Money moves

Updated: 2015-08-21 08:15

By Andrew Moody(China Daily Europe)

|

|||||||||||

Donna Kwok, senior China economist at UBS in Hong Kong, believes this is now a real possibility, despite skepticism in some quarters whether the yuan is ready for such exposure.

"There are essentially two tests for this. One is how much the currency is traded, and the second is whether a currency is freely usable. The problem is everyone focuses on how much China fails the second test without taking into account how much it excels on the first one."

One of the factors behind its inclusion will be whether a more freely floating yuan will be moving in only one direction: downwards.

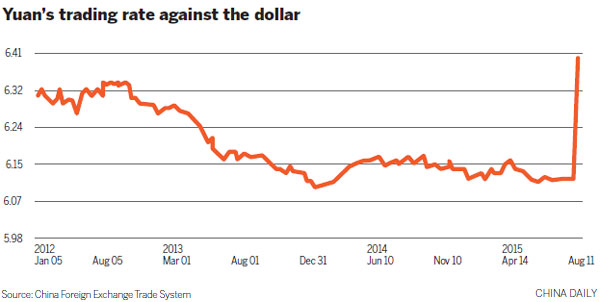

The move by the PBOC that provoked such excitement was to set the yuan's reference rate to the dollar 1.9 percent lower and create a mechanism whereby it can float by 2 percent in either direction. The rate around which it can float is fixed at the start of trading each day using as a reference the closing rate of the previous day. The exchange rate fell for two further days after the move and was 4.4 percent down by the close on Aug 13, but has since rallied.

The PBOC's chief economist, Ma Jun, made clear in a statement on Aug 16 that it has intended there would be "two-way volatility" and not the one-way traffic the markets seemed to have been assuming.

Despite the support from the IMF for the move, the value of the yuan has been a longstanding area of dispute between the US and China, particularly before US presidential elections. It also comes about a month before Chinese President Xi Jinping meets with US President Barack Obama in Washington in September.

"At least for the moment a lot of panic has dissipated, but it hasn't stopped many people shouting from the rooftops that China is triggering currency wars and global deflation," says George Magnus, an associate at the Oxford University China Centre.

"It only needs Donald Trump to get on his soap box and say the Chinese have been doing this for 10 years and it becomes contentious again."

Duncan Innes-Ker, regional editor for Asia, at the Economist Intelligence Unit, based in London, believes there is substantial scope for the yuan to depreciate.

He says many have overlooked that, while the exchange rate against the US dollar has remained relatively flat, the euro is down by 20 percent against the yuan since January 2014 and down against another SDR currency, the yen, by 15 percent over the same period. He also points out the CNH, the offshore version of the yuan, traded in Hong Kong and Singapore, is around 5 percent lower than the onshore one.

"If you look at where the onshore and the offshore rates are and also take into account that the yuan has appreciated significantly recently then a further depreciation of between 10 and 15 percent over the next few months would not be unexpected."

Kwok at UBS, however, predicts volatility. The rate will fall from 6.39 yuan to the dollar on Aug 18 to around 6.5 yuan at the end of 2015 and then 6.6 yuan at the end of 2016, she says.

"While we are expecting a modest degree of depreciation, we think the trajectory between now and then will not be a straight line because the PBOC has clearly stated it wants to see two-way volatility. It does not want a one-way directional trend," she predicts.

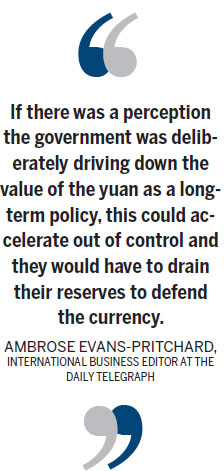

Ambrose Evans-Pritchard, international business editor at The Daily Telegraph in London, insists it is just not in China's interest to play any sort of devaluation card.

He points to a Morgan Stanley study at the end of last year that says Chinese companies had $1.3 trillion (1.16 trillion euros) of short-term debt, some 9 percent of the country's total GDP, in overseas loans, which would be made more difficult to pay back if the currency fell in value.

"It would be dangerous for China to pursue such a course. These companies that have borrowed overseas tend to be the weaker ones that have not been able to get money from the Chinese banking system, so they are quite close to distress anyway. So this would be a particular toxic combination."

Mark Williams, chief Asia economist at Capital Economics, the leading economics consultancy, believes the PBOC making a number of interventions in the market is already evidence it does not want to see any immediate further devaluation.

"The fact that the People's Bank has stepped in since to stem the currency decline tells us that the clamor about currency wars was overblown," he says.

Today's Top News

Tsipras resigns, asking snap general elections

Preparations shutter Forbidden City, other major tourist spots

Changing face of illegal immigration

President Xi Jinping calls for crews not to ease up

Jon Bon Jovi sings in Mandarin for Chinese Valentine's Day

DPRK deploys more fire units to frontlines with ROK

No cyanide detected from Tianjin river section with fish deaths

Greek PM to resign, seek snap election in September

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|