Flat growth data

Updated: 2013-06-13 08:03

(China Daily)

|

|||||||||||

Economic figures released over the weekend have led to exacerbated concerns over China's economic prospects. But it is likely that the authorities will remain hands-off unless the labor market worsens.

Economic activities remained at low levels in the world's second-largest economy in May, with the growth in exports slowing to 1 percent year-on-year from 14.7 percent in April, the lowest in almost a year. Consumer inflation, meanwhile, was 2.1 percent, the lowest in three months, while producer prices dropped by 2.9 percent, the lowest since September.

What is relatively reassuring is that industrial output improved by 9.2 percent year-on-year, with the month-on-month growth momentum showing signs of improvement, and retail sales registered 12.9 percent year-on-year growth.

But despite the low levels of economic activity, it is premature to expect any major stimulus measures until there are unmistakable signs of major stress in the labor market. The authorities have become more tolerant of the country's relatively low nominal economic growth rates, and restructuring and prevention of financial risks are obviously high on their agenda.

And in the labor market, things have not worsened to an unbearable degree. According to a survey by the global staffing company ManpowerGroup, China's employment prospects index for the third quarter has dropped to its lowest level since early 2010. But still, 14 percent of the surveyed employers plan to increase their workforce, compared with only 2 percent that said they would cut jobs.

Similarly, the employment sub-index of the official Purchasing Managers' Index released early this month shows that while both the manufacturing and non-manufacturing job growth conditions are slightly down, they are yet to slide to a dangerous level.

The authorities, therefore, may opt not to cut the interest rates or banks' reserve requirement ratio as many expected. Instead, the government will probably stick to its agenda and prioritize reforms to make the economy more sustainable.

But a pressing task in the short term is the prevention of financial risks, as economists have warned that the pile-up of the local government debt and the off-balance-sheet wealth management products could be a ticking time bomb for the economy.

Related Stories

Gold rises on weaker Chinese economic data 2013-06-11 09:40

Oil prices decline on weak export data from China 2013-06-11 09:42

Slow growth continues for China's fiscal revenue 2013-06-10 11:09

Premier: Growth will remain stable 2013-06-09 08:11

China's foreign trade growth slows in May 2013-06-08 14:48

Today's Top News

Lifetime award for Jackie Chan

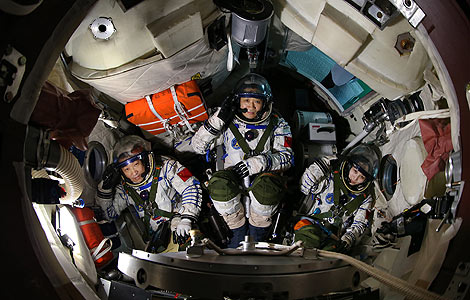

Space dream on course

Desert oasis

China's wine probe sparks worries

Teach children to avoid abuse: experts

Registry to open for organ donors

KMT officials begin three-day visit to mainland

Surveillance program a test of ties

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|