From the foreign press

Updated: 2012-03-09 08:01

(China Daily)

|

|||||||||||

Reform won't pump up stocks

Reforms planned for China's basic pension fund will not flood money into the stock market, said Yin Weimin, Minister of Human Resources and Social Security, at a news conference on the sidelines of China's annual meeting of parliament, the National People's Congress. This means the pension reform may not pump up the stock market, says an article on reuters.com. Excerpts:

Expectations are running high that Beijing is about to unveil landmark reforms to create China's own version of the US 401K pension savings program, to allow funds managed by local governments more freedom to invest in a wider range of assets, including domestic equities.

"Don't simply think that pension funds management means pumping money into the stock market. The trend is clear, we want to protect and grow the value of these funds." Yin said.

"Fund security will be the top priority," Yin said, adding that the exact reforms were still being considered and that any changes would ensure a prudent, diversified investment approach.

Chinese media have reported that Beijing may allow local pension funds to invest up to 30 percent of their capital in equities this year, potentially injecting 580 billion yuan ($92 billion) into the Chinese stock market, which was one of the world's worst performers last year.

Guo Shuqing, the chairman of the China Securities Regulatory Commission, said earlier this week that local pension funds are set to enter the stock market. Company and individual contributions to the 1.9 trillion yuan basic pension scheme are only allowed to invest in government bonds and bank deposits and are typically managed by municipal or provincial governments.

But Beijing is inclined to allow the National Social Security Fund to manage some of the pension money, local media have said. The National Social Security Fund has delivered average annual returns of 9 percent over the last decade.

Targeting China's consumers

China cut its 2012 target growth rate to 7.5 percent at the National People's Congress. A slowing of the world's second-largest economy may put the global stock market's current rally on hold for now, but as Premier Wen Jiabao said, "expanding consumer demand" is one of the priorities for the upcoming year, says an article on reuters.com. Excerpts:

China's economy could be moving to a new stage, in which consumer companies fare better than its well-established manufacturing base and look for higher profitability. China's new focus on the consumer is necessary for its industrialization efforts and economy to become self-sustaining.

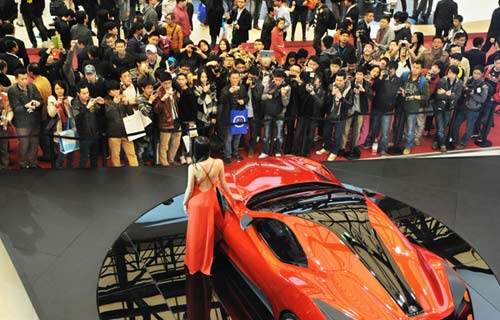

Therefore, companies should invest in those businesses targeting the masses in China, such as China Mobile, the country's largest mobile phone operator, and Sohu, which operates a popular network of Internet sites, including gaming and social networking. Global companies that make basic consumer products could also benefit. Experts believe that Chinese consumers will continue buying products from big brand name multinational companies because they have a reputation for quality. Companies like Coca-Cola, McDonald's and Yum Brands will continue to expand in China. Even global automobile companies such as General Motors, are increasing their market share.

(China Daily 03/09/2012 page10)

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|