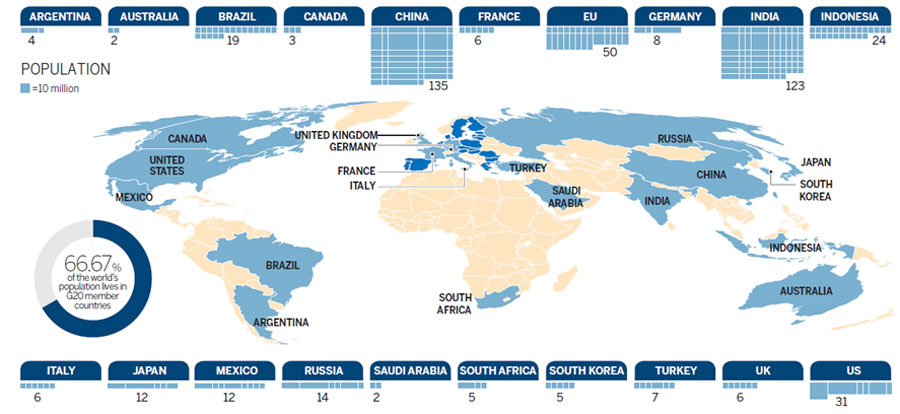

An in-depth glance at the economic forces driving the world's most powerful economies. Click the image for high-resolution file. |

| Action expected on several fronts | Stepping into the spotlight | ||||

|

SUSTAINED DEVELOPMENT, BALANCED GROWTH ARE KEY PRIORITIES FOR G20 LEADERS

Expectations are high that the eighth conclave of G20 nations in St Petersburg, Russia, will produce more concrete steps to aid global economic growth and for increased participation of emerging economies in international finance and trade. However, sparks are also expected to fly over topics like Syria and the quantitative easing program of the US. The US, where the first G20 summit was held in 2008, is likely to face criticism for its possible monetary and fiscal policy scale-back, actions that are likely to cause more shocks to global economic growth. Currently nations such as India and Brazil are facing capital flight problems due to the policy speculation in the US. Before the summit, Russian President Vladimir Putin had indicated that he expects further consensus among the participants on major global issues and commitment for strong, balanced and inclusive growth along with sustainable development. However, Putin says the global economy still faces several risks. "Though we are witnessing a slow recovery, the pace is not sufficient enough to offset the global imbalances," he says. Putin says important decisions need to be taken to stimulate investment, while a roadmap for long-term investment financing needs to be developed and implemented during Australia's G20 presidency next year, along with the principles for institutional investors. [Full story] |

CHINA NEEDS TO PLAY A MORE PRO-ACTIVE, BIGGER ROLE IN INTERNATIONAL AFFAIRS, SAY EXPERTS

Two men walk on a square inside a newly-built commercial complex in Beijing. As China contributes significantly to the global economic growth, it should have a bigger say in multilateral mechanisms, experts say. Kim Kyung-Hoon / Reuters The G20 meeting in St Petersburg, Russia, they say, is an ideal platform for China to tell the world that it is more than willing to contribute knowledge, resources and experience to realize these goals. "The rapidly evolving global situation is such that China can no longer afford to take a back seat," says Chi Fulin, president of the China Institute of Reform and Development. "China must play a more active and special role in multilateral mechanisms, especially within the G20." While China is contributing significantly to global economic growth, Chi says the changing situation requires both emerging economies and developed countries to work together for global development. "China should be more proactive in global situations and also come up with bolder reforms and restructuring agenda to improve global competitiveness." |

|

Experts discussion |

|

|

Where now for the China economy? |

|

Emerging markets must be heard Ahead of the Group of 20 summit of the world's largest economies in Russia, the International Monetary Fund noted that developing countries have been hardest hit in the past few months by the US central bank's warning that it will soon taper its massive bond-buying program that poured cash into the economy to stimulate it. The subsequent slowdown in emerging markets, particularly Brazil, China and India, could hold back global economic growth, the IMF warned. What risks lie ahead and how can the BRICS nations coordinate efforts to deal with the potential impact? China Daily interviewed four economists for their views. Q1: Concerns have risen as the US Federal Reserve plans to start tapering its $85-billion-a-month program of quantitative easing. What kind of risks would that bring to emerging markets, especially the BRICS nations? Q2: In what aspects do you think the BRICS members and other emerging countries need to cooperate to deal with the impact and fluctuations the US QE exit will bring to the international financial market? Q3: How can the G20 nations find an appropriate mechanism and solution for capital markets' healthy development on global and national levels, instead of just turning the summit meeting into a talking shop? | |||

1 The long-term quantitative easing measures adopted by some developed economies after the financial crisis have led to a continuous increase in global liquidity. As a result, emerging countries have been burdened with spillover costs such as asset bubbles and imported inflation. Currency depreciation in several countries such as India has weakened their international competitive edge while other countries such as Brazil have failed to resolve their own problems by shedding the adverse impacts onto emerging countries. |

1 Whether the next US Federal Reserve leader will be current vice-chairwoman Janet Yellen, former treasury secretary Larry Summers or somebody else, the simple reality is that moving too fast or too slow could severely disrupt the lingering recovery in the US. Consequently, the Fed will opt for gradual unwinding. Nonetheless, the economically more vulnerable BRICS nations are not immune to adverse impacts. In the short-term, the volatile "hot money" flows into BRICS have declined. |

1 The likely tapering of asset purchases by the US Federal Reserve comes in response to a better outlook for the country's economy. Our near-term forecast suggests that the US will continue to grow at 2.5 percent this quarter and the next. In this context, the increase in long-term interest rates in the US represents good news, as it signals the US economy is beginning to come out of a great recession. It will be positive for BRICS, as rising US imports are likely to benefit the exports of those nations, though to varying extents.

|

1 The tapering-off of the US Federal Reserve's quantitative easing policy has caused some turbulence in emerging economies such as India, Indonesia and Brazil. With the prospect of excessive easing of monetary policy ending and resulting in an increase in US power, international capital flew out of these countries and the local currency values tumbled. But it is worth noting that the turmoil was also caused by these nations' domestic deficiencies, such as excessively high deficits in current accounts and loose capital account management regimes. |

|

Economists: China impacts global economy As policymakers of the G20 nations meet on Thursday in the Russian city of St. Petersburg for the eighth time, one issue that cannot be ignored will be the growth of China, the world's second-largest economy. Given its growing economic clout and considering its contribution to the global economy, it is necessary to have a closer look at how the Chinese economy will impact other major economies and how it will evolve. China Daily interviewed three economists for their views. Q1: What kind of impact do you think China's economic slowdown will have on other economies in the world? Q2: How will China's economic transition affect other countries? | ||

|

If growth continues to decline in the world's second-largest economy, developed economies will be disappointed because they'll be worried that their economies will suffer from China's slowdown. But China should still maintain a growth rate above 7 percent until 2020 and it will continue making stable contributions to the global economy. [Read more] |

|

In early 2010, we had a batch of visiting international investment banks and funds, all of which were bullish on the Chinese market. No one would listen to the problems in the Chinese economy we discussed at that time. (China's GDP growth began retreating from its high of 10.4 percent after 2010.) |

|

Comments |

|

The 1997 Asian Financial Crisis increased the need for a more inclusive and balanced global economic architecture. The 2008 Global Financial Crisis further highlighted the flaws of the current international financial architecture, and the G20 became the premium forum for international economic cooperation with its role in crisis management and prevention strengthened. Experts: Fed's taper is a key issue for G20 As the US economic recovery picks up pace, there is growing concern among China and other emerging markets about a negative impact from the upcoming winding down of US stimulus program.

Since the G20 first met five years ago to urgently deal with the global financial crisis, its meetings have tended to become more routine and yield diminishing results. The G20 meeting in St. Petersburg on Sept 5-6, however, will be different because of the international political context. G20 summit must look at bigger picture The G20 summit will be held from Sept 5 to 6 in St Petersburg and should help strengthen global economic coordination. Establishing a fairer and more rational international economic order is much more urgent than at any other time in recent history. |

Report spotlights China's global role Global governance institutions are urged to be more inclusive of China and other developing countries in the decision-making process, according to an international organization's report on Thursday. From rule-takers to rule-makers From a rule-taker to a rule-maker, China has gained growing clout in global economic governance, but it faces new challenges. China has participated in global economic governance for only a short period and will need to make more adjustments to better play its role in global governance. But with rational and practical approaches, China's leaders are capable of guiding the G20 toward fairer long-term economic governance while taking good care of short-term economic issues. A change in perspective needed Four issues will be in the spotlight at the upcoming G20 summit : boosting confidence in global economic growth, promoting reform of global governance, increasing unity and cooperation among developing countries, and evaluating China's economic growth trend. G20 summit must look at bigger picture The G20 summit will be held from Sept 5 to 6 in St Petersburg and should help strengthen global economic coordination. Establishing a fairer and more rational international economic order is much more urgent than at any other time in recent history. As China's growth, as measured in traditional ways, has slowed down, many traditional experts, especially in the West, have seen this as a problem for the world. But a slowdown of traditional GDP should not be viewed with 19th century theories, instead it should be seen from a 21st century perspective. While scientists and experts all around the world are in agreement that the world needs to move beyond the simple ways that are used to measure GDP, and that GDP can no longer be used to measure the progress of a country in any meaningful way, almost no senior politicians outside China have publicly declared that they support this scientific knowledge. |

|

Related specials |

A1: China's growth has witnessed an obvious deceleration from its double-digit rate of previous years, but it's only been a mild slowdown from last year, which suggests that the changes in the economy are under control.

A1: China's growth has witnessed an obvious deceleration from its double-digit rate of previous years, but it's only been a mild slowdown from last year, which suggests that the changes in the economy are under control.  A1: Regionally, China's slowing growth will reduce prospects for export-led growth. It will also adversely impact commodity trade with major trade partners. Take, for instance, the role of Brazil. When President Luiz Inacio Lula da Silva took office in the early 2000s, Brazil was ailing and China had just joined the World Trade Organization. During his two terms, Brazil sold commodities to China, which supported the mainland's growth, while allowing Lula to reduce poverty in Brazil. Today, President Dilma Rousseff is trying to expand the Brazilian middle-class, but the country will not benefit that much from Chinese demand.

A1: Regionally, China's slowing growth will reduce prospects for export-led growth. It will also adversely impact commodity trade with major trade partners. Take, for instance, the role of Brazil. When President Luiz Inacio Lula da Silva took office in the early 2000s, Brazil was ailing and China had just joined the World Trade Organization. During his two terms, Brazil sold commodities to China, which supported the mainland's growth, while allowing Lula to reduce poverty in Brazil. Today, President Dilma Rousseff is trying to expand the Brazilian middle-class, but the country will not benefit that much from Chinese demand.  A1: There is indeed an economic slowdown in China and in other emerging markets, but changes in market sentiment are what have really astonished me.

A1: There is indeed an economic slowdown in China and in other emerging markets, but changes in market sentiment are what have really astonished me.