China jumps to number two in world investment survey

Updated: 2016-10-18 17:08

By CHRIS PETERSON(chinadaily.com.cn)

|

|||||||||

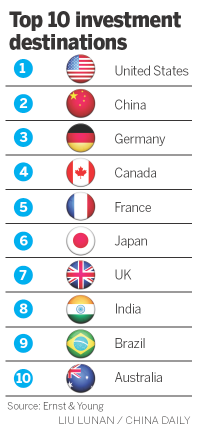

China jumped to second place in the list of the top 10 favored investment destinations, while the UK slumped from second to seventh in the wake of the referendum decision to leave the European Union, according to a survey by consultants Ernst and Young.

China's rise from fourth to second, behind the United States, was partly fuelled by the country's continued rebalancing of its economy, which spurred merger and acquisition activity as domestic companies looked to gain efficiency as well as investing in intellectual property assets in overseas industry and technology sectors.

"Companies are challenged by the ongoing uncertainty over where faster growth will come from," the report said. "Added to this frustration are the impact of events, such as the United Kingdom's decision to leave the European Union, the heightened market volatility caused by US interest rate uncertainty, and upcoming elections in several countries."

In its previous survey in April, Ernst and Young said China was set to become an increasingly important factor in mergers and acquisitions. That forecast was borne out by the latest report, which was issued on Monday.

"As China's economy rebalances towards a consumption and services-led model, executives are waiting to see how this affects growth. For now, continuing high levels of volatility in global capital markets and an overall increase in political instability around the world are more acute concerns of executives than China's evolution," the report added.

During the past six years, Chinese investment in business and infrastructure in the UK has increased by almost 500 percent, analysis by the Essential Daily Briefing website concluded.

China's appetite for investing in the UK appears to be continuing unabated, analysts noted.

Chinese companies have spent more than 3.8 billion pounds ($4.62 billion) on 20 merger and acquisition deals alone since the beginning of the year, and last month's agreement to go ahead with the construction of the 18-billion-pound Hinkley Point nuclear power project, in which China is investing a third of the capital, is likely to push the overall investment total far higher this year, according to data from Dealogic in August.

The pound has slumped by around 20 percent since Britons surprisingly voted in favor of leaving the European Union. The weaker pound has been one factor in attracting continuous Chinese investment, mainly in the infrastructure, technology, real estate, and soccer industry sectors.

Related Stories

China launches industrial investment fund to reduce poverty 2016-10-18 10:32

China's investment in Germany surges in H1 2016-10-18 10:32

UK falls out of top five investment sites post Brexit 2016-10-18 08:16

Loan contract dispute between Hainan-based Jianfeng Tourism Development Co, Ltd, Shanghai-based Longyu Investment Co, Ltd and Beijing-based DaYi Xingye Real Estate Development Co, Ltd 2016-10-17 14:20

Today's Top News

Iraqi forces fighting all out to free Mosul from IS

Greeks rally against labor reforms

Chinese pupils flock to UK independent schools

Britain's May, faced with turmoil, agrees to a debate

'Zero Hunger Run' held in Rome

Xi: China considers Bangladesh important partner

Deals with Cambodia include energy, trade

Xi: Step up investment in emerging economies

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|