Chocolate makers seek sweet success in China

Updated: 2012-10-10 11:01

By Xie Yu in Shanghai (China Daily)

|

|||||||||||

As global cocoa prices become more stable, foreign chocolate makers are expanding quickly in China.

As global cocoa prices become more stable, foreign chocolate makers are expanding quickly in China.

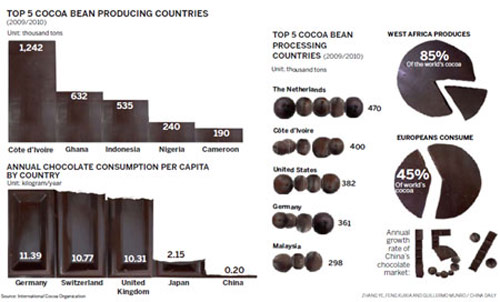

World cocoa prices hit a 10-month high in early September as a result of uncertainty over the crop, but the prices remain well below the height they reached last year during the civil war in Cote d'Ivoire.

"We opened our China company last month to better support the company's development in the country," said Thomas P. Meier, managing director of Lindt & Sprungli (China) Ltd, a maker of premium chocolates.

He said the Chinese market is very important to the company, even more so than the Japanese market.

The company has established more than 3,000 points of sale and duty-free outlets in China, mainly in cities.

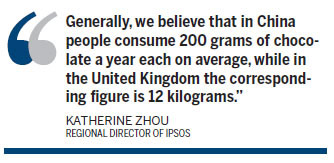

Industry research suggests that the Chinese consume less chocolate than European or US consumers.

"Generally, we believe that in China people consume 200 grams of chocolate a year each on average, while in the United Kingdom the corresponding figure is 12 kilograms and, in Japan, it is about 2 kilograms," said Katherine Zhou, regional director of Ipsos, a market research company.

"The market is steadily expanding, and Chinese people do trust and prefer European chocolate brands," Zhou said.

Someone who searches for "chocolate" on the e-commerce website Taobao.com is likely to find that the best-selling brands have words such as "Europe, "handmade" or "authentic" associated with them.

"Brands such as Dove used to be household words in China," said Si Yu, a shop owner who sold almost 2,000 boxes of handmade truffle chocolate in August for the Qixi Festival, which is sometimes called Chinese Valentine's Day.

But fewer and fewer people are expressing satisfaction with sweets that they already know and have tried.

"Compared to other chocolate brands, we came to China later, but right at the time when Chinese people began to crave premium chocolate," Meier said.

Decades ago, the main sort of chocolate the Chinese would eat were wedding candies that were made with cocoa butter substitutes, shaped into little coins and tended to taste like hard candy.

It was only in the late 1980s that multinational chocolate brands began entering the Chinese market.

The US brand Mars is now the most successful among them, controlling 40 percent of the country's chocolate market with its Dove brand. Following it were the Swiss brand Nestle, with 11 percent of the market, and the Italian brand Ferrero, with 9 percent, according to Euromonitor data from last year. Behind them were Cadbury and Hershey's.

Their China-based competitors such as Golden Monkey and Le Conte are meanwhile still struggling to appeal to Chinese consumers.

More and more foreign brands are flocking into the country. And Chinese customers are now not only concerned with the taste of chocolate but also its ingredients, origin and even history.

"My view is that China has a huge potential market, and we feel that we should allow Chinese consumers to feel the chocolate experience," said Mohamed Elsarky, international general manager for Godiva.

The Belgian chocolate brand opened a shop in Shanghai's Xintiandi entertainment complex in 2010 and began offering fancy, high-priced chocolate, pastries, ice cream and hotpot dishes in a garden villa setting.

Since the brand came to China three years ago, 21 Godiva retail shops have been opened in the country. Elsarky said there are plans to have 33 shops operating under the Godiva brand, which was bought by the Turkish company Yildiz Holding AS in 2007, in nine Chinese cities by the end of the year.

"I do not think the chocolate market in China will explode in the next few years, but I believe the premium segment will be the next part that expands quickly," Meier said. "That's what brands such as us and Godiva are targeting."

West Africa, the source of nearly three quarters of the world's cocoa, is likely to produce 2.8 million metric tons of cocoa in the 2012-13 season, up from the roughly 2.7 million tons produced during the season lasting from October 2011 to September 2012, according to Reuters.

xieyu@chinadaily.com.cn

Related Stories

Depp to receive MTV Generation award 2012-06-03 10:36

巧克力 Chocolate 2012-05-19 19:26

Cheryl Cole is too busy for love 2012-04-26 10:47

Salon du Chocolat debuts in Zurich 2012-03-31 08:28

Chocolate wonderland to open in Shanghai 2011-12-16 09:43

Satisfy your sweet tooth at Salon du Chocolat 2011-10-21 14:32

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|