China's economy continues its transition

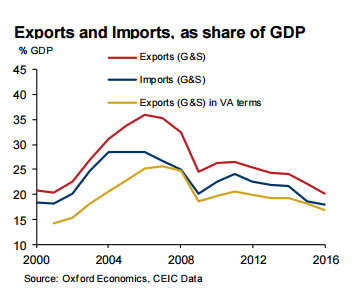

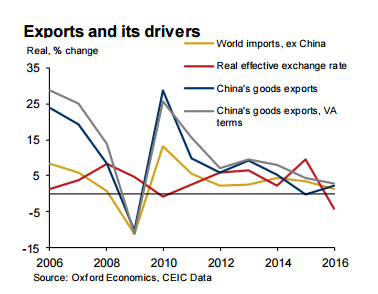

Real export growth picked up somewhat in 2016 but remained much lower than in the 2000s. As Chart 4 shows, relatively slow growth of global trade has been a drag in recent years. Moreover, the extent to which China’s exporters gain global market share has declined significantly. In 2014-16, China’s exports (of goods) outgrew partner country import demand by only 0.4 ppt, compared to 17 ppt in 2004-06, in real terms. In 2015, when China’s REER appreciated sharply, its exports even lost some global market share, in terms of gross exports (not in terms of domestic value added content). That market share loss was recouped in 2016, even though surprisingly, exports weakened in Q4.

Real import growth picked up in 2016, but continued to lag behind domestic demand growth. Real imports of goods and services held up pace with China’s rapidly expanding domestic demand from 2008 to 2014, but trailed demand in 2015-16 (Chart 5). This includes imports of services, which have grown by leaps and bounds in the last six years, according to the balance of payment data. Goods imports (for which the data is arguably more consistent over time than that for services imports), started to significantly lag behind domestic demand already in 2014 (Chart 5).

This slowdown in import volume growth, after a long period of rapid expansion, has been clearly felt across the globe. Indeed, it fueled the concerns among some observers that China’s economy was slowing much more strongly in recent years than the official data suggests (in our view, GDP growth in 2015 was around 0.6 ppt lower than the official estimate, but the gap narrowed to around 0.3 ppt in 2016).