Balance stimulus and supply-side reform

Updated: 2016-04-14 07:45

By Yu Yongding(China Daily)

|

|||||||||

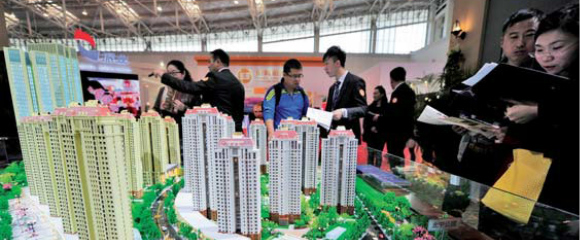

Compounding the challenge confronting China is the fact that the economy's major demand-side driver, real-estate investment, is declining more rapidly than the alternative source of demand, domestic consumption, is rising. In 2015, the unsold residential floor space for China as a whole was 700 million square meters, while the average annual sale of floor space in normal times was 1.3 billion square meters.

Faced with double-digit growth in inventory, real-estate developers slashed investment. By the end of 2015, real-estate investment growth dropped almost to zero. This year, though investment increased somewhat in January and February, that rate is almost certain to fall significantly further. Because real estate investment accounts for more than 10 percent of China's GDP, the impact of this trend on overall economic growth will be considerable.

In this context, China is not facing a choice between Keynesian stimulus or supply-side reform, but rather a challenge in balancing the two. In order to avoid a hard landing that would make structural adjustment extremely difficult to implement-not, it should be noted, to prop up growth-another stimulus package that increases aggregate demand through infrastructure investment is needed. Given that China's fiscal position remains relatively strong, such a policy is entirely feasible.

But the new stimulus package should be designed and implemented with much more care than the 4 trillion yuan ($586 billion) package China introduced in 2008.With the right investments, China can improve its economic structure while helping to eliminate overcapacity.

The key will be to finance projects mainly with government bonds, instead of bank credit. That way, China can avoid the kinds of asset bubbles that swelled in the last several years, when rapid credit growth failed to support the real economy.

And to accommodate this approach, the People's Bank of China should adjust monetary policy to lower government-bond yields. Specifically, it should shift the intermediate target of monetary policy from expanding the money supply to lowering the benchmark interest rate. Needless to say, in order to uphold the independence of its monetary policy, China has also to remove the shackles from the yuan exchange rate.

Structural adjustment remains absolutely critical to China's future, and the country should be prepared to bear the pain of that process. But, under current circumstances, a one-dimensional policy approach will not work. Expansionary fiscal policy and accommodative monetary policy also have an important role to play in placing China on a more stable and sustainable growth path.

The author, a former president of China Society of World Economics and director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, served on the Monetary Policy Committee of the People's Bank of China from 2004 to 2006. Project Syndicate

Related Stories

Supply-side reform must be balanced with stimulus: economist 2016-04-07 10:51

Supply-side up 2016-03-27 14:05

Supply-side structural reform to bring vitality to Asia 2016-03-23 13:47

Let market play bigger role in supply side reform: expert 2016-03-19 19:45

Today's Top News

Inspectors to cover all of military

Britons embrace 'Super Thursday' elections

Campaign spreads Chinese cooking in the UK

Trump to aim all guns at Hillary Clinton

Labour set to take London after bitter campaign

Labour candidate favourite for London mayor

Fossil footprints bring dinosaurs to life

Buffett optimistic on China's economic transition

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|