Op-Ed Contributors

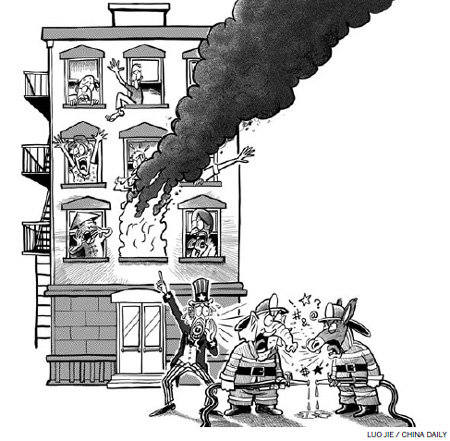

US debt impasse worries the world

Updated: 2011-07-26 07:53

By Martin Khor (China Daily)

The political deadlock in Washington on whether and how to increase the United States' debt limit is causing anxiety over a possible default and a new global economic downturn.

The deepening of the eurozone's debt crisis (though the European Union has agreed to bail out Greece for the moment) has been more than matched by the growing fear that the US administration would default on its bills from Aug 2.

Long negotiations have taken place between US President Barack Obama, and the Democrats and Republicans to avert a partial closing down of the federal government. The US at present has a limit of $14.29 trillion for its federal debt. This limit will be reached by Aug 2. Congress has to approve the raising of the debt limit before then, or else the Obama administration will have to defer meeting some of its financial commitments.

US Federal Reserve Chairman Ben Bernanke has warned that default would send shockwaves throughout the economic world. The alarm bells rang even louder when rating agencies Moody's and Standard and Poor's warned that they might downgrade US debt from its "AAA" status if the political impasse continues.

There are several reasons why the world, especially developing countries, should be alarmed at this situation.

First, many developing countries hold hundreds of billions of dollars of US Treasury bills as part of their foreign reserves. An actual default raises the unthinkable prospect of those countries having to take a "haircut" or being paid back only part of the amount.

This is unlikely to happen. But even the prospect of default and a credit status downgrade would reduce the value of their bonds. Moreover, the decline in the value of the dollar is likely to accelerate, causing further losses.

No wonder, China, which holds $1.15 trillion in Treasury bonds, repeatedly urged the US to adopt responsible policies and measures to protect investors in US bonds.

Second, economic growth in developing economies will be hit if the standoff or the eventual solution causes the US economy to stand still or relapse into recession. Whatever the final deal between the US president and congressmen, its centerpiece is certain to be deep cuts in government spending. This will reduce effective demand in the economy.

The effect will be opposite to the Obama administration's recession-busting fiscal stimulus that enabled the economy to bounce back after the 2008-2009 recession.

Third, the uncertainties in Washington emphasize the present unhealthy dependence on the greenback as the international reserve currency. The need for reform to reduce the dependence on a single currency, for example by greater use of the special drawing rights (a basket of major currencies) as a global reserve currency, has been advocated by several prominent economists such as Joseph Stiglitz, Jose Antonio Ocampo and Yilmaz Akyuz, as well as policymakers such as the governor of the China's central bank Zhou Xiaochuan.

A default in servicing US debt has moved from the unthinkable to the possible, though it is still in the realm of most unlikely. It may re-ignite the debate on reform of the global reserve system.

The facts of the impasse in Washington are as follows: The US administration is forecast to reach current debt limit of $14.29 trillion on Aug 2, so it cannot take any new loans after that. The US administration estimates that the debt limit has to be increased by $2.4 trillion so that the government can meet its commitments up to November 2012, that is, until the presidential elections.

Many Republican congressmen, especially those under the influence of "Tea Party", want the government to strike a budgetary balance by reducing spending without increasing taxes.

A few Republican leaders, however, are willing to agree to a small increase in taxes, or rather in closing taxation loopholes, but they find it difficult to convince their colleagues. They also want spending cuts to exceed the rise in the debt limit.

The president and Democrats are willing to cut spending significantly, but want to raise taxes for the rich, too, so that both can help reduce the deficit. Democrat leaders are adamant that social and medical security should not be affected by the cuts, though Obama is willing to allow some cuts there as well.

If the extreme stance of the Tea Party faction becomes the overall Republican line as well, a deal would be extremely difficult to reach. To meet it, the Democrats and the president would have to compromise to the degree of total capitulation.

If the deadlock continues, a possible solution may be the proposal of Senate Minority Leader (Republican) Mitch McConnell in which the president submits his plan to increase the debt limit and to cut the budget, the Congress rejects it, the president vetoes the rejection, and his proposal is adopted unless two-thirds of Congress rejects it again.

This will allow all sides to claim that they stuck to their positions but a grave crisis will be avoided. If there is still no agreement by Aug 2, however, then the US administration will have to choose which items not to pay for and when. These include interest on Treasury bills, social security, medical care, defense vendors, unemployment benefits, food stamps, military pay and federal salaries.

Priority will be given to debt servicing so a default on Treasuries is very unlikely unless the impasse lasts long. But other services and salaries will be hit, and increasingly so, as long as there is no deal.

As almost everyone will agree, this is no way to run a government, and the US governance system is becoming dysfunctional. This has had and will have further serious consequences on the rest of the world. So the universal hope is that some solution is found before Aug 2.

The author is executive director of South Centre, a think tank of developing countries, based in Geneva.

(China Daily 07/26/2011 page9)

E-paper

Ringing success

Domestic firms make hay as shopping spree by middle class consumers keeps cash registers ringing in Nanjing

Mixed Results

Crowning achievement

Living happily ever after

Specials

Ciao, Yao

Yao Ming announced his retirement from basketball, staging an emotional end to a glorious career.

Going the distance

British fitness coach comes to terms with tragedy through life changes

Turning up the heat

Traditional Chinese medicine using moxa, or mugwort herb, is once again becoming fashionable