Growth Driver

|

E-commerce helps Western companies gain a toehold in China's vast, untapped domestic market Though it is a relatively new kid on the block, in terms of size and spread e-commerce has no peers in China. But its real strength, as many foreign companies and brands are discovering now, is its ability to be a matchmaker in the vast and untapped Chinese domestic market.

With revenues in excess of $210 billion last year and a steadily growing customer base of over 500 million, the e-commerce industry in China is fast catching the fancy of big names like Louis Vuitton, Adidas, Samsung and Disney. Many others like the UK-based retailer Marks & Spencer and Mothercare are in talks to be a part of the sunrise industry that deals with the buying and selling of products as diverse as mobiles, fresh vegetables, textiles, dresses, exotic food, machinery and personal care products. “E-commerce has a key role in bolstering China’s economic growth and also in increasing domestic consumption. It is a crucial tool for the government as it charts steps to rebalance the economy and ensure sustainable development,” says Qi Xiaozhai, dean of the Shanghai Commercial Economic Research Center. Pointing out the importance of the industry, analysts maintain that it is one of the few industries, which has been recording consistently high growth rates over the past few years. The e-commerce industry has seen growth rates of over 78 percent since 2006. Unlike the brick and mortar stores, where physical presence is the key driver, e-commerce relies more on faster, cheaper and better consumer experiences and more shopping choices online. While there are no doubts about the vast potential of e-commerce, it is its ability to reach out to customers in remote areas of China, where stores are few and the costs of building a physical retail presence high that is proving irresistible to Western companies. “Having access to so many companies under one platform, especially those who are able to produce bespoke items at affordable margins is of great to start up businesses,” she says adding that it also gives companies enough brand exposure,” says MaryAnn Richardson, founder of Makeup By MaryAnn, a UK company that sells makeup brushes and other fashion essentials, says that having a presence on Alibaba.

To understand the power of e-commerce in China, one does not need to look further than the success of Jack Ma and his Alibaba Group. Alibaba currently accounts for more than 5 percent of the total retail market in China and according to Ma’s estimates, more than 30 percent of all the retail trade in China would be conducted online over the next five years. “I initially started using Alibaba as an additional platform to sell my products to overseas clients. But that has changed and it is now my primary source of overseas business, and accounts for more than 50 percent of my total profi ts and orders,” says Zhou Mingwang, owner of Yiwu Mingwang Jewelry, a small export-oriented company in Yiwu, Zhejiang province. "It is this changing reality that is forcing companies like Alibaba to move beyond playing a mere intermediary role," says Qi Junsheng, business director of the international department of the company’s B2B. “I initially started using Alibaba as an additional platform to sell my products to overseas clients. But that has changed and it is now my primary source of overseas business, and accounts for more than 50 percent of my total profits and orders,” says Zhou Mingwang, owner of Yiwu Mingwang Jewelry, a small export-oriented company in Yiwu, Zhejiang province."It is this changing reality that is forcing companies like Alibaba to move beyond playing a mere intermediary role," says Qi Junsheng, business director of the international department of the company’s B2B. Despite the lackluster export and import situation, Alibaba is looking to take a bigger bite of the e-commerce pie by renovating its systems for better match making between merchants and buyers. Alibaba will leverage the data it collects from overseas buyers to precisely locate relevant Chinese suppliers. “Today we are seeing see a changed export environment in which producing bulky orders is no longer a common practice. Instead what we are seeing is more smaller-cap foreign buyers who are seeking diversified products and want to find the appropriate suppliers in China as quickly as possible," says Wu Minzhi, president of the company’s international business. [Full story] |

|

Payment solutions will bring in more players

One of the biggest hurdles for foreign companies, who are keen to be a part of the Chinese e-commerce market, is the absence of uniform payment solutions. That looks set to change now as companies like Tencent are now coming up with solutions that offer safety and ease in transactions. Tencent Holdings Ltd,China’s largest listed Internet company, has enabled online transactions for select merchants by linking payment services to its popular WeChat smartphone application that has more than 300 million users globally. The application lets users send voice messages, photos and other media the way they might send text messages, without charging any extra fees. Since early June, WeChat has empowered a select few of its registered corporate accounts with online shopping facilities. WeChat does all back-end technical integration and support for these vendors, including page design and payment linkups. Online transactions are made available through credit cards, online banking or TenPay, the company’s third-party payment platform, says Liu Sishan, public relations officer, Tencent. TenPay, like its domestic rival Alibaba Group Holding Ltd’s AliPay and eBay Inc’s PayPal in theUS, allows merchants to process payments from customers’ personal accounts. The application has already attracted foreign retailers like fast-food chain McDonald’s Corp. The retailer has opened an online channel on WeChat and offers several discounts to customers who complete transactions using the WeChat framework. According to Ma, Tencent also plans to introduce mobile social games on WeChat and other micro-payment facilities for services like taxis. Yi Fanghan, an independent industry expert and blogger feels that the mobile phone payment service on WeChat is a key step in Tencent’s ambition to develop e-commerce solutions. “It provides momentum for the changes taking place within the whole industry-as future payments will take place on mobile devices,” he says. Sina Corp, which owns the popular micro-blogging service Weibo, has recently launched an online payment service in a bid to transform its heavy Web traffic into revenue amid increasing competition. The company is also planning to launch an online payment service, in a bid to translate its heavy Web traffic into revenue amid increasing competition. Dubbed WeiboPay, the online service will team up with merchants that sell goods via their corporate accounts on Weibo, says Hong Lizhou, the general manager responsible for Sina Weibo’s marketing strategy. [Full story] |

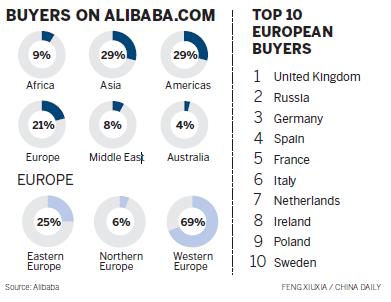

Small Strides, big gains Struggling European SMEs bank on Chinese e-commerce platforms to stay afloat Though trust and value-added services has been the mainstay of Alibaba’s success in China, it has not deterred it from expanding aggressively in overseas markets like Europe. The e-commerce giant, which deals with business-to-business online marketplaces, retail and payment platforms, shopping search engine and data-centric cloud computing services is banking on connecting the struggling small and medium-sized businesses in Europe with the huge domestic market in China. James Hardy, Europe, Middle East and Africa director of Alibaba feels that Alibaba will become an increasingly global platform in the future. “E-commerce reduces the physical boundaries between markets. Customer bases are also experiencing a shift to become more international,” he says. “There is now a growing trend towards globalization, where particular products are increasingly made in specific areas that have a comparative advantage in making them. E-commerce will help these geographies maintain their comparative advantages and create a large eco-system,” he says. However, for Chinese e-commerce firms it will be the speed and quality of services that will be the game-changer in Europe. “Speedy and proactive responses to customer needs is what sets Chinese ecommerce firms apart in Europe,” he says. “There’s an expectation and enthusiasm (at Alibaba) that if the market has changed in any way, to immediately change course. It is done fast and by everyone in the team smoothly,” Hardy says. Alibaba has more than 7.2 million registered members in Europe, including more than 1.6 million in the UK, 420,000 in Germany, and 495,000 in France. Hardy says Alibaba’s key customers in Europe are small and medium sized businesses, because a lot of SMEs rely on e-commerce for international trade, as they do not have the budget to physically manage international sales themselves. “Globally, we believe in the power of small businesses. Small businesses are impacted by regulation, and the cost of travel accounts for a bigger percentage of their revenue. Hence e-commerce removes a big cost element in international trade for them,” Hardy says. “E-commerce also makes the playing field a lot more level, and the growth of e-commerce is a key reason for the growth in the number of SMEs globally,” he says. In the UK, for example, SMEs accounted for 59 percent of private sector employment and 49 percent of total business turnover in 2011, according to government statistics. According to European Commission statistics, more than 99 percent of all businesses in Europe are SMEs, defined as having employment numbers no more than 250, and turnover of no more than 50 million euros. [Full story] |

|

Related Articles |

|

Web sector set for a wave of change: Experts |

Tencent moves money online through WeChat |

| Two Views |

|

Making the big difference E-commerce has played a stellar role in lowering overall transaction costs for small businesses By Wu Shiping [The author is a researcher at the Institute of Industrial Economics of the Chinese Academy of Social Sciences] E-commerce has also played a key role in creating better market opportunities for small and medium-sized firms in China. Under the traditional international trade pattern, access to international market information was always a costly affair for SMEs. The high-cost trade pattern has forced many SMEs to depend on secondary orders from the bigger players. E-commerce has led to more openness and globalization across time and space for SMEs. It has removed the time and space barriers among different countries and regions and simplified the entire international trade process by lowering the transaction costs. The addition of more trade channels has effectively lowered the threshold for SMEs in international trade. Third-party e-commerce platforms like Alibaba, HC360, DHGate have helped several Chinese SMEs make significant strides in global trade. E-commerce has not only become a key tool for SMEs planning global moves, but also helped in fostering more emerging markets and better regional economic development. All of these indicate that e-commerce is an emerging industry that has high industrial relevance, sensitivity and strong driving force. Its rapid development not only stimulates the growth of credit, logistics, payment, standards, cloud computing and other support services, but also promotes the development transaction related electronic commerce, technology, operations, credit, payment, training and other derivative services, including finance, human resources, third-party logistics, information services, education and training. It is also prompting traditional service industries to speed up their industrial upgrade process. [Full story] |

Building trust in virtual world Quality concerns are still a major hurdle for Chinese e-commerce companies By Z.Justin Ren and Xin Wang [Z. Justin Ren is associate professor of operations management at Boston University School of Management. Xin Wang is assistant professor of marketing at the Brandeis University International Business School, Massachusetts] China’s e-commerce firms have proven to be resilient against foreign competitors, but they are facing unique challenges. Quality of online merchandise is still one of the top concerns. The recent infant formula scandal has significantly changed the landscape of Chinese domestic dairy industry. Even though the largest impact happened to brick-and-mortar retail stores and their supply chains, e-commerce firms experience similar shocks. Moreover, such incidents are not a simple matter of switching brands. They can destroy the confidence of consumers, and in turn affect demand as well as supply of a whole industry. Quality issues could be even more difficult to solve in e-commerce, as buyer and sellers interact virtually. How Chinese e-commerce firms can collectively improve the quality of goods and service sold online remains to be seen. Another significant issue is the prevalence of counterfeit products in online markets. This has serious long-term consequences if China does not step up its efforts to address the issue. It is also preventing more foreign companies from entering the market for fear of losing their intellectual properties and profits to the counterfeits. This, in turn, stymies market growth and hurt consumers. If China does not correct this problem, its international reputation as a healthy marketplace will be tarnished, and its long-term competitiveness will suffer. Jack Ma, former CEO of Taobao, had always attributed the success of Taobao to the trust that customers placed in the company and the company on its employees. [Full story] |

|

Related articles |