RBS sees record Asia bond sales as Europe woes fade

Updated: 2010-07-15 11:04

By Katrina Nicholas (China Daily)

SINGAPORE - Asian borrowers may sell a record amount of bonds in dollars this year as concern fades that Europe's sovereign debt crisis will slow global economic growth, according to Royal Bank of Scotland Group Plc.

Sales started the year "like a house on fire" before hitting "a bit of a wall" after Greece's credit rating was cut, John Wade, the bank's head of primary debt markets for the Asia-Pacific, said at a briefing in Singapore on Tuesday. As stress tests on European banks calm investors "we might even be able to challenge last year's record", he said.

Sales of bonds denominated in dollars, euros or yen in Asia outside Japan jumped to a record $56.7 billion last year from $16.3 billion in 2008 and $37.9 billion in 2007 as bank lending slowed, according to data compiled by Bloomberg. Companies and governments raised $30.2 billion this year, the data showed.

The International Monetary Fund this month raised its forecast for global growth in 2010 to 4.6 percent, the biggest gain since 2007, compared with an April projection of 4.2 percent.

European regulators are examining the strength of the region's banks to determine if they can survive potential losses on sovereign-bond holdings and are counting on the stress tests to reassure investors about the health of financial institutions.

Sale pipeline

|

||||

G3 currency sales this month rose to $3.3 billion compared with $2.5 billion in June and $3.2 billion in May, Bloomberg data showed. Woori Bank, State Bank of India and PTT Exploration & Production Pcl either sold or started marketing dollar bond sales on Tuesday.

The Royal Bank of Scotland is ranked the No 14 underwriter of G3 currency sales in Asia outside Japan this year with a 2.8 percent market share, according to Bloomberg data. Market leader Deutsche Bank AG has a 13.9 percent share.

"It's not just financial institutions and high-yields," planning sales, Wade said. "Some sovereigns are thinking of coming back to the market and South Korean corporates are always coming as they have massive dollar funding requirements."

When Korea Exchange Bank sold $500 million of 4.875 percent bonds on July 7, it received more than $2 billion in orders from 195 accounts, a person familiar with the matter said at the time.

Woori Bank, a unit of South Korea's third-largest financial institution by market value, sold $600 million of 4.75 percent bonds on Tuesday priced to yield 300 basis points more than similar-maturity Treasuries, Bloomberg data show.

Bloomberg News

Paper's Digest

Fit for fashion

Traditional dresses are becoming High-End favorites with price tags to match.

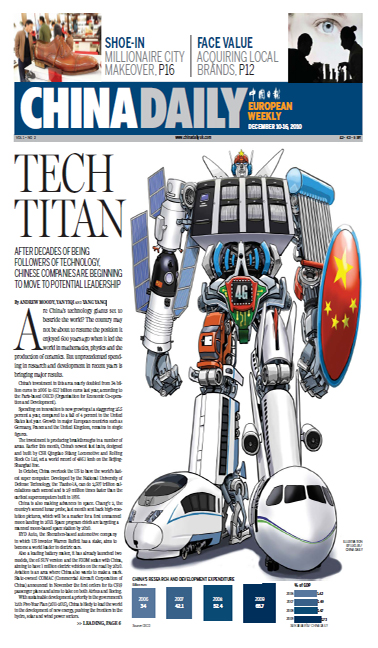

China is producing tech leaders

Coffee giants rush for prime plantations

Printing revolution

Specials

The naked truth about nude art

A growing number of Chinese people are now choosing to go nude for posterity, particularly young women and new brides.

Past Perfect

Management consultant delves into Chinese history and five-year plans to find clues to nation's future.

Dream walker

Norwegian Robert Loken knows that a journey of a thousand miles begins with a single step but in his case it was a sojourn of 6,000 kilometers.