Macao's gaming for recovery

Updated: 2016-09-23 08:02

By Luo Weiteng in Hong Kong(China Daily Europe)

|

|||||||||

Old and new casinos pour billions of dollars into economy, promising to reverse recent slump

A cluster of new casinos could mean a recovery in Macao's gaming industry is on the cards.

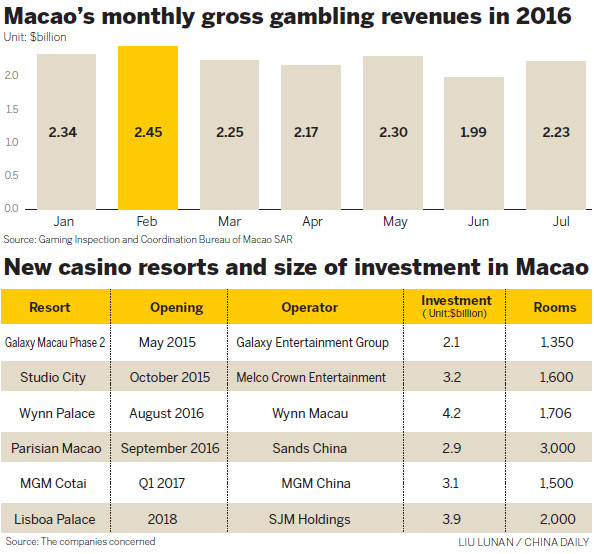

Casino operators have had a busy time in terms of construction. This year has seen the opening of the city's most expensive casino, the $4.2 billion Wynn Palace, as well as the $2.9 billion Parisian Macao.

|

A guest poses with an artist impersonating Napoleon at Parisian Macao, part of the Las Vegas Sands development in Macao. Reuters / For China Daily |

MGM Resorts will follow next year with its $3.1 billion MGM Cotai, while SJM Holdings is on track to open the $3.9 billion Grand Lisboa Palace in 2018.

The new casinos comes after Macao's gross gaming revenue fell 4.5 percent in July to $2.2 billion, stretching declines for the 26th month in a row.

However, revenue in July beat analysts' estimate of a 5.5 percent drop, fitting the optimistic tone of casino tycoon Sheldon Adelson and JPMorgan Chase, which sees signs of a turnaround on the horizon.

Gaming has been part of Macao since the 1850s, when Portuguese administrators made it legal and taxable. The local gaming industry exploded after foreign casino operators were allowed into the market in 2002.

According to global ratings agency Moody's, gaming accounts for 58.3 percent of Macao's GDP and contributed to roughly 75 percent of total government revenues.

Macao is the only place in China where gambling is legal. The territory cemented its status as the world's No 1 gaming center in 2006, when its gambling revenues outstripped that of Las Vegas for the first time. During that time, the city's casinos pulled in a record $4.57 billion in revenue in a single month.

The co-called Las Vegas of Asia started to lose its shine in 2014, however, when Beijing's crackdown on corruption and extravagance scared mainland high rollers away to other gaming destinations.

Cambodia is an emerging rival. Its Hong Kong-listed casino operator NagaCorp posted a 24 percent surge in net profits to $125.2 million for the first half of this year, with a shiny new casino of 200 gaming tables on the way in 2017.

This is in contrast to Wynn Macao's 20.6 percent tumble in net profit to $1.14 billion, and Sands China's 25 percent decrease in net profit to $551 million over the same period.

Stanley Au Chong-kit, chairman of Delta Asia Financial Group, believes policymakers' tough stance on curbing gambling growth is a sure thing for the foreseeable future.

"By 2018, at the latest, some casinos failing to make ends meet will be forced to restructure," he says. "But the point is, why does the market cling to the hope of a turnaround, defying the fact that the gambling business has already developed excessively in Macao?"

Even when a 34.3 percent drop in profit sent jitters across local casino operators last year, the territory's $29 billion gross gaming revenue was still three times that of Las Vegas, six times that of Singapore, and 10 times that of South Korea and the Philippines, says Macao Chief Executive Fernando Chui Sai-on.

For the first half of 2016, Macao's $13.5 billion gross gaming revenue was down 13 percent from a year earlier, but it is still more than any others across the globe.

sophia@chinadailyhk.com

(China Daily European Weekly 09/23/2016 page30)

Today's Top News

State of emergency declared in US city amid protests

Universities given boost in rankings

Demand for Mandarin rises in UK

China 'capable of keeping medium-to-high growth'

Li tells Obama of opposition to THAAD deployment

Greek vows to improve refugee situation on island

UN suspends aid convoys following deadly strikes

New York bombing suspect captured in New Jersey

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|