Dec inflation dips to 4.1%, 2011 CPI at 5.4%

Updated: 2012-01-12 09:45

(Xinhua)

|

|||||||||||

BEIJING - China's consumer price index (CPI), a main gauge of inflation, rose 4.1 percent year-on-year in December, down 0.1 percentage point from November on falling non-food prices, the National Bureau of Statistics (NBS) said Thursday.

The CPI was up 5.4 percent in 2011 from the previous year, well above the government's full-year inflation control target of 4 percent, the NBS said in a statement on its website.

The inflation rate in December marked a five-straight-month decline after hitting a 37-month high of 6.5 percent in July amid government tightening measures, according to the NBS data.

On a monthly basis, the cost of living dipped 0.2 percent in December, while prices of entertainment, educational and cultural articles and services dropped 0.3 percent, the NBS said.

Food prices, which account for nearly one third of the basket of goods in the nation's CPI calculation, went up 9.1 percent year-on-year in December and 1.2 percent month-on-month, the NBS said.

The December inflation figure was in line with the market expectation, as many economists forecast that the CPI would grow around 4 percent year-on-year in December.

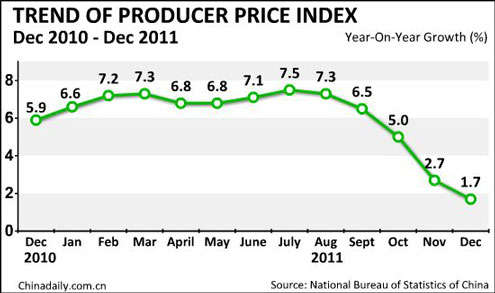

China's Producer Price Index (PPI), a major measure of inflation at the wholesale level, rose 1.7 percent in December year-on-year, further weakening from 2.7 a month earlier.

The reading eased further from November's 2.7-percent growth, the NBS said in a statement on its website.

On a month-on-month basis, China's December PPI fell 0.3 percent from November, the NBS said.

Producer purchase prices grew 3.5 percent year-on-year in December and were down 0.4 percent from a month ago, said the NBS.

The full-year PPI climbed 6 percent year-on-year in 2011, while producer purchase prices rose 9.1 percent from a year earlier.

Analysts expect the pullback to ease temporarily, as upcoming holiday demand will drive prices higher in the short term, although the downward trend is likely to last amid the global economic downturn.

"As long as there is not a significant easing of China's monetary policy, the downward trend will not change," read an analysis by Bocom International.

Analysts warned that any change in market sentiment will influence the trend.

"Though investors' confidence remains low, possible government measures to spur the economy could boost prices at all levels," said Chen Kexin, an analyst with the distribution productivity promotion center of China Commerce.

China has made controlling prices a top priority last year and implemented a series of measures to address the issue, including tightening monetary policy, cracking down on speculation, increasing food supplies and reducing circulation costs.

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|