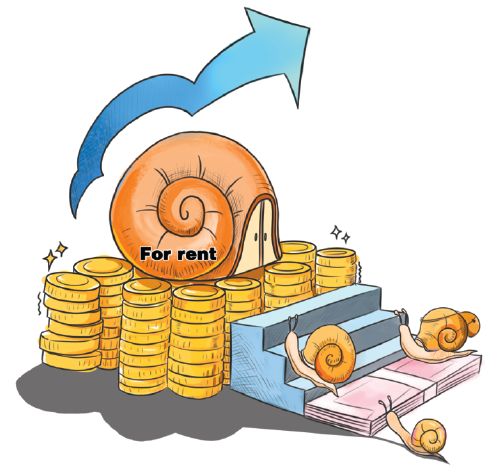

Streamlining the rental property market

|

| SHI YU/CHINA DAILY |

The rental property market in Beijing has been warming up with the return of migrant workers after the Spring Festival holiday. The increase in house rent in the post-Spring Festival period is more than 10 percent this year, compared with 3 percent in the same period last year. The period immediately after Spring Festival in Beijing sees an increase not only in owner-tenant agreements but also house rent.

The rapid rise in housing prices last year played an important role in the unusual increase in house rent this year. When the real estate market is sluggish, more second-hand houses are offered for rent and prevent rent from rising rapidly. And if the real estate market is hot, more second-hand houses that otherwise would have been offered for rent will be sold, and as demand exceeds supply the rent rates will increase.

Housing prices in Beijing have risen sharply over the past two years, much higher than rent rates. So the recent sharp increase in house rent can also be regarded as a transmission effect of the rapidly rising housing prices.

Because of the rapid increase in housing price in first-tier cities, the average age of people buying their first house is gradually delaying to between 31 and 35, which could also have influenced the increase in house rent. Statistics show that in the first-tier cities about 77 percent of the tenants are aged between 20 and 30, and the period for which they rent houses has correspondingly increased.

With the development of subway lines and supporting facilities such as education, medical treatment and commercial real estate in suburban areas, more and more people in Beijing choose to rent houses beyond the Fifth Ring Road, which offer more rental properties. In addition, due to real estate control policies, the sale of second-hand houses has declined in Beijing for three consecutive months. This means more second-hand homeowners are postponing their decision to sell their properties and offering them for rent.

Since 2015 central and local governments have been focusing on the simultaneous development of the real estate and house rent markets to standardize the house rent sector. But the rapid increase in rent despite the ever-increasing supply of rental properties indicates the supply of houses is still not enough to meet the demand. For instance, the young generation's demand for rental properties has changed and the traditional house rent market cannot meet their individual demands.

Given these factors, the government should accelerate the formulation of legislation on the rental property market. On June 3 last year, the General Office of the State Council issued a guideline for the cultivation and development of the rental property market. Now, they should further strengthen the market rules and regulations, especially the inspection mechanism, and enforce the law more strictly against rule breakers to safeguard the legal rights of consumers and provide them with the necessary legal help.

The authorities should also encourage more enterprises and developers to offer their properties for rent. Till now about 90 percent of the houses for rent are offered by individual homeowners, as enterprises prefer to sell their properties instead of offering them for rent. So the authorities should encourage enterprises to offer their properties for rent by expanding their financial channel that will enable them to build more rental properties.

Moreover, the authorities should further regulate the rental property market by strengthening the supervision of the real estate agency service, and strictly implementing the professional qualification system of property agencies.

They should also build as well as encourage commercial developers to build more low-rent housing to meet the rising demand of consumers.

The author is a researcher at the Institute for Urban and Environmental Studies, Chinese Academy of Social Sciences.

- Reducing housing prices proves to be tricky

- Housing: Chinese cities among most unaffordable

- Top 10 cities with most unaffordable housing

- Chinese cities take top spots with most unaffordable housing

- Government's commitment to housing will remain: CE

- Housing sales contract dispute between Ji Yuanfeng and Dalian-based Huacheng Tianyu Real Estate Development Co, Ltd

- Two China cities tighten housing purchase