State of the art

Updated: 2015-09-25 07:59

By Riazat Butt(China Daily Europe)

|

|||||||||||

China's cultural marketplace not only can weather the stock market storm - the long-term forecast is for solid growth, experts say

George Wong has been a collector for many years. The real estate mogul, who is in his 60s and whose net worth is about $1 billion (885 million euros), has gone from amassing albums and stamps as a youth to becoming a patron of the arts in the Asia-Pacific.

"I buy famous artists," he says. "I have Monet, Picasso, Magritte, Chagalle, Lichtenstein and Degas ... But I'd like to own a decent-sized Monet."

|

Wang Zhongjun, chairman and cofounder of entertainment giant Huayi Brothers Media Group, paid $61.8 million last year for a Van Gogh, Still Life, Vase with Daisies and Poppies. |

A bigger Monet, perhaps a painting of a water lily? "Yes," he replies. "I would like a water lily."

There is a shelf of Star Wars memorabilia in Wong's Beijing office and a metallic, bubble gum-pink machine gun mounted to the wall behind his desk.

"I like artwork. I started small, just collecting, collecting anything. It doesn't matter if you buy art for investment, to appreciate it or to show off. As long, as you're involved."

China is deeply involved in art, to the extent that it is a regular fixture in the world's top three art markets in terms of value. Its cohort of billionaires and their spending sprees is legendary, including $116 million dropped in one night at one auction on three paintings in May. How involved they are during auction season - which begins in September and ends in November - remains to be seen. China's stock market rout, which started in mid-June and has spiraled downward since, has hit the country's super rich.

On July 8 Forbes said that the 205 Chinese billionaires tracked by its Real-time Billionaires List lost a total of $195 billion since the Shanghai Composite Index hit its peak on June 12.

China's richest man, Wang Jianlin, head of real estate giant Dalian Wanda, lost $6.5 billion in that period as share prices of his two public companies fell, Forbes says, adding that he was still worth $32.3 billion and remained Asia's richest man.

Wang was one of the three deep-pocketed Chinese collectors that night in May. He spent $20.4 million on Monet's Bassin aux nympheas les rosiers. Two year earlier, in November 2013, he spent $28.2 million on Picasso's Claude and Paloma, a portrait of the Spanish artist's children.

The list's biggest loser, says Forbes, was the copper and cable entrepreneur Wang Wenyin, who lost $7.3 billion in that period, more than any other Chinese billionaire on the list.

Internet services giant Tencent's stock, traded in Hong Kong, dropped 13 percent on July 8, and its chairman Pony Ma lost $1.2 billion on a single day, Forbes says.

But international auction houses are confident that China is capable of weathering the storm because it has enough wealth - and enough wealthy collectors - to absorb financial shocks. President of Christie's China, Cai Jinqing, says: "Like any market there are cycles and fluctuations. This is one of those things. Our strategy is geared toward the long term. We have to adapt."

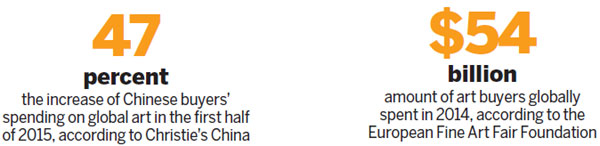

Chinese buyers increased their spending on global art by 47 percent in the first half of this year, she says. Figures from Sotheby's in July show that Chinese buyers spent 51 percent more during its summer sales in London and that there has been a 35 percent increase in buyers from China.

Asian buyers accounted for three of the top five works sold at Sotheby's New York Impressionist and Modern Art Evening Sale in May and 30 percent of that evening's sales. One of the bidders was an Asian man who spoke Chinese, but denied being Chinese. He stood out for wearing a hooded top, sneakers and denim while bidding on a Van Gogh. He bought the painting on behalf of an unknown person for $66.3 million.

"China is an important consumer of art," says Colin Sheaf, chairman of Bonhams UK board and chairman of Bonhams Asia. "At the moment the focus is very much on Chinese art, though I think we can expect to see some diversification as some collectors - especially of modern and contemporary art - broaden the scope of their interests to include works by some of the Western contemporary masters. Even if middle-range buyers in China become less active for a while, Bonhams has clients around the world who we are confident will continue to bid."

A report in July from Artnet says the market for Chinese fine art, not including foreign art, contracted by 30 percent. Sales in the Chinese mainland and Hong Kong, for the first half of this year, amounted to $1.5 billion. For the first half of last year, sales were $2.2 billion. This could be linked to a slowdown in China's gifting culture, experts say.

Giving art as gifts, known in China as elegant bribery, has been part of the domestic art market for decades, but it has declined due to the government's anti-corruption campaign. As a side note, Artnet also reported lower sales in other important art markets: France, Germany and the United Kingdom. Only the United States experienced a significant increase.

The European Fine Art Fair Foundation, in its annual market report, says art buyers globally spent $54 billion last year, 7 percent more than in 2013. The figure, as well as setting a record, exceeds the pre-recession high of 2007. Credit Suisse, in analysis published in August, says the growth in global wealth fuels the art market and that there is a link between art prices and emerging wealth.

In 2003, sales at Christie's Hong Kong were $98 million. By 2011, they had reached $836 million, say Dan Scott and Marc Hafliger, investment strategists at Credit Suisse and authors of the report.

"We really see China as an emerging market," says Christie's Cai, who, like other industry experts, believes the Chinese art market is a work in progress. "China has a long history of art creation and art collection. It is part of world civilization. The Chinese art market only really started in the 1990s. The first Chinese auction house was only founded in 1994. That was the starting point.

"Twenty-something years ago, most people were showing up in sale rooms. At that time the Chinese market was just starting, but it is now the second-largest in the world. It has 24 percent of the market share. It is a rising giant, and the future will see continued growth."

As well as being a young art market compared with more established ones in the United States and the Europe, China also presents a chance to innovate and experiment. "The China market is more willing to experience new things in terms of collectors and artists," Cai says.

"There's not too much to lose. People are more optimistic. They want to know more about art and they want to experience it in a new way. We are being encouraged to try new things. There is an emerging generation of very active female collectors in China. It's not as simple as saying young people are buying young art. They are interested in special provenance and the interesting story behind it, if the piece belonged to an interesting collector. They want to understand a specific piece of art and its value."

To this end auction houses are wooing Chinese buyers through experiences rather than catalogues alone. These initiatives, as well as being informative and educational, also nurture allegiances and relationships with Chinese collectors who might otherwise be drawn to the two domestic auction behemoths, Poly and Guardian, themselves a force to be reckoned with when it comes to Chinese classical and contemporary art.

In May last year Christie's invited 18 new Chinese collectors to New York. The itinerary included a guided tour to the city's Museum of Modern Art and VIP tickets to an art fair.

"The Chinese want to understand a specific piece of art and its value. They are getting more sophisticated. They want exchanges and interaction with the outside world," says Cai.

That same month Sotheby's Beijing held its second spring sale and selling exhibition. It was supported by talks and lectures to target the diverse collectors in China. At the time, Larry Zhu, Sotheby's Asia chief operating officer, said art education would play a fundamental role in the market's future development. Sales in China would bring previously unavailable and prestigious works to the country, and educational events would increase knowledge about these works and inform the market, he says.

Wang Zhongjun, chairman and cofounder of entertainment giant Huayi Brothers Media Group, gave an interview to Sotheby's in May. It provided insight into the evolution of a Chinese art collector. Wang bought a Van Gogh for $61.8 million in November and says that 10 years ago he could not have dreamed of buying such a work. His initial purchases took place from 1998, when he made his fortune, and included Chinese contemporary and classical artists such as Luo Zhongli, Ai Xuan, Wu Guanzhong and Fang Lijun.

The Van Gogh, the movie tycoon says, was a higher-priced and very important "museum-quality" painting. The name, together with the rare-to-market nature of the piece, presented him with an opportunity. "I don't buy paintings every year - at this level, it's impossible to be too whimsical about it, unless I were to have more money. I am not yet at that level."

Wang Zhongjun, who is worth about $1.26 billion, bought a $29.9 million Picasso in May. The painting was in the collection of film producer Samuel Goldwyn Jr. In a statement after the Picasso purchase he says: "I first fell in love with the painting and then I fell in love with its story. The Goldwyn family is legendary in our industry."

There are parallels between China's luxury market and its art market. Both have experienced stratospheric growth over a short time, and a lull in activity does not necessarily point to an impending collapse or a loss of interest. "As the Chinese market has become more mature, collectors have refined their tastes and are now more discerning about what they want to buy and how much they are prepared to pay for them," says Sheaf, of Bonhams. "This is normal with any maturing market."

Larry Warsh, a New York art collector and publisher with a specific focus on Chinese contemporary art, warns against ghettoizing the Chinese art market, saying it is like any other.

"The financial crisis in general works both ways. It's not China specific. If you look at Dow drops in the last 10 or 15 years, the art market booms when the stock market is down. It creates a sense of insecurity and it creates a safe haven for commodities like gold and art. It also makes people need to sell quicker. Art is a great way to hold on to assets."

He rejects the idea that the country's financial problems will cause the Chinese to flee the art market and cause it to crash just as the Japanese one did more than 25 years ago, when Japanese collectors smashed records at auctions and then exited the art market when their economy imploded. The art market is bigger than it was in 1990, he argues, and there is more money in a greater number of regions.

"Japan doesn't have the scale of the Chinese art market, but there was a lot of bad buying in the 1980s. Wealth will support the Chinese art market, and there is enough wealth to support the art available. There is trophy buying in China but that doesn't mean it's not good buying or good collecting."

Confidence and education will make the market thrive, he says. "That will happen through the billionaires' children. I think they will add to the power of China. Stanley Ho has a big family. His daughter, Angelo Ho, started buying Keith Haring. But money is far better spent by Chinese collectors on Chinese art, which is still undervalued."

riazat@chinadaily.com.cn

(China Daily European Weekly 09/25/2015 page1)

Today's Top News

Hundreds killed in Saudi Hajj stampede

Volkswagen to pick Porsche boss as new CEO

EU leaders claim unity regained, pledge aid for Syrians

Business leaders, experts applaud Xi's speech in Seattle

Premier encourages innovation

Xi calls for safe cyberspace, reassures US business titans

Volkswagen CEO quits after carmaker rocked by diesel scandal

EU pushes through plan to relocate 120,000 refugees

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|