Riding on emotions

Updated: 2016-04-08 08:19

By Andrew Moody(China Daily Europe)

|

|||||||||

Chinese consumers are seen as volatile and fickle - and companies are racing to keep up with their changing tastes

When Chinese President Xi Jinping dropped in for a pint at an English country pub with British Prime Minister David Cameron in October, few could have predicted it would start yet another Chinese consumer craze.

Within a few weeks, monthly China sales of the particular beer - Greene King IPA - soared from 6,000 bottles to 80,000 bottles a month.

|

Consumers at Lancome's counter at a shopping center in Nanjing, Jiangsu province. Provided to China Daily |

The Chinese, who normally drink domestic lagers such as Tsingtao and Yanjing, had suddenly developed a taste for English bitter ale.

The brewer that makes the beer based in Bury St Edmunds, Suffolk was the latest to benefit from the desire of Chinese consumers to have the latest thing.

This often emotional and sometimes erratic behavior is "shaking the world", according to a recent article by Jeffrey Towson, professor of investment at Peking University's Guanghua School of Management, that went viral.

Chinese consumers are a vital market for virtually all leading global consumer brands, yet their behavior is so volatile that trends are becoming increasingly difficult to forecast.

They do not often behave according to the more established and standard patterns of behavior they see in Western markets, according to experts.

So foreign multinationals - like Chinese companies that are just as desperate to capture their own domestic market - are having to adjust their business models so they can align them with the latest trends and fashions in the world's second-largest economy.

There was much interest last month therefore in the publication of the 2016 China Consumer Report, The Modernization of the Chinese Consumer, by McKinsey & Co.

It was the 11th such report produced by the international management consultants since 2005, and this year included interviews with 10,000 consumers.

Daniel Zipser, partner at McKinsey's Shanghai office and the leader of its consumer and retail practice in Greater China, who was co-author of the report, says it is the speed of the consumer trends that presents the biggest challenge to companies.

"You see brands emerging from nowhere to be worth a billion dollars in just 12 to 18 months. We just haven't seen that in the Western world," he says.

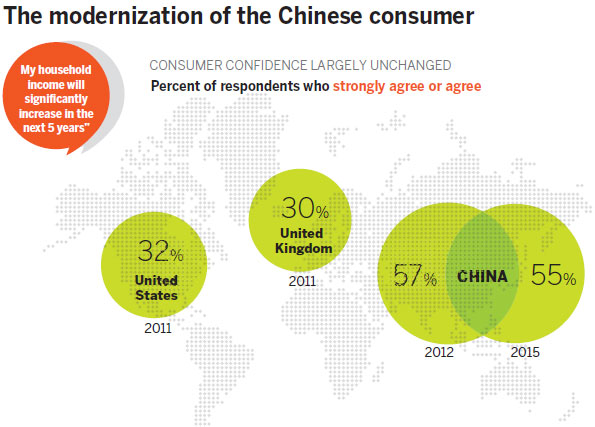

Despite the recent slowdown in the economy, Chinese consumers remain among the most confident in the world.

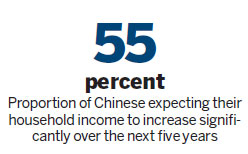

Those expecting their household income to increase significantly over the next five years was 55 percent in 2015, barely unchanged from the 57 percent in 2012.

This contrasts with only 30 percent of British consumers and 32 percent US consumers, believing the same when they were last polled in 2011.

"Although there are regional differences with consumer confidence in Northeast China (an area of declining heavy industries and higher unemployment) dropping to UK and US levels, China is still a nation of more optimistic consumers," adds Zipser.

With this level of buoyancy, China - and not the United States or Europe - has become the place for companies to launch new products and services.

In February, Apple chose China to be the first country outside of the US to launch its Apple Pay mobile payments system, linking with Union Pay and Chinese banks.

It also had a simultaneous California and Beijing launch for the iPhone 5 in 2013.

Many leading automotive manufacturers now launch their new models first in China, the world's largest car market.

Wang Qing, professor of marketing and innovation at Warwick Business School in the UK, says this is because Chinese consumers are always clamoring for something new.

"They are seeking novelty. They get a thrill out of getting the latest product. There is also a conspicuous consumption motive," she says.

"The Chinese are very social people and if you buy the latest thing, it gives you a talking point among their friends and peers. Western consumers are much more rational. They are more likely to analyze the cost and benefit of any new product and are prepared to wait three or six months when it might be cheaper."

Wang says that companies are being forced to respond to this and cannot take the Chinese market for granted like they may have done in the past.

"They now realize it would be a huge mistake to do what they sometimes did in the past and just try and sell some outdated model to China on the assumption consumers were somehow unsophisticated."

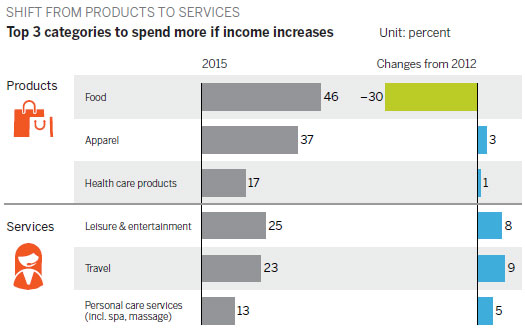

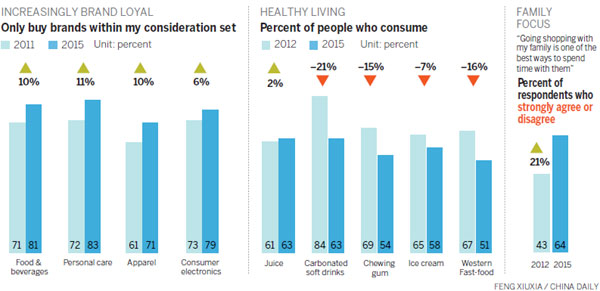

The McKinsey report highlighted just how much consumerism has become a fundamental part of the fabric of life. Apart from the well-documented obsession with online shopping, some 64 percent of those asked said going shopping was now one of the best ways to spend time with their families, up from just 43 percent in 2012.

Those selling to China now also have to take into consideration that there is a move toward healthy living. Perhaps reinforced by recent food scandals, some 50 percent of Chinese consumers are now focused on healthy eating.

This could be bad news for international brands such as Coca-Cola and Pepsi with the percentage of those consuming carbonated soft drinks falling from 84 percent in 2012 to 63 percent in 2015. Consumption of Western fast foods is also down from 67 to 51 percent over the same period, and ice cream was down from 65 to 58 percent. The number of urban consumers participating in sporting activities, 73 percent, is now higher than the 70 percent in the US.

"This is one of the big changes that has taken place over the past 12 to 18 months. It is something that has been talked about in our previous surveys going back more than a decade, but now it has actually happened," adds Zipser at McKinsey.

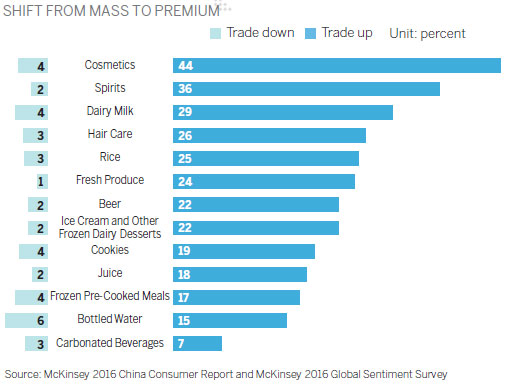

One of the major trends, however, is that Chinese consumers now want to trade up to premium brands over mass market brands. In almost every product category, consumers are wanting the best they can afford.

With cosmetics, 44 percent want to trade up, spirits 36 percent, milk 29 percent, hair care 26 percent and even rice 25 percent.

Zipser says this can be far too easily dismissed as the sort of nouveau riche behavior seen in other fast-developing societies, but he believes it is a far more subtle than that.

"It is essentially about buying a more expensive shampoo or beer and not some crazily expensive one. It is more about consumers saying they want quality brands and anyone doing business in China has to be aware of this."

Where Chinese consumers, particularly younger ones, often differ from Western consumers is being heavily influenced by fashion trends in their Asian neighbor, South Korea.

Although the chart-topping Gangnam Style from the South Korean musician Psy may have permeated Western culture, everything to do with South Korea, from movies and soap operas to lipstick, is seen as cool in China.

"South Korea has very much influenced the millennial generation in China, and it is something that distinguishes the Chinese consumer from their Western counterparts," says Wang at Warwick Business School.

"It is interesting that the deeply philosophical and reflective culture of Japanese society has very little resonance with young Chinese."

Eden Yin, senior lecturer at Judge Business School at the University of Cambridge, says what is seen as erratic behavior among Chinese consumers is often the result of a herd mentality.

"I have lived in both the US and the UK. People in the US often spend their spare time outdoors or doing DIY. Here in the UK, many people spend their time reading. Chinese people spend their time socializing, particularly on social media like WeChat. They are basically bored, and that is why they get excited by these fads and trends that suddenly sees everyone rushing to buy the same product," he says.

Yin, who will be teaching a program, Strategies for Winning in China, at Cambridge next month, argues that this does not mean they are emotional.

"I think an example of emotional behavior would be Jewish people refusing to buy German products. You sometimes get this in China when trouble flares with Japan and people refuse to buy Japanese goods. There is nothing emotional, however, about trading up and wanting to buy premium brands. That is perfectly rational."

Mike Bastin, course leader of the MA in fashion marketing at the University of Southampton and a contributor to China Daily, says his recent research findings suggest Chinese consumers are driven less by a herd mentality.

"They are becoming more private about their consumer choices. Conspicuous consumption and 'gaining face', for so long key drivers of Chinese consumer behavior, appear to be less common. Consumers have matured and do not need to show off as much as they did before," he says.

Bastin, currently on a nine-city guest lecture tour across China, says where Chinese are making more individual choices in fashion they are moving toward upmarket Chinese brands like Shanghai Tang, the brand that has tried to capture the city's 1920s and 1930s chic.

"When consumers make individual choices this is what they now see as sophisticated, not always Western brands."

Whatever the idiosyncrasies of the Chinese market, attracting the attention of the Chinese middle class consumer is the holy grail in boardrooms across the world.

Zipser at McKinsey says the danger for many is over-intellectualizing the challenge.

"The biggest common mistake is trying to get it perfect and over-researching to predict trends in advance," he says.

"It is better to get in there with your product 90 percent right and see how the market responds. You might have to tweak what you are offering, change its positioning in the market or pull it altogether and try something else. You need to be as quick in your decision-making as the market itself is fast-moving."

andrewmoody@chinadaily.com.cn

|

People at a gym in Beijing. More Chinese consumers are focusing on healthy eating and sports as they move toward healthy living. Wei Xiaohao / China Daily |

( China Daily European Weekly 04/08/2016 page1)

Today's Top News

Zhubi Reef lighthouse comes to life

Huawei picks UK for global launch of new phone

Social media fury after woman claims attack in hotel

Germany rules out debt relief for Greece

Li: Tax reform to boost vitality of real economy

First wave of migrants returned to Turkey

Once-endangered pony makes comeback

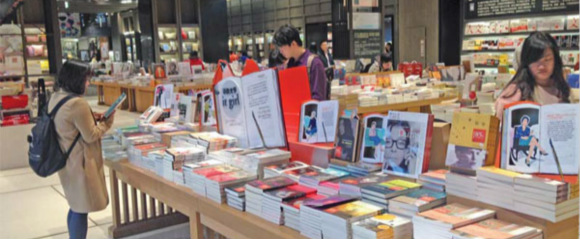

Bookshop worms way into community

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|