Double drivers for economy

Updated: 2012-12-12 08:31

By Zhang Monan (China Daily)

|

|||||||||||

To maintain competitive advantage, as well as boosting domestic demand, manufacturing must be upgraded

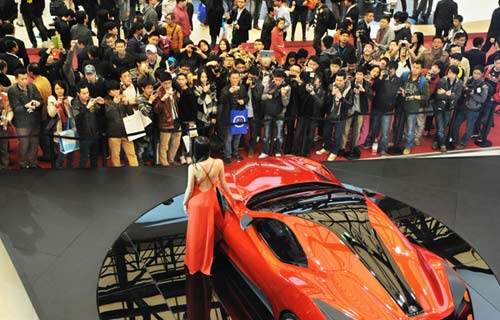

China is realizing a transformation from an external demand-driven economy to a domestic demand-driven, especially consumption-driven, economy to maintain its sustainable development, and the ever-increasing domestic consumption will be an important driving force for the country's economic growth.

However, consumption alone will not be enough to sustain China's development and retain its threatened competitiveness. International experience shows that an economy founded on consumption alone will be unable to maintain sustainable development. So China should maintain a strong manufacturing industry to bolster its consumption.

In the report delivered by Hu Jintao, the former general secretary of the Central Committee of the Communist Party of China, to the 18th National Congress of the CPC, the country aims to double its gross domestic product and the per capita incomes of urban and rural residents from the 2010 level by 2020. These goals, if realized, will help release 64 trillion yuan ($10.20 trillion) of purchasing capacity. According to the Boston Consulting Group, China's domestic consumption will rise to 50 percent of the domestic consumption in the United States by 2015 and 80 percent by 2020 if its GDP achieves a 7 percent growth rate year-on-year, assuming that the US maintains a 2 percent GDP growth year-on-year.

While statistics show that China's trade surplus declined in 2011 for a third straight year, with its proportion to the GDP declining from 10 percent in 2007 to 2.8 percent, the country's import volume is expected to grow by 27 percent year-on-year from 2011 to 2015, five percentage points higher than its exports during the same period. Its total import value over the next five years is expected to exceed $10 trillion. Such an enormous market means huge opportunities for foreign capital and this also explains why many transnational corporations have shown a strong desire to increase their presence in China since the global financial crisis.

According to a survey conducted by the Development Research Center of the State Council in May, transnational companies not only regard China as an important market, they also view it as a research and development base and an important export destination. It is also seen as an important base for services, product assembly, low-cost manufacturing, as well as an important source of financing.

The strategy adopted by the US and other developed countries to relaunch their manufacturing sector is, to a large degree, targeted at China and other emerging markets. Under such a strategy, they have begun a new wave of setting up research and development centers in the Chinese mainland. Statistics from the Ministry of Commerce indicate that more than 480 of world's top 500 enterprises have established subsidiaries in China, and nearly 1,000 research and development centers have been set up. In 2010 alone, an additional 194 research and development centers were set up by foreign investors. More overseas companies have chosen to transfer their research and development departments here because of the enormous consumption potential.

China is now the world's largest manufacturer, with its manufacturing volume accounting for 19.8 percent of world's total. However, its research and development input into manufacturing is less than 3 percent of the world's total. China's industrial manufacturing and innovation capability is generally at a comparatively low level and the international competitiveness of its technology and knowledge-intensive industries is weak compared with technology and knowledge-intensive industries in developed countries. There is still a wide gap between China and developed countries in terms of their industrial productivity. Many of China's traditional industries are still plagued by "impoverished growth". For example, China's industrial productivity and ability to create added value are 4.38 percent that of the US, 4.37 percent of Japan and 5.56 percent of Germany.

Besides, China's long-held advantages for maintaining a high capital return ratio is expected to gradually vanish over the next decade. The imbalance in its labor demand and supply relations will further fuel increases in its labor costs. Despite wages being lower in China than the US, the ever-narrowing wage gap between them has prompted the US to adopt a localized strategy to relaunch its "lost" manufacturing. According to the Boston Consulting Group, China's wages, if priced in the US dollar, are expected to rise 15 percent to 20 percent year-on-year, faster than the growth of its productivity. The gap between labor costs in China's coastal regions and some of the states in the US will narrow in the years ahead. China's advantages will further narrow if the US' lower energy costs as a result of its exploitation of shale gas are taken into account.

China's manufacturing faces gloomy prospects as a result of the re-industrialization strategy being implemented by the US and other developed nations and an accelerating manufacturing development in other emerging countries. Signs have emerged that labor-intensive industries have accelerated their transfer to Vietnam, India, Mexico and some East European countries where low-cost advantages are more obvious. Due to their lower costs, products made by India, Mexico and the member countries of the Association of Southeast Asian Nations are starting to replace the "made in China" brand.

Although China's enormous consumption potential can serve as a new driving force for its economic growth, increased technological input aimed at achieving some technological breakthroughs and realizing technological and product upgrading should be prioritized in the country's economic transformation. A robust domestic demand and a prosperous manufacturing sector together can help China maintain its comparative advantage and ensure its sustainable growth over the next decade.

The author is an economics researcher with the State Information Center.

(China Daily 12/12/2012 page8)

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|