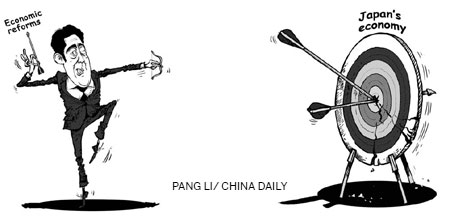

The gamble that is Abenomics

Updated: 2013-06-07 08:13

By Xu Changwen (China Daily)

|

|||||||||||

After being sworn in as prime minister at the end of 2012, Abe introduced "Abenomics" in an attempt to tide over the country's economic troubles. Abenomics includes "three arrows": quantitative easing, positive fiscal policies to stimulate demand and creation of sustainable growth.

The first two arrows, the depreciation of Japanese yen and a 2 percent rise in consumer prices index, have already been shot. The exchange ratio of the US dollar against yen increased from 1:80 to 1:101.52 on May 24, and then fell to 1:99.95 on June 5. Last year, the International Monetary Fund set the ratio at 1:100.47, while the Organization for Economic Cooperation and Development insisted that 1:103.9 was a more realistic ratio. So the ratio is close to Western economists' estimate.

The primary reason for the depreciation of the yen is the huge supply of banknotes. According to Bank of Japan data, the supply of money in the country will increase by 132 trillion yen to 270 trillion yen by the end of 2014.

The immediate impact of the yen's depreciation has been the increase in the value of some Asian countries' currencies against the yen. For example, the value of the Chinese yuan against the yen has increased by 18.5 percent. Likewise, the Indian rupee has risen by 17.12 percent, the Republic of Korea's won by 10.88 percent and the Thai baht by 20.17 percent.

This development may curb the economic recovery of these countries. Since more than 50 percent of the trade between these countries and Japan is settled in the Japanese currency, its depreciation has caused a decline in Japanese investment in these countries. Also, their exports have declined. For example, the ROK, one of Japan's main competitors, has seen a fall in the export of its oil products, automobiles and mechanical products.

The stock and debt markets of these countries, too, may come under pressure, because fears of the yen depreciating further could force more international short-term capital to flood their markets. That would not only cause their stock and debt prices to fluctuate, but also could lead to inflation.

The depreciation of the yen has had a negative impact on Japan too, and the country could enter a vicious circle of currency depreciation. Japan's trade deficit has been rising continuously. In 2011, it had a trade deficit of $32.28 billion for the first time in decades. The figure has increased to $87.11 billion last year, and the trade deficit could force Japan to increase its fuel imports, which, in turn, could lead to further depreciation of the yen.

Related Stories

A weak currency for Japan is not the full answer 2013-06-04 18:48

Japan disaster money spent on counting turtles 2013-06-04 09:25

More volatility under Abenomics 2013-06-03 11:37

Too early to judge Abenomics' effect 2013-05-23 05:31

'Abenomics' may not cure Japan 2013-04-03 07:15

Today's Top News

China's economy might be No 1 in 2030

355,000 parents have lost only children

Russian President Putin, wife announce divorce

Xi: Strengthen trade links with Mexico

Top global enterprises welcomed

Gold miners held in Ghana

China, Vietnam set up naval hotline

More students looking overseas

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|