Lower barriers urged for jump in investment

Updated: 2012-06-01 09:10

By Yan Yiqi (China Daily)

|

|||||||||||

Foreign companies complain rules of Chinese markets too tough

China needs to speed up reforms to create more opportunities for foreign and local companies, leading business analysts have warned, as European and American companies complain of a restrictive regulatory environment in the country.

According to a survey released this week by the European Union Chamber of Commerce in China, more than 20 percent of European companies said they were considering moving investment outside of China. The survey was carried out in February among 557 companies.

"The decrease of FDI from Europe does not completely relate to the debt crisis, since the sovereign debts are not necessarily related to companies in the EU. The drop, from my point of view, should be attributed to lack of reform of the regulatory environment," says EUCCC President Davide Cucino, following the release of its annual business confidence survey on May 29.

China's FDI has been dropping for six consecutive months since November, and this was mostly due to decreased investment from the European Union. In the first quarter of this year, EU companies invested $1.9 billion (1.5 billion euros) in China, dropping 27.92 percent year-on-year, according to statistics from the Ministry of Commerce.

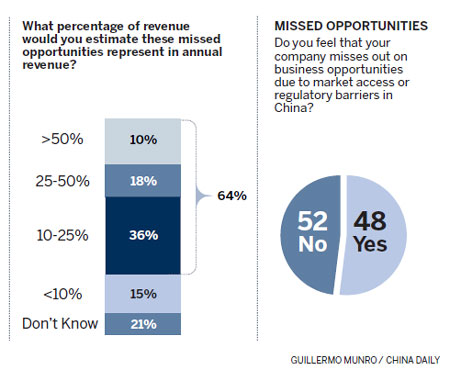

The survey results claimed that due to restricted market access and regulatory barriers, 48 percent of European companies missed out on business opportunities, with 64 percent of these estimating the value of these missed opportunities as more than 10 percent of revenue.

Missed opportunities were most apparent for professional services and consumer goods/service companies, with 55 percent of them claiming they have missed out on potential revenue. For industrial goods/services companies, 40 percent perceived missed opportunities.

"Developing a professional goods and services sector is a stated goal of the Chinese government. The results of this year's survey make it apparent that there is a need to further open up this area to foreign competition for the ultimate good of the Chinese market," says Cucino.

The American Chamber of Commerce in China expressed the same feeling in this year's White Paper on American Business in China.

"To position itself for the coming decades of growth, we believe China should open up market access across the many industries that remain restricted to foreign investors, completing the transition to a market economy, and promoting greater consistency and transparency in government policies around the country," says Ted Dean, its chairman.

Long Guoqiang, director-general of the foreign economic relations department at the State Council Development Research Center, also agrees China should be more open in the professional sectors. "The opening-up should not be thought of as foreign companies invading the Chinese market, but as two parts exchanging experiences and technologies," he says.

Song Hong, an international trade researcher at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, believes opening market access to more industries is just a matter of time.

"The sluggish FDI and trade figures this year all indicate that China needs to look for a new growth point for its economy. The industries that foreign companies are keen to access are of strategic importance to China's economy, but their entrance thresholds will be lowered bit by bit eventually, since the traditional manufacturing industries are almost filled up," he says.

Song says the foreign companies should be patient and have faith in China's determination to improve its business environment.

However, in the EUCCC survey, a significant proportion of companies are not optimistic about regulatory improvements taking place within a few years - 22 percent said they were considering moving investments to markets outside China.

Most of them say uncertainty and ambiguity over regulations when doing business in China would be the main motive for shifting their investments elsewhere.

Over 42 percent of European companies believe China's government policies concerning foreign companies are less fair now than they were two years ago.

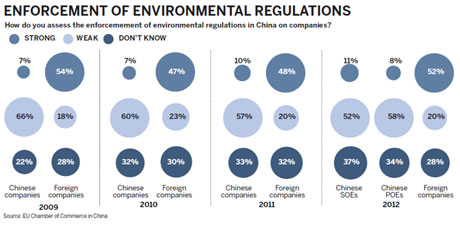

Concerning environmental regulations in China, 52 percent of the companies surveyed believe these are strongly enforced on foreign companies. In contrast, only 11 percent perceive them to be strongly enforced on State-owned enterprises, and a mere 8 percent on privately-owned Chinese enterprises.

Nie Pingxiang, a researcher with the Chinese Academy of International Trade and Economic Cooperation, which is affiliated to the Ministry of Commerce, says the problems that foreign companies have also trouble local companies.

"I believe China is on its way to improving its regulatory environment for both foreign and Chinese companies, so there is no such discrimination," she says. "As far as I know, many western Chinese cities and regions have implemented incentives to attract foreign investment, and I have heard many Chinese companies, especially private enterprises, complaining about that."

Nie also says the drop in European investment in China can be largely attributed to European economic circumstances in general. "As an emerging market, the advantage of China's large market potential absolutely overcomes the disadvantage of China's still improving regulatory environment, so the overall investment environment is good for foreign companies," she says.

Despite foreign companies' pessimism about China's regulatory reform in the next few years, most of them still consider China as their top investment destination.

Seventy-six percent of members of the American Chamber of Commerce in China expect revenue to grow in 2012, according to its survey, with 26 percent expecting growth in the range of 11 to 20 percent.

According to the EUCCC survey, 63 percent of the companies plan to make new investments in China in the next two years, up 4 percentage points from the previous year, and about 74 percent said China is becoming increasingly important in their overall global strategy.

Thirty-four percent stated that their revenue from China represented more than 15 percent of global revenue.

yanyiqi@chinadaily.com.cn

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|