Preparing for Belt and Road success

Updated: 2015-09-18 07:41

By Wang Yongzhong and Li Xichen(China Daily Europe)

|

|||||||||||

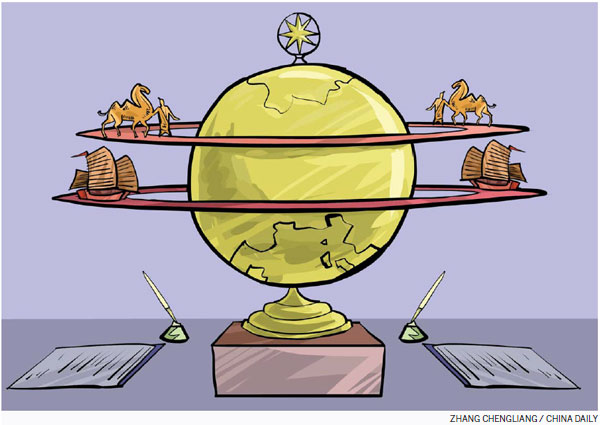

Initiative will help transform many other countries but China will also need to change

The Belt and Road Initiative, which is China's strategy to build the Silk Road Economic Belt and 21st Century Maritime Silk Road, will be an important strategy for China's opening-up over a long time into the future.

Its key objectives are to promote communication between countries in the region, as well as road connections, trade flow, currency circulation and people-to-people exchanges.

This provides great opportunities for China to speed up the pace of economic restructuring, to achieve a new normal of economic development, to promote the diversification of foreign trade and economic cooperation, and to improve the overall level of China's opening-up.

China and countries along the proposed belt and road are planning to build six economic corridors: linking China, Mongolia and Russia; China and Central and Western Asia; China and Indochina; China and Pakistan; Bangladesh and China, India and Myanmar; and the New Eurasian land bridge, which will be the focus of efforts related to Asia-Europe connectivity.

National and cross-border direct investment is a critical issue between China and countries in the Belt and Road Initiative area.

The focus of economic collaboration will include the regions' construction of interconnected infrastructure, and cooperation in energy, resources and industrial parks. Thus, in implementing the strategy, direct investment from China to countries in the area will be significantly increased - in the future.

But while countries in the Belt and Road Initiative area are important, they are not the main destinations for Chinese foreign direct investment. Developed countries in Europe and North America, and countries abundant in natural resources, remain the main focus for China's foreign direct investment.

Statistics from Chinese authorities and the American Heritage Foundation show that by the end of 2013, China's direct investment to countries in the Belt and Road Initiative area represented between 10.8 percent and 28.1 percent of the country's total FDI. This means that despite smooth implementation of the Belt and Road Initiative, the primary focus of China's foreign investment will be hard to change in the short term.

It will take a long and gradual process to see the effect of the implementation of the Road and Belt Initiative, and people should not have unrealistic expectations for this strategy over a short time frame.

In stark contrast to the low share of cross-border direct investment, more than half of China's large engineering contract projects are in countries in the Belt and Road Initiative area. This is evidence of China's realistic and forward-looking vision to put "infrastructure interoperability" as one of five priority areas of collaboration in the initiative.

There are also large regional differences for China's foreign direct investment and major engineering contract business in the Belt and Road Initiative area. China has maintained close trade ties with countries of the Association of Southeast Asian Nations, which have attracted the largest volume of Chinese direct investment in the belt and road area, as well as being the largest market for engineering contracting. West Asia and Central Asia are the two regions where China has undertaken the most large-scale projects that have received the largest direct investment from China. China's investment in South Asia, the Commonwealth of Independent States and Central and Eastern Europe lags behind and is relatively small.

Regarding the industrial structure that China has invested in the belt and road area, energy holds an overwhelmingly dominant position, followed by metal ores, real estate and transport. China's investment in the agricultural, high-tech and chemical industries are relatively small. The majority of engineering contract projects undertaken by China in the initiative area fall in energy, transport and real estate.

China's state-owned enterprises are the main force carrying out investment in those areas, with local companies playing a complementary role.

China's past investment failures in large-scale projects in the initiative area were mainly in West Asia and the ASEAN region, with most missed opportunities in energy and metal ores. Investment risk in the Belt and Road Initiative area is significantly higher than China's national average.

For Chinese enterprises, investment risks in the belt and road area are also varied. For them, investment in West Asia is the most risky, and investment risks in South Asia are also very high. Central Asia has lower investment risks. In Eastern Europe, the CIS, ASEAN and other regions, risks are modest.

Here are some proposals on reducing investment risks and enhancing returns and the efficiency of foreign direct investment, as well as improving its level of sustainable development and ensuring the successful implementation of the Belt and Road Initiative. First, Chinese government, academia, media and business should explain objectives and areas of cooperation of the Belt and Road Initiative to people in the initiative area, so as to resolve any misunderstandings or doubts, as well as increasing consensus and mutual trust.

Second, we should step up efforts to train language experts in the area, and encourage trade associations to set up branches in those regions. We also need to strengthen efforts in research and gathering intelligence in the region, as well as helping our nationals deepen their understanding and knowledge of countries in the area.

Third, the Chinese government should sign and modify bilateral investment agreements with countries in the area, support Chinese enterprises in standing up for their legitimate rights overseas, and demand that the authorities in foreign countries make their law fair and transparent in order to protect the legitimate rights and interests of Chinese companies.

Fourth, Chinese enterprises should standardize their overseas operations and improve their awareness of the law. We should improve the government's foreign investment promotional system, as well as reduce political risks that Chinese companies face overseas.

Fifth, Chinese enterprises should improve their investment strategies and not blindly pursue large-scale investment projects. They should reduce investment in sensitive sectors such as energy and resources, take measures to reduce concerns about investment projects in local areas and minimize political risks.

Sixth, we should give full play to Hong Kong as a mediation agent and platform during mainland enterprises' going-out campaigns to ease their overseas investment risks. Finally, we should build China's own risk rating, early-warning and management systems for outbound investment, to reduce investment risks and improve the chances for success.

Wang Yongzhong is deputy director of the Institute of World Economics and Politics Research at the Chinese Academy of Social Sciences. Li Xichen is a graduate student in the world economics department of the academy. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 09/18/2015 page12)

Today's Top News

EU's Tusk calls EU summit on migration

At least three killed as powerful quake hits off coast of Chile

Australian father takes on Chinese drug dealers after son's death

Senior securities watchdog official under investigation

Transactions on overseas real estate projected to hit $220b

Migrants in Serbia reroute to Croatia

UK Labour leader Corbyn takes on ritual at first Cameron duel

Britain marks 75th anniversary of victory in Battle of Britain

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|