Demand unlikely to boost yuan despite basket inclusion

Updated: 2015-11-27 08:11

By Mark Williams(China Daily)

|

|||||||||

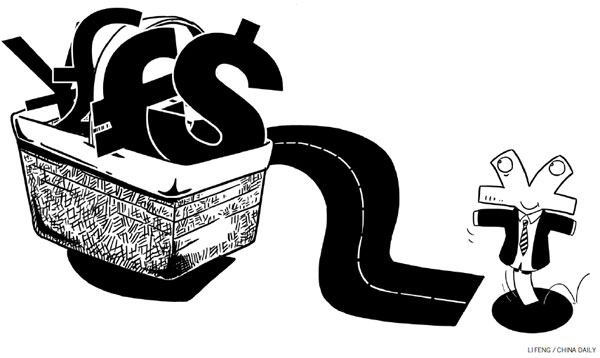

The International Monetary Fund's decision to include the yuan in the Special Drawing Rights basket will not directly increase the demand for yuan assets. Also, the implicit endorsement of the yuan as a reserve asset is unlikely to sway the decisions of global asset managers. Indeed, China's market interventions this year in response to capital outflows and the bursting of the equity bubble provide strong reasons for them to steer well clear.

Much of the commentary on the IMF's decision has been marred by misunderstanding of the role the SDR performs. The SDR is the unit of account used within the IMF. Its value is determined as a weighted average of the basket currencies (currently the dollar, euro, yen and the pound sterling).

IMF members hold balances denominated in SDRs. If any of them encounter balance of payments strains they can sell SDRs to other members in exchange for any of the currencies in the basket. In this way, SDRs are a supplementary reserve asset, giving access to reserve currencies. In normal circumstances, though, there is no boost in the demand for a currency simply because it is in the SDR basket.

A second misconception is that membership of the basket determines "reserve currency status". On this basis neither the Australian nor the Canadian dollar would be reserve assets, although they each account for 1.9 percent of global reserves for which a currency breakdown is available.

In practice, what determines whether central banks are willing to consider a currency a reserve asset is their confidence that they can sell those assets whenever needed into deep and liquid markets. Inclusion in the SDR basket could be taken as endorsement by the IMF that the yuan and China's financial markets meet this standard. But central banks are likely to reach their own judgments.

Related Stories

IMF leadership vote a chance to reform 2015-11-22 10:03

RMB to IMF's SDR? More than just alphabet soup for China 2015-11-19 12:26

IMF chief reiterates supports for Chinese currency's inclusion into SDR basket 2015-11-17 17:12

G20 leaders urge US to agree to IMF reforms 2015-11-17 03:23

Today's Top News

Inspectors to cover all of military

Britons embrace 'Super Thursday' elections

Campaign spreads Chinese cooking in the UK

Trump to aim all guns at Hillary Clinton

Labour set to take London after bitter campaign

Labour candidate favourite for London mayor

Fossil footprints bring dinosaurs to life

Buffett optimistic on China's economic transition

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|