The China reflex

With a newly elected US president pledging to dump the TPP, Beijing's next move has become a prime topic of discussion

Will China take advantage of Donald Trump's decision to effectively scuttle Asia's biggest-ever trade deal?

The US president-elect announced on Nov 21 that on the first day of his presidency he will withdraw the United States from the Trans-Pacific Partnership.

Japanese Prime Minister Shinzo Abe, who had expended considerable political capital getting the deal passed against opposition from his own farmers, has said TPP will be effectively "meaningless" without the US.

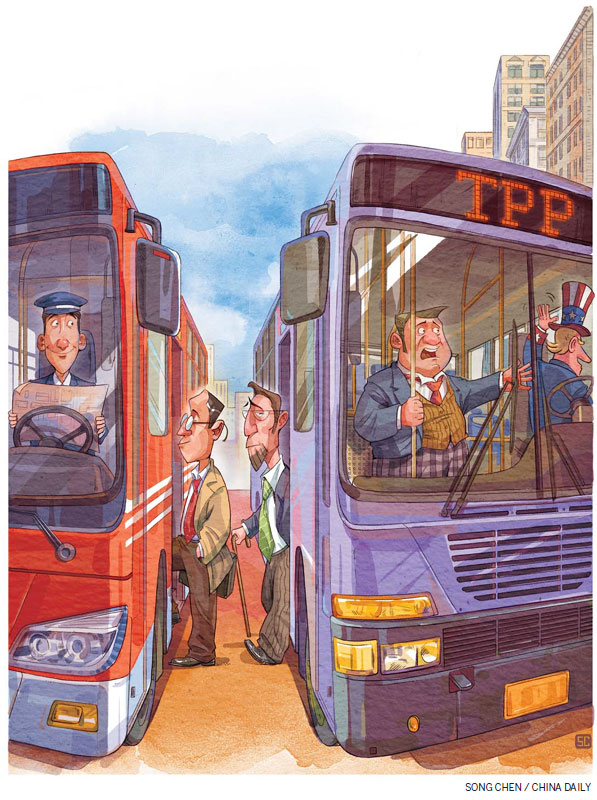

|

A container port in Lianyungang, Jiangsu province. China, the largest trading nation in Asia, may look to lead regional trade if TPP collapses. Geng Yuhe / For China Daily |

The 11 other members, aside from the US, had almost all signed up because it offered a closer trade relationship with the world's largest economy.

President Barack Obama had come close to turning the TPP - which covers 40 percent of the global economy - into the physical embodiment of his "pivot to Asia" strategy, which critics say was designed to contain China's power in the region.

A major question is whether China will now move into the vacuum and attempt to build its own trade partnership with other Asian countries for which it is already, in most cases, the largest trade and investment partner.

This could mean breathing new life into RCEP - the Regional Comprehensive Economic Partnership - which was launched at the Association of Southeast Asian Nations summit in Cambodia in 2012. It is seen as a China-led grouping and one that also notably excludes the United States.

There might also be an attempt to finally realize the Free Trade Area of the Asia Pacific, or FTAAP, the roadmap for which was put in place at the Asia Pacific Economic Cooperation, or APEC, forum in Beijing in Nov 2014.

It is seen as more of a long-term initiative. With a more protectionist US as one of its potential members, it may lose momentum.

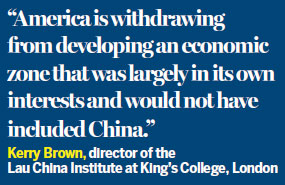

Kerry Brown, professor of Chinese studies and director of the Lau China Institute at King's College, London, believes Trump's TTP decision does play into China's hands.

"It depends on how China deals with this. It is not an easy space to fill because it will have to propose its own free trade proposals, and that will be complicated. It can, however, now do this in a way it couldn't do before the announcement was made," he says.

The academic, however, believes it is a spectacular "own goal" for the US.

"It means that after 10 years of effort, America is withdrawing from developing an economic zone that was largely in its own interests and would not have included China," he says.

That the US would not stick with the TPP, which was signed by all its members (including the US) in February, was not a surprise. Even the Democratic presidential candidate, Hillary Clinton - who, when Secretary of State had called it the "gold standard" of trade treaties - made a U-turn during her campaign.

Hugh White, professor of strategic studies at the Australian National University and once a foreign policy adviser to former Australian prime minister Bob Hawke, does not believe she would have changed her mind had she won the election.

"It is very unlikely she would have done that," White says. "She would have found it difficult to get it through Congress, given strong opposition on her own Democrat side as well as all the Republicans who would have denied her."

Trade minister Steven Ciobo announced his backing of the RCEP approach within hours of Australian Prime Minister Malcolm Turnbull speaking to Trump following the US election, signaling the country had its sights set on the China-led grouping.

White, author of The China Choice, which deals with the politics of the South China Sea region, says the whole episode looks like a retreat by the US.

"It is such a striking demonstration that America's resolve to remain strong in Asia is not as strong as what everybody keeps saying it is," he says.

He is also unclear whether China will now take up the mantle and create trade blocs that deliberately exclude the US, since that might not be in its ultimate interest.

"China wants to see the US as a full economic partner in Asia, but it wants itself to be the primary strategic power in the region. It may believe in the end that the economic relationship is more important than the strategic."

Leading foreign policy expert Shi Yinhong, a professor of international relations and director of the Center on American Studies at Renmin University of China in Beijing, does not believe - even if there were a change of heart in Washington - that China and the US would be comfortable together in any new trading bloc.

"There would be a danger, from China's point of view, of the US gradually gaining greater influence over the other members because it has a bigger economy and a high technological level," Shi says.

Stephen Roach, former chairman of Morgan Stanley Asia and author of Unbalanced: The Codependency of America and China, also thinks it unlikely that China will suddenly conjure a new body in the wake of Trump's decision.

"It is unrealistic to think that all of a sudden some new arrangement will be cobbled together to exclude a country like the US, which is in a political position to start raising objections to existing trade deals, let alone new ones," Roach says.

"China has got a whole load of other issues to deal with, not least managing its own domestic economy and its own relationships in the South China Sea, before it can assume a strong leadership role in the region."

Roach, however, believes the pivot to Asia strategy, which was so much the central plank of Obama's foreign policy, is in tatters.

"It was the crux of the pivot, and without TPP it would have exclusively been done on military terms, which would have created more tensions. I think the pivot without TPP now rings hollow," he says.

Many are concerned that with the UK's Brexit decision, and now with the election of Trump on a distinctly protectionist agenda, the world is moving to a new era that has echoes of the 1930s.

Shi of Renmin University insists there is no direct parallel.

"Then, Hitler was already in place, we had a militarist government in Japan, and the protectionism was much more severe than anything we are seeing today," he says.

"I do think the current situation, however, is worse than at any time since the end of the Cold War, with nativism and nationalism prevailing almost everywhere in the world. We have all these strongmen saying they want to make our nations great again."

Roach, who is also a senior lecturer at the Yale School of Management, thinks trade deals are a difficult sell in a world consumed by populist election outcomes.

"The votes in the UK and now the US, and those coming up in Italy and France, are all a significant large piece of sand in the gears of liberalization and globalization," he says.

He also cannot conceive that Trump's protectionist agenda will work in practice because the US and China are now completely dependent in each other:

"China depends on the US for its markets, and the exports to these markets are a key driver of the economic growth that produce such fabulous results for China. And the US needs China to provide low cost goods for income-constrained American consumers. We also need China's surplus savings because we don't save and it is hard to grow without saving."

He believes the lack of savings in the US will make it even more reliant on China if Trump pursues a fiscal expansion policy to invest money in infrastructure.

"If there are to be larger deficits under the Trump administration, the US weak savings position will probably go into negative territory somewhere around 2018 or 2019. If we turn protectionist at a time when we need even more savings from abroad, that has enormous potential consequences."

Brown at King's College believes the TPP decision or protectionist rhetoric will not affect the overall relationship between the US and China.

"There has been so much work done on the relationship, and the vast majority of those involved in it will carry on as normal. It would take a huge amount of effort for any individual to shift the tramlines an inch, never mind totally changing them," Brown says.

Paul Cheng, the former chairman of NM Rothschild & Sons in Asia and author of On Equal Terms: Redefining China's Relationship with America, says the TPP might be replaced by a more deal-making approach across Asia by the US.

He is encouraged by the expected appointment of American investor Wilbur Ross, who spent 24 years in Rothschild's New York office, as commerce secretary in the new administration.

"Wilbur is a guy who really knows where to pick value. It's a skill that can be really useful. I know that he was highly regarded by the Rothschild family."

ANU's White thinks Trump's TPP decision is likely to lead to a major rethink as to whether trade deals are the way forward.

"There is real question as to whether these regional, multilateral or even bilateral trade agreements of various sorts are really the best way to go in terms of global trade," he says.

"The big steps made in global trade were perhaps made when we had these global multilateral deals under organizations like GATT (General Agreement on Tariffs and Trade), the forerunner of the World Trade Organization. These might be now preferred in future."

andrewmoody@chinadaily.com.cn

Trade proposals in pipeline

Trans-Pacific Partnership (TPP)

Formed in 2005 with Brunei, Chile and New Zealand and Singapore. The US joined in 2008. It now has 12 members, including the original four, plus Australia, , Canada, Japan, Malaysia, Mexico, Peru, Vietnam and the US. China was not a member. It's absence was seen as part of the US "pivot to Asia" strategy.

The TPP has tough regulatory standards on labor, environmental protection, intellectual property and government procurement.

President-elect Donald Trump signaled in November that the US would withdraw from the agreement in January.

RCEP (Regional Comprehensive Economic Partnership)

Formed in 2012. Includes the 10 members of the Association of Southeast Asian Nations, or ASEAN: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam, plus six regional trading partners - China, Japan, South Korea, Australia, India and New Zealand.

The RCEP excludes the United States and is seen as China-led since it is the largest economy in the grouping.

Free Trade Area of the Asia Pacific (FTAAP)

Still on the drawing board. First discussed at the Asia Pacific Economic cooperation summit in Hanoi in 2006. The roadmap for its eventual realization was announced at the APEC Summit in Beijing in November 2014 and given further impetus by a keynote speech by Chinese President Xi Jinping at the Lima Summit in November.

Both the US and China could play a leading role in the FTAAP, although this seems less likely with US President-elect Donald Trump's position on TPP.

( China Daily European Weekly 12/02/2016 page1)