Interest rate shackles not ready to fall

Updated: 2015-11-06 07:38

By Zhu Ning(China Daily Europe)

|

|||||||||||

With deposit insurance, savers no longer motivated to withdraw savings if they hear anything negative

The Peoples' Bank of China made a somewhat surprising move on Oct 23 by lowering both the interest rate and reserve requirement ratio. Despite the wide expectation that the bank would need to cut both the interest rate and reserve requirement ratio at least once to raise growth, the market is nevertheless surpised by how soon the rate cuts came. The move has prompted some to question whether economic growth is so weak that the central bank had to act so aggressively.

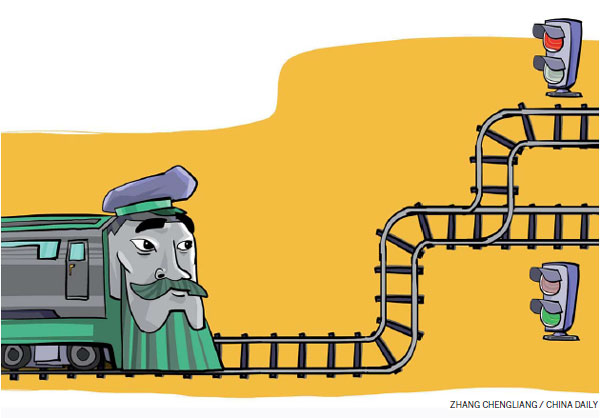

Leaving aside speculation on the rate of economic growth for a moment, a more important policy change at the same time did not seem to attract deserving attention from the market. At the same time of the rate cuts, the bank also announced the removal of caps on regular yuan savings rates offered by banks and financial institutions.

After continuous relaxation of various interest rates, the regular savings rate for the yuan remains the last regulated interest rate, and the final step of Chinese interest rate liberalization reform. Before this last move, the interest rate for loans was fully liberalized, after a series of widening of the floating band. On the savings side, the interest rate for certificates of deposits, standard and transferable savings instruments of large amounts offered and bought mostly by institutions, has been liberalized. Even for regular savings of over 10 million yuan, savers had already gained access to entrusted loans or negotiated loans, for which banks have to compete with each other on interest rate.

The regular savings rate of not so large amounts, therefore, is the only one that is still being regulated. From an investor protection and financial stability perspective, there are good reasons why the central bank remains conservative with finally liberalizing regular interest rate.

Regular savers have little ability in discerning the risks of different financial institutions and the savings rates that different banks offer. Therefore, they may fall victims to banks that offer aggressively high interest rates and have to take excessive risks to obtain high returns. In such attempts, banks and financial institutions will be motivated to take unwarranted risks that are beyond their handling and eventually lead to the demise of some such financial institutions and eventually, instability of the market.

To reduce the impact of such moral hazard and adverse fallout, many countries use deposit insurance.

A deposit insurance program was introduced in the US after the Great Depression of 1929-33. The purpose of such a program is to set up a third-party insurance program that ensures the security of savers' capital, with the help of sovereign credit enhancement and different insurance rates depending on different financial institutions' risk profiles. With the deposit insurance program, savers are no longer motivated to withdraw their savings if they hear anything negative about the specific bank in which they hold deposits, therefore avoiding a run on banks or the emergence of a banking crisis.

The Peoples' Bank of China introduced the insurance program last year, which should pave the way for complete interest rate liberalization. That said, the implementation of the Chinese deposit insurance program is still in its incubation period, and not many banks have been covered. As a result, should there be a sudden rise in interest rates and some banks are unprepared and get into trouble, mechanisms protecting such banks and savers may not exist.

Except for such risks, the central bank's move to completely liberalize interest rates is undoubtedly a correct and decisive one. With uncertainties in whether and when the US Federal Reserve raises its interest rate and whether other countries follow suit, the window for further interest rate cuts in China is closing.

According to the experience of interest rate liberalization in many countries, interest rate liberalization is likely to lead to prevailing market interest rates rising in the near term. This may pose a threat to Chinese financial and economic reform, which is already facing the challenge of lack of credit and high interest rates for small and medium-sized enterprises, which will constitute the main driving force of the economy.

A major mandate to Chinese regulators is to resolve the financing challenges facing Chinese SMEs. Therefore, interest rate liberalization without corresponding interest rate cuts may lead to a near-term rise in the interest rate, which will aggravate the financing challenges facing SMEs and could lead to resistance to interest rate liberalization. It is worth pointing out that such incremental concerns and resistance may be the deal breaker for finally completing interest rate reform.

Many involved parties, such as banks, shadow banks and state-owned-enterprises are all beneficiaries of the existing financial system, namely, the access to cheap and readily available bank loans. In fact, it is hard to predict the fate of some SOEs and financial institutions if it were not for the subsidized, low interest rate.

Therefore, it is important to perceive the reduction of the interest rate and the reserve requirement ratio in light of the final liberalization of the savings rate. Even though such actions by the Peoples' Bank of China may be interpreted by many as yet another piece of evidence of further slowing economic growth, it is more important to look at this from the perspective of comprehensive financial reform and regard the reduction of the interest rate and the reserve requirement ratio as necessary hedging against potential shocks from the eventual interest rate liberalization.

In a sense, the Chinese economy is not venturing into uncharted waters where the bank does not provide specific guidelines for savings and loan rates. As one of the few key areas that remain regulated, the Chinese financial sector will meet some unprecedented opportunities and challenges.

More likely than not, this new market-oriented pricing mechanism in the financial sector will better realign the interests of the state and the market, the state-owned enterprises and private enterprises, the present and the future, the rewards and risks. Even though there surely will still be bumps along the road to further financial reforms, the decisions on Oct 23 may well mark a watershed in the Chinese financial sector and economic growth and bring new opportunities for the economy for years to come.

The author is deputy director of the Shanghai Advanced Institute of Finance. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 11/06/2015 page10)

Today's Top News

UK unveils new spying powers, raising privacy fears

UN chief commends efforts by China, France to push for climate pact

China and Europe to jointly fund scientific research and innovation

Merkel calls for European solution to refugee crisis

China, France made progress in nuclear energy cooperation

More than 100 UK investment projects revealed

Hollande highlights green growth during visit

Tougher controls leave migrants stuck in Austria

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|