Op-Ed Contributors

Debate: Income tax

Updated: 2011-02-28 07:45

(China Daily)

Jia Kang and Liang Ji

Comprehensive reform a better way

The government's plan to discuss the income tax threshold is the first step toward a comprehensive reform of the income tax and a timely reaction to people's expectations under inflation. It's right to raise the tax threshold to a proper level, but it's more important to reform comprehensively also by reducing tax brackets and simplifying tax rates.

Individual income tax is the fourth highest form of taxation in the country and plays a big role in adjusting income distribution in society. It is so designed that low-income people pay little or no tax and those with higher incomes pay more tax, and thus helps balance social equality and efficiency.

Even when the revenue scale gradually increases, individual income tax does well to adjust income distribution. People whose monthly income is 3,000 yuan ($456.34) a month are estimated to pay 20 yuan as individual income tax. For those earning 5,000, 8,000 and 10,000 yuan a month, the tax rate is 175, 535 and 825 yuan. Individual income tax differs from one income group to another, which again indicates that it helps bridge the income gap.

The country is in the prime stage of economic development, but it is still beset with the serious problem of the widening income gap. Unlike other countries, China does not impose property, inheritance or gift tax, which could adjust national wealth distribution and, hence, the onus of doing so falls squarely on individual income tax. (Property tax was introduced in Shanghai and Chongqing on a trial basis, aimed at cooling down the real estate market.)

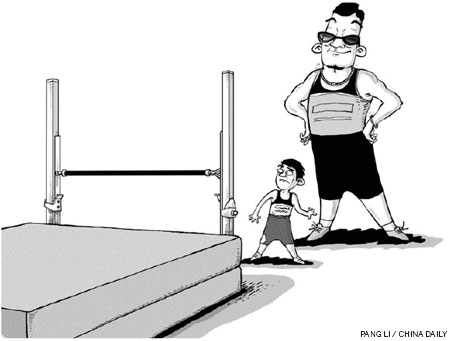

If income tax plays such an important role, why do people say it has become a heavy burden?

Compared with international practice, China's individual income tax still has some deficiencies. First, the individual income tax system mixes the high-income group with the high-salary group. This distorts the picture because a majority of the high-income people, entrepreneurs for instance, don't earn their money in salaries. The booming stock and real estate markets have increased the number of such people drastically.

The individual income tax burden has fallen mostly on salaried people because their taxes can be easily deducted at source, which is not possible in the case of entrepreneurs, stockbrokers, stock traders or property developers. This undermines individual income tax's role as adjustor of income distribution.

Second, there are nine brackets for individual income tax, with the highest rate being 45 percent. This is against the international trend of reducing high tax rates. In actual practice, the tax rates don't work well because very few people pay 30 percent or more of their salary as individual income tax. The exceptionally high rate of the highest bracket and the multiple tax rates make the taxation system complicated and difficult to impose taxes, and prompts people to evade tax.

Therefore, the authorities should discuss not only whether the threshold of individual income tax (or cutoff point) should be raised, but also the actual practice of comprehensive reform. Raising the cutoff point alone would not make income distribution fairer. In fact, a rash act could have the opposite effect.

But how could it have the opposite effect. To begin with, the cutoff point of individual income tax is not low, because many among the low-income group don't need to pay tax at all. The existing cutoff point is 2,000 yuan, that is people earning 2,000 yuan or less do not pay any tax. The premiums paid for basic pension, medical and/or unemployment insurance and mortgage payments for housing, which have to be paid according to national regulations and could add up to about 20 percent of an employee's monthly salary, are deducted before tax. Besides, some subsidies such as those for child-care and retirees' pension are tax-free.

If the cutoff point is raised substantially, the biggest beneficiary will be the high-income group. For instance, if the cutoff point is raised to 3,000 yuan a month, people who earn 5,000 yuan a month would save 100 yuan only, while people whose salary is 10,000 yuan or more would save 200 yuan. If the threshold is increased to 5,000 yuan, people who earn that amount or less don't need to pay any individual income tax, which means they save 175 yuan a month, but those earning 10,000 yuan would save 500 yuan.

In other words, the higher the cutoff point, the more high-income people will benefit. The money that high-income earners should pay does not necessarily flow into the national treasury to help the low-income group, which undermines the redistribution function of individual income tax.

We have some specific suggestions on individual income tax. Taxpayers should include Chinese citizens as well as foreigners working in China. Taxes should be imposed on all monetary and non-monetary earnings of Chinese citizens in and outside the country, as well as on all monetary and non-monetary earnings of foreigners working in China. Farmers' income from agricultural production, however, should be tax-free.

Individual income tax exemptions should vary according to factors such as a family's condition and its medical expenses for terminally or seriously ill members. And the basic tax exemption should be adjusted according to inflation and deflation.

Furthermore, there should only be five tax brackets for individual taxpayers and the highest rate should be reduced by 10 percent.

The authors are researchers with the Institute for Fiscal Science Research under Ministry of Finance.

The main view points in the article are from the authors' paper on individual income tax reform.

E-paper

Chinese tourists as top shoppers

Since last summer, Chinese tourists emerged as the top tax-free shoppers in Europe.

Golden run ahead

Looking abroad

Mapping out a plan

Specials

The green lantern

Environmental concerns are shedding new light on a colorful tradition

Inland interchange

Chongqing bets on its position as a hub for China's west.

Zooming in on Chinese skies

Helicopter companies ride on country's growing interest in luxury aviation.