Society

In start-ups, a touch of dread

Updated: 2011-06-26 07:37

By Claire Cain Miller (New York Times)

A high-profile failure sounds an alarm

Palo Alto, California

What if you threw a $41million party and nobody came? A start-up company called Color knows how that feels.

In March, Color unveiled its photo-sharing cellphone application - and revealed that it had raised $41million from investors before the app had a single user. Despite the company's riches, the app landed with a thud, attracting few users and many complaints from those who did try it.

"It would be pointless even if I managed to understand how it works," one reviewer wrote in the Apple App Store.

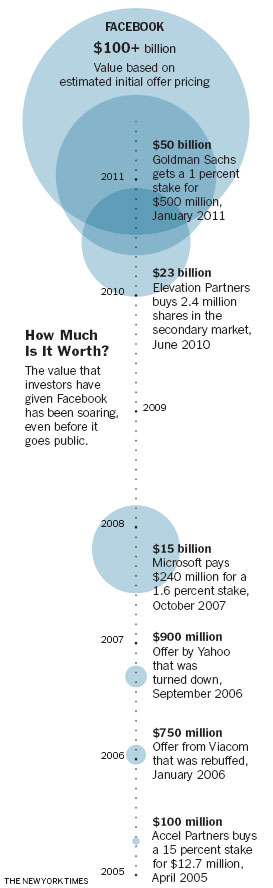

Since then, Color has become a warning sign for investors, entrepreneurs and analysts who fear there is a bubble in start-up investing. They say it shows that venture capitalists, desperate to invest in the next Facebook or LinkedIn, are blindly throwing money at start-ups that have not shown they can build something useful, much less a business that can provide decent returns on investment.

Color, which says it is overhauling its app, is just one of the start-ups that have driven fears about bubbly excess in Silicon Valley. The Melt plans to sell grilled-cheese sandwiches and soup that people can order from their mobile phones. It raised about $15million from Sequoia Capital, which also invested in Color.

Airbnb, which helps people rent rooms in their homes, is raising venture capital that would value it at a billion dollars. Scoopon, a kind of Groupon for Australians, raised

$80 million; Juice in the City, a Groupon for mothers, raised $6 million; and Scvngr, which started a Groupon for gamers, raised $15 million. These could, of course, turn out to be successful businesses. The worry, investors say, is the prices.

They say they have paid two to three times more for their stakes in such start-ups over the past year. According to the National Venture Capital Association, venture capitalists invested $5.9billion in the first three months of the year, up 14 percent from the period a year earlier, but they invested in 51 fewer companies, indicating they were funneling more money into fewer start-ups.

"The big success stories - Facebook, Zynga and Twitter - are leading to investing in ideas on a napkin, because no one wants to miss out on the next big thing," said Eric Lefkofsky, a founder of Groupon who also runs Lightbank, a Chicago-based venture fund with a $100million coffer.

Two of Color's photo-sharing competitors, Instagram and PicPlz, started with $500,000 and $350,000, respectively, and teams of just a few people. As they have introduced successful products and attracted users, they have slowly raised more money and hired engineers.

Color, meanwhile, spent $350,000 to buy the Web address color.com, and an additional $75,000 to buy colour.com. It rents a cavernous office in downtown Palo Alto, where 38 employees work in a space with room for 160, amid beanbag chairs, tents for napping and a hand-built half-pipe skateboard ramp.

Bill Nguyen, Color's always-smiling founder, has hired a team of expensive engineers, like D.J. Patil, a former chief scientist at LinkedIn.

"If I knew a better way of doing it, I would, but that's what my cost structure is," Mr. Nguyen said in an interview in June.

Michael Krupka, a managing director at Bain Capital Ventures and one of Color's investors, said Color needed to raise a lot of money because it planned to do much more than photo-sharing.

"When we get to the end product that we envision, people will realize how technically sophisticated it is, so we couldn't do it with four people," he said. "That's expensive to do, so therefore I think the valuation's a fair one."

A serial entrepreneur, Mr. Nguyen, 40, started a service for receiving faxes, e-mail and voicemail called Onebox.com, which Phone.com bought for $850million, and Lala, a digital music service that Apple bought for $80million last year. He said he had always raised more money than he needed so that if his products faltered, he had enough to keep going longer than his competitors.

But he said he has been chastened in the last three months.

"There's no doubt I wish we would have launched and millions of people would have used it, but that didn't happen," he said. "The reality is we're going to plug away at it and take a much more traditional route to go from A to B."

But he makes no apologies for the amount of money he raised.

"We live in a very favorable environment for start-ups right now, so if the number we raised was significantly larger than it would be at any other time, I'm not going to apologize for that," he said.

At its start, Color said it would usher in a new era of location-based social networking, letting people share cellphone snapshots with other Color users nearby.

But though it had some success at big events like music festivals, those who tried it elsewhere found that there was rarely anything to see.

Mr. Nguyen said the company had taken the criticism seriously and charted a new course. Its engineers are building a new version of the app to be released later this summer.

Analysts are curious about whether Color can pull off a do-over.

"In every bust, there are ones that stand out and become Google, but that's the exception rather than the rule," said Mark Suster, managing director of the investment firm GRP Partners.

"For every success there will be 250 really dumb valuations."

The New York Times

E-paper

Franchise heat

Foreign companies see huge opportunities for business

Stitched up for success

The king's speech

Tough sail

Specials

Premier Wen's European Visit

Premier Wen visits Hungary, Britain and Germany June 24-28.

My China story

Foreign readers are invited to share your China stories.

Singing up a revolution

Welshman makes a good living with songs that recall the fervor of China's New Beginning.