Top News

Tough measures to fight inflation

Updated: 2010-12-31 12:30

By Zhang Ran (China Daily European Weekly)

|

The headquarters of the People's Bank of China in Beijing. The central bank may take more tightening measures in the first half of 2011 to rein in inflation. Nelson Ching / Bloomberg |

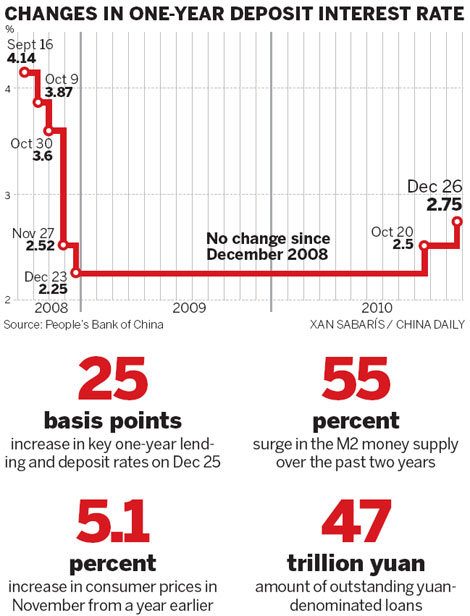

On Dec 25, China's central bank announced to raise interest rates for the second time in just over two months as it stepped up moves to rein in stubbornly high inflation at home.

The benchmark lending rate was lifted by 25 basis points to 5.81 percent and the benchmark deposit rate was raised by 25 basis points to 2.75 percent.

This demonstrated the government's determination to fight inflation, with Premier Wen Jiabao saying on Dec 26 that the government could keep prices at a reasonable level.

While there were expectations that an interest rate hike was very likely at the end of the year after the country's consumer price index rose to a 28-month high of 5.1 percent in November, analysts and investors were still surprised that the government moved so quickly after it announced a shift of monetary policy from a "moderately loose" stance to a "prudent" one in early December.

There are several reasons why the central bank chose Christmas to announced the interest rate hike, analysts point out.

"Given that the interest rates of the US dollar, the euro and the yen being close to zero, and with strong speculation about yuan appreciation, an interest rate hike of the yuan could easily draw hot money to the Chinese mainland. That is why the central bank chose Christmas to make a move," said central bank adviser Li Daokui, who is also a professor at Tsinghua University.

"During the holiday season, it is very difficult for investors to move funds."

"Compared to rate hikes at the beginning of 2011, a rate hike before the year-end will have a more tightening impact, as the interest rates on medium- and long-term loans and deposits are reset at the beginning of each year according to base rates," said Wang Qing, Hong Kong-based chief China economist at Morgan Stanley.

"The interest rate adjustment at this time would have a limited impact on the international foreign exchange market since it is closed during the Christmas holiday," said He Zhicheng, analyst from Agricultural Bank of China.

"Another reason is that the stock market has speculated on the interest rate hike for a long time, the final launch of the policy would be read as the ending of unfavorable factors. The hike will in turn help the market to bottom out."

Chinese stock markets have dropped nearly 10 percent since mid-November on concerns that the government would raise interest rates soon to fight inflation.

After weeks of adjustment, analysts believe China's stock market will rise. Bank and insurance stocks are expected to benefit from the interest rate hike.

Real estate stocks, however, are expected to come under pressure as the price of credit is raised.

|

|

China Vanke, the nation's biggest listed property developer, lost 7.81 percent in the past five trading days. Poly Real Estate Group Co, the second largest, slid 9.94 percent.

China had introduced a slew of policies to cool the hot real estate market in 2010, including the suspension of mortgages for third-home purchases in Beijing and Shanghai. Yet, latest figures from the National Bureau of Statistics show that property prices in 70 major Chinese cities still rose 7.7 percent on average year-on-year in November.

In the latest remarks on curbing property speculation, Premier Wen acknowledged that these policies have not achieved satisfactory results.

"I made a promise to the Chinese people last year that I would try to keep housing prices at a reasonable level during my tenure, and I won't shrink from the goal," Wen said on Dec 27.

Following an interest rate increase in October, another hike was adopted after a batch of quantitative measures including reserve ratios (the government had raised the bank reserve requirement ratio for the sixth time in 2010) to rein in liquidity and credit proved to be insufficient to bring food and property prices under control.

Analysts believe that more monetary tightening may occur, mainly in the first half of 2011.

"More adjustment in China's deposit rate, lending rate and reserve requirement ratio are very necessary in 2011, especially in the first half," said central bank adviser Li Daokui.

"The central bank may increase the interest rate by 75 basis points in the next six months," said Pan Xiangdong, economist with Beijing-based Everbright Securities Co Ltd.

Officials may keep raising interest rates and banks' reserve requirements, sell bills to soak up cash, and allow more gains by the yuan against the dollar, said Wang Qian, Hong Kong-based economist from JPMorgan, in a research note.

However, as the risk of deflation in developed economies and inflationary pressure in emerging economies are expected to intensify in 2011, there is concern that more capital will flow from developed countries to developing countries.

"The scale of hot money flowing into China will definitely increase next year, due to the interest rate gap and the expectation of yuan appreciation," said Zhang Ming, a senior researcher from Chinese Academy of Social Sciences.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.