Making movies that dazzle

British visual effects expert excited by 'opportunity to innovate' in China

Over three decades, Sir William Sargent has built an Oscar-winning visual effects company behind some of the world's best-known films, including Doctor Strange and Harry Potter. Now he is on a mission to find new success in China, following a crucial move last December when his company, Framestore, sold a 75 percent stake to a Chinese investor.

"In five years China could have an Oscar-winning visual effects film - and it would be amazing for Framestore to be the visual effects supplier for it," says Sargent, 60, who received his knighthood in 2008 for services to the business community and government.

|

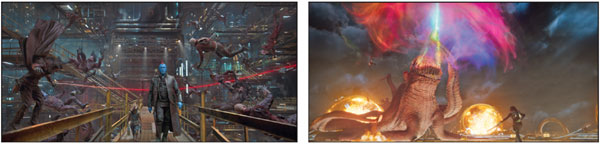

Images from Guardians of the Galaxy 2, a 2017 film which Framestore contributed visual effects to. Photos Provided to China Daily |

Framestore started as a five-person team based in Soho, the center of London's creative district, and has become one of the world's biggest post-production houses. It employs 1,400 people and has offices in London, New York, Montreal and Los Angeles.

The Chinese investment came from Cultural Investment Holdings, which bought 75 percent of Framestore for £187 million ($245 million; 212 million euros). In Sargent's view, the investment not only injected new capital to help Framestore grow, but also gave the company a valuable partner that can support its China expansion.

CIH's investment in Framestore coincides with a boom in China's movie market. China, now the world's second-largest film market after the United States, has seen an average year-on-year growth of 30.35 percent at the box office in the past five years. Its box office has grown from 17.1 billion yuan ($2.59 billion; 2.19 billion euros; £1.94 billion) in 2012 to 49.2 billion yuan in 2016.

Such strong revenue has led to growing production budgets. Meanwhile, many Chinese producers are looking for leading international partners to coproduce top quality films that can also appeal to an international audience. Before 2015, around 40 coproductions were approved every year, but 2015 saw a rise to more than 50. That number grew to 73 in 2016.

Sargent, who has been considering Framestore's China entry since 2008, says it was only in the last two years that he felt the timing was right for the expansion.

"The 2016 film The Great Wall was the first Chinese film with the same kind of budget as a big UK blockbuster. For special effects, having an adequate budget is key, as about 50 percent of the production budget is for the digital effects."

With a $150 million production budget and directed by the renowned Chinese director Zhang Yimou, The Great Wall tells the story of European mercenaries, led by Matt Damon, who join forces with the Chinese to fight rampaging monsters. Such a budget is significantly larger than for earlier Chinese films. Ang Lee's 2000 blockbuster Crouching Tiger, Hidden Dragon had a $17 million production budget, and his 2004 film House of Flying Daggers $12 million.

Film market opportunities at home prompted many Chinese companies to invest in the best movie industry resources and expertise abroad. Perhaps the best-known example is the Chinese conglomerate Dalian Wanda's acquisition of the movie theater chain AMC Entertainment for $2.6 billion in 2012.

CIH, which invests in Chinese films and television series, invested in Framestore with a view to helping introduce it as the special effects provider for its projects. As a majority shareholder, it is set to enjoy the fruits of Framestore's increased revenue if such a strategy works out.

CIH's history can be traced back to 2015, when a group of cultural industry investors bought stocks in an already listed company and changed its name to CIH in 2016. The company the group invested in was called Song Liao Automotive, which was founded in 1993 and specialized in car parts. In 1996, the company listed on the Shanghai Stock Exchange, but declining growth in later years prompted it to stop producing car parts in 2009.

In 2015, a group of cultural sector investors bought into the listed entity of Song Liao Automotive, through private share placing, and a year later changed its name to CIH, with the key focus on cultural sector investment and related businesses.

Although not all the shareholders are willing to reveal their identities, some of those newly added are among the biggest movie stars and directors in China, including Feng Xiaogang, Zhang Guoli, Fan Bingbing and Huang Xiaoming. Another key milestone that helped CIH's structural shift was its 2015 acquisition of Beijing Sparkle Roll Media, a film production company. Some of Beijing Sparkle Roll Media's more famous film productions in recent years include the 2016 comedy I Am Not Madame Bovary and the 2015 historical action film Dragon Blade.

I Am Not Madame Bovary, with a box office of $70 million, was selected to be screened in the Special Presentations section of the 2016 Toronto International Film Festival. Dragon Blade, which starred Jackie Chan, brought in $120 million at the box office and was distributed in the US market.

CIH's connections and investment in these popular Chinese films has excited Framestore. "CIH's ability to support us and share its networks in China with us is a core part of our partnership," says Alex Robin, who heads the company's Beijing office.

Over the past year, Framestore has been approached for several film projects, although existing discussions have not led to contracted work because the timing was too tight, Robin says. He is not discouraged about the delayed results, reasoning that Framestore's planning is for the long term. "In the China market our plan is not a two-to-three year plan, but a 20-year-plus plan, so to date our work has been planning, research and creating partnerships," he says.

After the sale to CIH, Sargent still retains a 10 percent stake in the business. He adds that he is particularly optimistic about some Chinese technology companies as potential collaborators.

"Many Chinese technology companies are advanced in their research and development, ranging from motion capture to streaming, which is very exciting for us because ultimately our work is to apply technology to tell a story," he says.

Framestore's team is also preparing to create training courses for new recruits in China, focusing on skills from art to technology. "In Europe and the US markets, we can rely on universities to train talent that would become a good fit in our organization. But in China, because visual effects is still in its early stages, finding local talent is hard, which is why we are keen to invest in this talent training journey," he says.

Aside from the market opportunity, Sargent is also excited by "an opportunity to innovate" as China's film industry grows. "The capacity for Chinese films to be innovative is huge, as China has a long history of storytelling, and visual effects can help to tell stories better," he says.

Although the expansion of Framestore's activities into the Chinese market is still at an early stage, its strategy is endorsed by analysts, who add that there are obvious synergies with CIH.

"Framestore is a specialized visual effects company that fits well with CIH's strategic goal of achieving vertical integration in the movie industry," says Jeongwen Chiang, a professor of marketing at the China Europe International Business School. "It is a win-win situation in which Framestore can expand into the huge Chinese market while CIH can enhance its position in the Chinese movie industry and become a dominant player."

Chiang also points to some challenges facing Framestore in China, especially the process of adapting to the Chinese movie industry's culture. The shortage of local talent could also limit its expansion in the Chinese market, Chiang says.

cecily.liu@mail.chinadailyuk.com

(China Daily European Weekly 12/15/2017 page30)