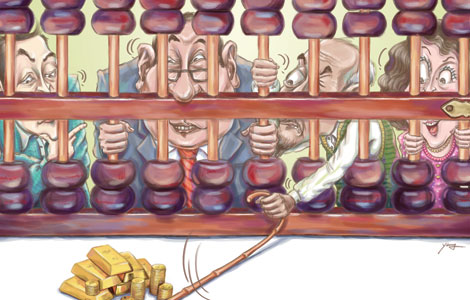

Exchange rate reform may take time

Updated: 2013-05-23 08:17

By Louis Kuijs (China Daily)

|

|||||||||||

It also fits in with the broader movement to more market-oriented economic policies. Financial and monetary reform includes opening up the capital account more fully to financial flows. As underscored by the lessons from emerging market crises in recent decades, the capital account can be fully opened up only after domestic financial reform has been mostly completed and the exchange rate made basically flexible. In addition, the internationalization of the yuan calls for exchange rate flexibility and a more open capital account.

However, there are some challenges on the way to more exchange rate flexibility. Real flexibility means no intervention on the foreign exchange market and true two-way risk. While there is in principle no reason to delay the move to more flexibility, there is a practical issue. China is likely to continue to see sizeable net inflows in the coming years from the surplus in the current account and net foreign direct investment. On top of that, with a more convincing growth outlook than most other countries and substantially higher interest rates, China is likely to continue to face net financial inflows.

With such foreign exchange pressures, the kind of appreciation that would bring the yuan to a point from where there is true two-way risk would be substantially larger than what we saw in recent weeks. Even though China seems to have become more tolerant toward exchange rate appreciation, there must be limits to the appreciation the government can accept given that China's trade-weighted real exchange rate is already 15 percent higher than what it was two years ago while global demand is weak.

Another challenge is sequencing. Although countries should not open their capital account before making good progress toward exchange rate flexibility, some of the steps already taken toward the internationalization of the yuan and the role of Hong Kong have already created quite a bit of de facto capital account opening for many enterprises, especially Chinese mainland enterprises.

The sizeable financial flows, outward in much of 2012 and inward so far in 2013, complicate progress toward more exchange rate flexibility - which is one reason why the government acted in early May to make it harder for China's banks to facilitate inflows and to clamp down on inflows apparently disguised as export revenues.

Given these challenges, even though there is in principle no reason to delay more exchange rate flexibility, in practice it may take a while before the exchange rate can be brought to a level from which there is true two-way risk without damaging the real economy too much. And, since major capital account liberalization should await introduction of meaningful flexibility, hopefully the government can resist the calls for a quick move to full "yuan convertibility under the capital account".

The author is chief China economist at RBS.

Related readings:

Rising yuan increases risks

Yuan appreciation burdens exporters

China to simplify foreign exchange rules on FDI

Singapore exchange to list RMB equities

Today's Top News

China, Pakistan to set up economic corridor

Solar negotiations with EC fail

Special envoy from DPRK arrives

Consumers' demand for luxuries growing

Survey predicts fast growth in business travel

Consumers more willing to spend

Premier Li arrives in Pakistan for visit

H7N9 test reagents hit the market

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|