The Europe of the future

Updated: 2012-01-04 07:37

By Jean-Claude Trichet (China Daily)

|

|||||||||||

Whenever people seek a justification for European integration, they are tempted to look backward. They stress that European integration banished the specter of war from the old continent. And European integration has, indeed, delivered the longest period of peace and prosperity that Europe has known for many centuries.

But this perspective, while entirely correct, is also incomplete. There are as many reasons to strive toward "ever closer union" in Europe today as there were back in 1945, and they are entirely forward-looking.

Sixty-five years ago, the distribution of global GDP was such that Europe had only one role model for its single market: the United States. Today, however, Europe is faced with a new global economy, reconfigured by globalization and by the emerging economies of Asia and Latin America.

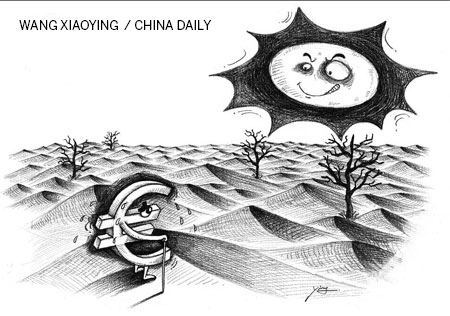

It is a world where economies of scale and networks of innovation matter more than ever. By 2016 - that is, very soon - we can expect eurozone GDP in terms of purchasing power parity to be below that of China. Together, the economies of China and India could be around twice the size of the eurozone economy. Over a longer time horizon, the entire GDP of the G7 countries will be dwarfed by the major emerging economies' rapid growth.

So Europe must cope with a new geopolitical landscape that is being profoundly reshaped by these emerging economies. In this new global constellation, European integration - both economic and political - is central to achieving an ongoing prosperity and influence.

Like individuals in a society, eurozone countries are both independent and interdependent. They can affect each other both positively and negatively. Good governance requires that both individual member states and EU institutions fulfill their responsibilities.

First and foremost, every eurozone country needs to keep its own house in order. This means responsible economic policies on the part of governments, as well as rigorous mutual surveillance of those policies - not just fiscal policies, but measures affecting all aspects of the economy - by the European Commission and member states.

In a society, law-enforcement institutions can ultimately compel a citizen to abide by the rules. In the eurozone, a framework based on surveillance and sanctions has, until the most recent decisions, depended on offending states' willingness to comply.

But what can be done if a member state cannot deliver on its promises? For countries that lose market access, the approach of providing aid on the basis of strong conditionality is justified. Countries deserve an opportunity to correct the situation themselves and to restore stability.

This approach nonetheless has clearly defined limits. So a second stage is now envisaged for countries that persistently fail to meet their policy targets. During this second stage, eurozone authorities would play a much deeper and more authoritative role in the formulation of countries' budgetary policies.

This moves us away from the current framework, which leaves all decisions in the hands of the country concerned. Instead, it would not only be possible, but in some cases compulsory, for the European authorities to take direct decisions.

Implementing this idea also implies embracing a new concept of sovereignty, given the complex interdependence that exists between eurozone countries. But it is ultimately in the interests of all eurozone citizens that these changes be made.

It is my firm conviction that the Europe of the future will embody a new type of institutional framework. What might it look like? Would it be too bold to envisage there being an EU finance ministry one day?

Any future European finance ministry would oversee the surveillance of both fiscal policies and competitiveness policies, and when necessary, impose the "second stage". Moreover, it would carry out the usual executive responsibilities regarding the supervision and regulation of the EU financial sector. Finally, the ministry would represent the eurozone in international financial institutions.

Recent events have only strengthened the case for pursuing this approach. Europe's leaders are discussing a change in the Maastricht Treaty (already revised in Amsterdam, Nice and Lisbon treaties) to create stronger economic governance at the EU level, and eurozone citizens are themselves calling for better supervision of the financial sector. And I know that our partners in G20 look to Europe as a whole, rather than to individual member states, for solutions. So, increasingly, it seems that it would be too bold not to consider creating a European finance ministry at some point in the future.

But an EU finance ministry would be only one component of Europe's future institutional framework. One can imagine that, as various elements of sovereignty come to be shared, the European Council might evolve into the EU Senate, with the European Parliament becoming the lower house. Similarly, the European Commission could become the executive, while the European Court of Justice takes on the role of an EU judiciary. And, given European countries' long and proud history, I have no doubt that "subsidiarity" will play a major role in the future Europe - significantly greater than in current models of federation.

Mine are the personal views of a European citizen. The future of Europe is in the hands of its democracies, in the hands of Europe's people. Our fellow citizens will decide the direction Europe is to take. They are the masters. But, however Europe's institutions take shape, a truly pan-European public debate is essential.

As Europeans, we identify deeply with our nations, traditions and histories. These are Europe's roots. But we also need to extend our branches more widely.

So today, we should not look back. We must look forward - to opportunities of collective betterment, and to every country's potential to be stronger and more prosperous in a well-functioning union.

The author is a member of the Board of Directors of the Bank for International Settlements, and was president of the European Central Bank (2003-2011) and president of the Bank of France (1993-2003).

Project Syndicate

(China Daily 01/04/2012 page9)

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|