Economy

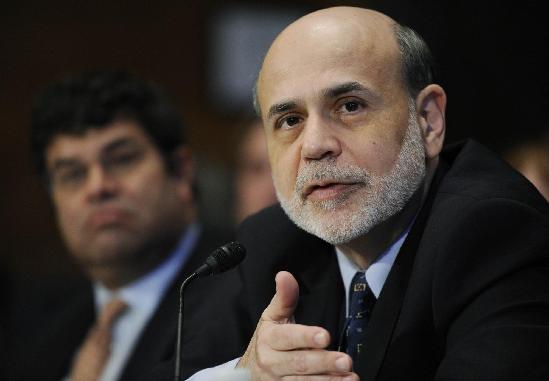

Bernanke to take spotlight and assess economy

Updated: 2011-06-07 14:32

(Agencies)

|

US Federal Reserve Chairman Ben Bernanke gestures during testimony before the Senate Banking Committee hearing on oversight of Dodd-Frank Wall Street reform and consumer protection implementation, on Capitol Hill in Washington, May 12, 2011. [Photo/Agencies] |

WASHINGTON - It's Ben Bernanke's turn to assess how much the economy has weakened.

Investors have pushed stock prices lower for four straight days in response to data showing weaker hiring in May, falling home prices and a drop in manufacturing. On Tuesday, the Federal Reserve chairman will offer his outlook.

Bernanke is giving a speech in Atlanta to a banking conference. It represents his first remarks on the US economy since April, when he said temporary factors like high gas prices were largely to blame for weaker growth at the start of the year.

Economists don't expect Bernanke to deviate from that position or signal any further action from the Federal Reserve.

"It's going to be steady as she goes. Bernanke will argue that his current game plan for the economy is just what is needed," said Sung Won Sohn, an economics professor at the Martin Smith School of Business at California State University.

Last Friday, the government reported that the unemployment rate ticked up in May to 9.1 percent and the economy created just 54,000 jobs, the fewest in eight months. That's far below the average of 220,000 jobs per month that were created during the previous three months.

Economists expect Bernanke will acknowledge serious problems facing the economy. But he's likely to repeat that they are temporary.

Chief among them are energy prices. The nationwide price for regular gasoline was close to $4 per gallon in early May. The price has since declined to around $3.77, according to AAA's daily fuel gauge.

The natural disasters in Japan also have disrupted supply chains and created parts shortages for many US auto and electronics manufacturers.

Bernanke's speech is coming two weeks before Fed policymakers meet to discuss interest rates and monetary policy. The Fed has held interest rates at record lows since December 2008 to boost the economy after the worst economic downturn since the 1930s.

The recession officially ended in June 2009. But growth has been subpar compared with previous recoveries. A big reason is because of continued problems in housing and a huge overhang of debt.

The Fed has also turned to two rounds of credit easing aimed at driving long-term interest rates lower. The second of those efforts, to purchase $600 billion in Treasury securities, is scheduled to end on June 30.

Analysts said they don't expect Bernanke will firmly close the door on a possible third round of bond buying. But they said they don't expect the central bank will embark on such a program unless the economy weakens much further.

Mark Zandi, chief economist at Moody's Analytics, said the recent softening will lead the Fed to hold off on raising interest rates this year, despite some calls from critics who worry about inflation.

Zandi said he had been expecting the Fed to start raising interest rates in the first three months of next year. Now, he said he did not expect the first Fed rate hike to occur until the summer of 2012.

E-paper

Harbin-ger of change

Old industrial center looks to innovation to move up the value chain

Chemical attraction

The reel Mao

Improving app-iness

Specials

Vice-President visits Italy

The visit is expected to lend new impetus to Sino-Italian relations.

Birthday a new 'starting point'

China's national English language newspaper aims for a top-notch international all-media group.

Sky is the limit

Chinese tycoon conjures up green dreams in Europe with solar panels