Govt putting US economy at risk

Updated: 2013-10-17 23:39

(Agencies)

|

|||||||||||

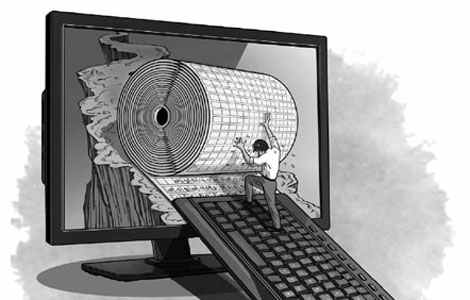

Consensus may be hard to find in Washington these days, but many corporate executives and economists seem to agree on one point — the biggest risk to the world's largest economy may be its own elected representatives.

Down-to-the-wire budget and debt crises, indiscriminate spending cuts and a 16-day government shutdown may not be enough to push the US economy back into recession.

But Washington's policy blunders in recent years have significantly slowed economic growth and kept some 2 million people out of work, recent estimates show.

Steep spending cuts are a big reason. But governance-by-crisis may also be prompting businesses to sit on their cash rather than building new factories, buying more equipment and hiring more workers, some economists say.

"I'm of the view that the reason why our economy can't kick into a higher gear is because of the uncertainty created by Washington," said Mark Zandi, chief economist of Moody's Analytics.

Congress on Wednesday voted to reopen the government and extend its borrowing authority until February. But the deal did nothing to resolve the underlying disputes that led to the crisis, leading many to fear that the standoff may play out again in a few months.

The deal sets up a forum to try to forge a more permanent budget agreement, but few expect it to succeed.

"We have crisis after crisis after crisis and it has a corrosive impact on the economy," said Greg Valliere, an analyst with Potomac Research Group. "If you're a business, how do you make plans in this environment?"

Leading chief executives agree.

"Most CEOs I speak to in the US say they're seeing a slowdown in business because of this," said Laurence Fink, the CEO of giant asset manager BlackRock.

"I was on a conference call with many of them. I heard across the board of a slowdown from the American consumer because of this narrative, so it's having an impact on our economy already — and it's going to have an impact on job creation at a time when we need more job creation."

Not all economists agree that the political circus in Washington is hurting the economy in a measurable sense.

While worries over the debt ceiling have pushed up the government's borrowing costs over the past week, the increases are minimal, and the S&P 500 stock index remains near its all-time high.

Slow recovery

But the pace of recovery since the 2008-09 recession has been unusually slow.

While the US' economic output is now higher than it was before the recession, the level of private investment remains lower than it was in 2007. Employers also continue to hire workers at a slower pace than before the recession.

Since the financial crisis eased, Washington has sent out one jolt after another. Democrats passed sweeping reforms to the healthcare system and the financial sector in 2010 that, whatever their merits, imposed significant changes on two pillars of the US' post-industrial economy.

Public unease with the healthcare law helped Republicans win control of the House of Representatives in 2010, ushering in an era of divided government that has led to repeated standoffs over taxes and spending.

A near-shutdown in April 2011 led to the debt-ceiling impasse in July and August of that year, which took the country to the edge of default and prompted its first debt downgrade.

As in the most recent crisis, Congress averted disaster at the last possible moment. But the brinkmanship pushed consumer confidence to rock-bottom levels, where it remained for months. The S&P 500 tumbled 17 percent and took more than six months to recover its gains.

That debt-ceiling deal called for steep cuts to national defense, highway construction, scientific research and other forms of discretionary spending that Congress must approve annually.

Another budget deal this year, reached in January after another round of brinkmanship, included tax increases to help narrow budget deficits further.

Neither of those deals addressed the health and retirement spending that poses the greatest threat to the country's long-term fiscal health.

Failure to cut back these programs or find savings elsewhere prompted a round of deliberately disruptive across-the-board spending cuts — the so-called sequester — to take effect in March.

Along with an improving economy, the measures helped US budget deficits fall from 8.7 percent of GDP in the 2011 fiscal year to an anticipated 3.9 percent of GDP for the fiscal year that ended on Sept 30.

But this has all come at a steep cost.

Related Stories

China warns on risks of US debt default 2013-10-17 21:16

US govt to reopen as Obama signs last-minute bill 2013-10-17 17:22

China trusts US to quickly solve debt crisis 2013-10-17 14:48

US Senate passes deal to end debt crisis 2013-10-17 08:44

Today's Top News

Mayor of Nanjing under probe

FDI rose 4.88% in September

Former mistresses are active online whistle-blowers

Guardian star reporter leaves for 'dream' project

Quantum of solace as breakthrough looms

London mayor hails China's FTZ, subway

Deal passed to end US debt crisis

China has record number of billionaires

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|