America

Fed says $600b bond program to end in June

Updated: 2011-04-28 10:45

(Agencies)

|

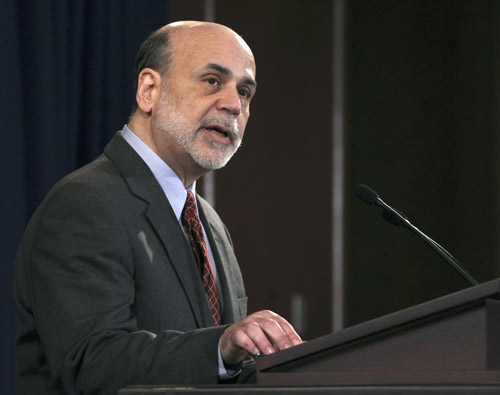

US Federal Reserve Chairman Ben Bernanke addresses a first-ever regularly scheduled news conference by a Fed chief following a Fed meeting at the Federal Reserve in Washington, April 27, 2011. [Photo/Agencies] |

WASHINGTON - The economy and job creation have strengthened enough for the Federal Reserve to end on schedule a program of buying Treasury bonds to help the economy, the Fed said Wednesday.

Ending a two-day meeting, the Fed made no changes to the program. The decision was unanimous. The bond purchases were intended to lower loan rates, encouraging spending and boost stock prices. But critics worried that the purchases would feed inflation.

|

||||

Fed Chairman Ben Bernanke spoke at a news conference after the meeting. It was the first time in the Fed's 98-year history that a chairman has begun holding regular sessions with reporters.

Bernanke said Fed officials expect the moderate economic recovery to continue after weak growth in the first three months of the year.

Stocks rose after Bernanke spoke. The Dow Jones industrial average gained 95 points on the day to close at 12,690 - the highest point in nearly three years.

Before Bernanke spoke, the Fed offered its latest economic projections for the year. The economy will grow as much as 3.3 percent this year, slightly lower than the Fed's estimate in January. The unemployment rate will fall as low as 8.4 percent, a slight improvement from the previous forecast.

Inflation could rise as high as 2.8 percent this year, nearly double last year's rate. But that would still be lower than the average over the last 30 years.

The Fed's main economic support program, which consists of buying $600 billion in Treasury bonds, is scheduled to end in June. But the Fed said it's continuing a separate aid program: It's reinvesting about $17 billion a month in proceeds from its portfolio of mortgage securities to buy Treasury debt. That should help keep rates low on mortgages and other consumer loans.

Since the Fed's bond-purchase program was announced in early November, the economy has gained strength. The unemployment rate has dropped a full percentage point to 8.8 percent, a two-year low. Companies have added more than 200,000 jobs for two straight months, the first time that's happened in five years. And the S&P 500 index has surged 28 percent over the past eight months. Rates on 30-year mortgages have dropped and now stand at 4.80 percent.

Even with the drop in unemployment, Bernanke said the rate is still high by historically standards. But Bernanke said the Fed is less inclined to do more to lower unemployment because additional stimulus could lead to higher inflation.

"The trade-offs are getting less attractive at this point," Bernanke said. "It's not clear that we can get substantial improvements in payrolls without some additional inflation risk."

For now, the Fed downplayed the risk of inflation. It kept its key interest rate at a record low near zero and pledged to leave it there for an "extended period." Bernanke said that means "a couple of meetings." The Fed has kept rates at ultra-low levels since December 2008.

When the Fed decides to abandon the "extended period" language, it would be viewed as a signal that the Fed was getting ready to reverse course and start boosting interest rates.

E-paper

Blowing in the wind

High-Flyers from around the world recently traveled to home of the kite for a very special event.

Preview of the coming issue

Image maker

Changing fortunes

Specials

Costly dream

Uninhabited havens up for lease but potential customers face wave of challenges in developing them.

Models gear up car sales

Beauty helps steer buyers as market accelerates.

Urban breathing space

City park at heart of Changchun positions itself as top tourism attraction