Foreign firms bullish about economy

Updated: 2012-05-07 07:49

By He Wei in Shanghai (China Daily)

|

|||||||||||

Maturing market

|

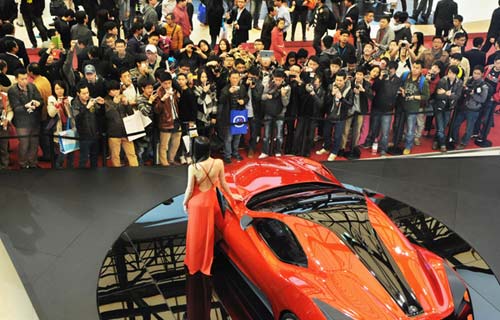

Despite forecasts that China's economy will slow, seemingly vindicated by the latest year-on-year gross domestic product growth of 8.1 percent in the first quarter, international companies are planning to further involve their businesses in the country's economy. Gao Yuwen / For China Daily |

As the China market continues to develop, companies increasingly are treating it as a mature, fiercely competitive market with all the attendant benefits and challenges of such a status.

First, China has become a growth engine for most multinationals, so that to advance beyond a merely supportive role, a growing number of them see the necessity to introduce key technologies, or build research and development centers in the country.

Dow Chemical Co established its flagship 100,000 square meter innovation center in Shanghai in 2009, which now has more than 500 scientists and researchers working in 84 world-class laboratories.

According to Peter Sykes, president of Dow China, the lab has facilitated Dow's overall research and development globally and helped China to become its second-largest international market. In March, it opened a new center in Chengdu to explore more investment and innovation opportunities.

Likewise, General Motors signed an agreement with SAIC Motor Corp late last year to jointly develop electric vehicles in China. Tim Lee, president of GM's international operations, told China Daily that the two sides want the partnership to serve as the global test ground for new energy cars over the next five years.

The cooperation will leverage GM's expertise in electric vehicle development and global know-how and the techniques will be carried out in China.

In an earlier interview with China Daily, DSM's global CEO Feike Sijbesma said the company's decision to establish a global R&D center in Shanghai was a result of his "four-phase China" theory.

"It is a country with four different development phases. The first phase was to show the world how big a market it is. The second phase was flexing its muscles to become a productive manufacturer and a strong competitor. In the third phase, China was home to the industrial bases of Western companies," he said.

Now the fourth phase is coming with the Chinese realizing they can no longer depend on low-cost manufacturing and need to create a base for innovation and global brands.

Butler from Booz agreed. As China is climbing the global value chain, companies are no longer treating China as a "market to tap into" or a "manufacturing base", but rather placing an increasing portfolio of capabilities there.

According to Norris from Knauf, his company started to operate an innovation center in Taicang this year. "We have six senior research fellows up to now and we expect the team to have some 20 people when fully established."

These scientists mostly have to be Chinese people with knowledge of cutting-edge German technology, Norris noted.

"We need to come up with products that meet the demand of the locals here but you really can't expect German scientists to understand the environment or living conditions here in China".

What Norris said brings up a related issue for multinationals' China businesses: the "in China for China" trend.

In the AmCham survey, a maturing China market is forcing companies to target their product development toward China, with 71 percent responding that they have and also plan to sell and support products and services uniquely designed for the Chinese market.

Trumpf, the world's largest maker of laser cutting machines, has designed a special cutting machine to meet Chinese customers' needs.

"We are not producing in China to be less expensive, or to export to other parts of the world," said Nicola Leibinger-Kammueller, the company's chief executive officer.

"We are producing for the Chinese market."

Also a German family-owned enterprise, Trumpf took a similar approach to Knauf - it runs a plant in Taicang and is currently overhauling the factory to double its production capacity.

Her company also lowered its forecast for the Chinese market's growth rate from 100 percent in 2011 to a moderate 15 to 20 percent this year.

"We want a steady growth that focuses on the premium market, where demand for quality in China is absolutely rising."

And this trend may be good for another reason, according to Steve Ganster, managing director of Technomic Asia, a market entry consultancy.

"Given the challenges that will emerge in 2012, service companies will be in a good position to help their clients navigate the increased complexities, uncertainties and inevitable difficulties, as companies adjust their strategies, organizations and resources to align with a more dynamic economic environment," he said.

"The 'in China for China' trend is here to stay and service firms need to reshape their own priorities to accommodate this critical shift."

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|