From overseas press

US should prevent military conflicts with China

Updated: 2011-07-07 11:19

(chinadaily.com.cn)

The United States should prevent war with a rising China, for any military conflicts would be catastrophic for both sides and the entire world economy, said US Navy Lieutenant Commander Matthew Harper in the latest Proceedings magazine of the US Navy Institute.

According to Harper, as China's growing strength gains greater global attention, more time, energy, and money will be spent asking how the United States will counter an increasingly capable Chinese military. But he warned that fear of China's perceived military intentions is "both overblown and unproductive for the United States and its military" and "focusing solely on Chinese military capabilities clouds the critical challenge of preventing a catastrophic Sino-American conflict".

The US' immense reliance on China means that a military conflict would have dire effects, noted Harper. As few people fully understand the immensity of that reliance, Harper quoted a list by James Fallows who gives a partial run-down of what China produces. From computers, telecom equipment, medical devices, to sporting goods and exercise equipment, anything you can think of is labeled with "Made in China".

Actually, any announcement of military activities would set off a downward spiral in the international stock markets, said Harper. Both Apple and Walmart would see their stock prices plummet. As approximately 50 percent of the US population owns stocks, the resulting dive in the stock market would make Americans acutely aware of just how connected their financial well-being is linked to China.

Meanwhile, the impact to the world economy would be instantaneous, warned Harper. Apple, along with other technology firms that rely on China, would face disaster and Walmart would fare little better. "It only would be a few days before the United States would start seeing eerily empty shelves, not only at Walmart but at other stores across the country. Companies in the Dow Jones Industrial Average that are dependent on sales and growth in China—including Alcoa, Caterpillar, General Electric, McDonald's, and Boeing, to name a few—would see huge losses. The technology-heavy NASDAQ companies would lose even more of their stock-market value."

As China becomes more of a potential military rival, said Harper, US strategic thinking needs to evolve beyond the age-old question of "How do we counter?" to the real question, which is "How do we prevent any type of military conflict with China?"

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

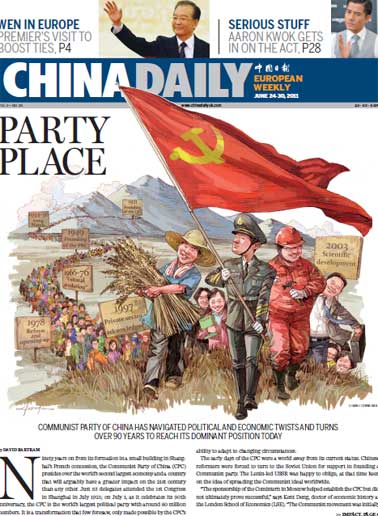

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city