Asia

Japan intervenes to stem yen's rise against dollar

Updated: 2011-08-04 13:56

(Agencies)

|

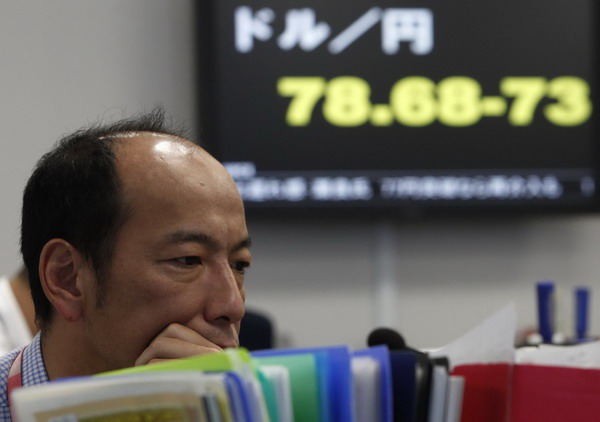

A foreign exchange broker looks at a monitor in front of a television displaying the Japanese yen's exchange rate against the US dollar at a dealing room in Tokyo August 4, 2011. Japan intervened in the currency market and its central bank looked set to ease policy on Thursday in a concerted effort to stem a rise in the yen that Tokyo fears could derail the economy's recovery from the March earthquake. [Photo/Agencies]

|

The dollar, weakened by the dimming US economic outlook, fell as low as 76.29 yen on Monday - setting off alarm bells in Tokyo. It hit a record post-World War II low of 76.25 yen in the days following the March 11 earthquake and tsunami.

The move by Japanese authorities to buy dollars and sell the yen, immediately sent the greenback to 78 yen. It later reached the 79 yen level. That boosted the stock market with the Nikkei 225 index rising 0.9 percent.

Finance Minister Yoshihiko Noda said the unilateral intervention was taken because the strong yen could hurt the economy and slow Japan's efforts to recover from the disasters.

"The one-sided rise of the yen could have a negative impact," Noda told reporters. "We have decided to intervene."

Noda did not specify the amount of the intervention.

A strong yen is painful for Japan because it reduces the value of foreign earnings for companies like Toyota Motor Corp and Nintendo Co and makes Japanese goods more expensive in overseas markets.

The yen's surge after the March disasters prompted the Group of Seven major industrialized nations to work together to weaken the Japanese currency. Officials feared that the fast rising yen would exacerbate the economic impact of the disaster.

That coordinated intervention in international currency markets was the first by the G-7 countries since the fall of 2000, when the G-7 intervened to bolster the euro.

Japanese companies that based their earnings forecasts on assumptions of a weaker yen may be forced to downgrade expectations if yen strength persists.

Nintendo, for example, had assumed 83 yen to the dollar this fiscal year through March 31. But it lowered its estimate to 80 yen per dollar last week when it reported a deep loss in the latest quarter and cut its full-year forecasts. About 80 percent of the video game and console maker's sales are outside of Japan.

Honda Motor Co said earlier this week that the exchange rate erased 22.5 billion yen ($288 million) from its operating profit in the latest quarter. At Mazda Motor Co, the yen sapped 3.1 billion yen ($40 million) from its bottom line last quarter.

The intervention will likely be coupled with monetary policy easing by the central bank's policy board, which was meeting Thursday for a shortened one-day meeting.

"The Bank of Japan expects that the action taken by the Ministry of Finance in the foreign exchange market will contribute to stable price formation in the market," Gov. Masaaki Shirakawa said in a statement.

The yen's resurgence after the effects of G7 action dissipated had recently triggered speculation in financial markets that Japan might once again intervene _ this time alone _ by selling the yen. As the yen dipped to the low 77s Thursday morning, Noda made his announcement that Tokyo had decided to act.

Japan's move followed the Switzerland central bank's efforts Wednesday to weaken its currency. It described the franc as "massively overvalued" and issued a strongly-worded statement that the country's economic outlook had deteriorated because of exchange rates.

While it did not directly intervene in foreign exchange markets, the Swiss National bank lowered interest rates and said it would significantly bolster liquidity in the Swiss franc money market.

Lowering interest rates can help reduce a currency's value against other currencies by lessening demand for investments and assets in that currency.

Switzerland's currency, along with gold and the yen, has risen sharply because it's considered a safe haven from the debt and economic woes in the US and Europe.

While Thursday's intervention by Japan brought some immediate relief, it is unlikely to change longer-term currency trends, said Junko Nishioka, chief economist at RBS Securities Japan.

"As long as concerns for the downside risks in the US economy and expectations for the Fed's further easing measure persist, it is hard to expect the (dollar-yen) to return to high enough levels to alleviate the negative pressure on exporters' earnings," Nishioka said in a research note.

E-paper

Double vision

Prosperous Hangzhou banks on creative energies to bridge traditional and modern sectors

Minding matters

A touch of glass

No longer going by the book

Specials

Ancient plate broken

An ancient porcelain plate was accidentally destroyed during a research in the Palace Museum.

Selfless actions

A 20-year-old girl becomes an Internet star for giving her first kiss to a drowning old man.

Space race

Homebuyers are learning the hard facts of supply and demand: too many cars and too few parking spaces.