Foreign buyers bring potential, but face pitfalls

Updated: 2015-07-24 08:05

By Zhang Chunyan(China Daily Europe)

|

|||||||||||

Realtors in London and other major European cities are bracing for a surge in their already hot property markets due to signs that wealthy Chinese are seeking a haven from the nation's recent stock market turmoil.

Chinese individuals and corporations have been amassing property overseas for several years, particularly in the British capital.

Yet after last month's market crash, in which about 20 percent was knocked off the value of Chinese shares prior to government intervention, real estate industry insiders predict that Chinese investors will be looking to further diversify their portfolios by pumping money into European property.

|

Offices, hotels, apartments and mixed developments in London are the most attractive assets for Chinese buyers. Wang Mingjie / China Daily |

"There is anecdotal evidence that Chinese buyers have intensified their interest in global property markets, including London, as a result of the recent stock market volatility," says Tom Bill, head of London residential research at Knight Frank LLP, a property consultancy founded in 1896.

Brian O'Connor, director of Adhoc Immobilien, a Berlin real state agency, echoes this, adding: "The whole (Chinese) market is precarious, so people would like to spread their risks and enter different markets."

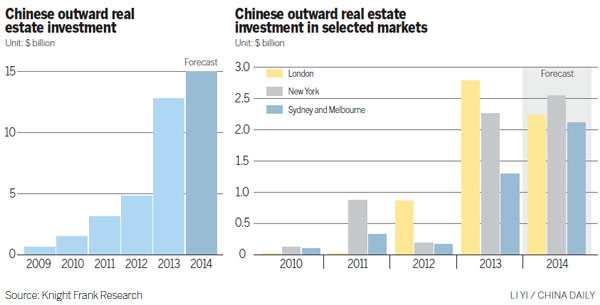

The value of investment in overseas property by Chinese individuals and companies rose from $600 million in 2009 to about $15 billion in 2014, according to estimates by Knight Frank. The company says Chinese buyers accounted for 11 percent of all transactions above 1 million pounds ($1.55 million; 1.43 million euros) in London last year, up from 4 percent in 2012.

A separate report released in January by UK property consultants Savills states that 70 percent of real estate purchases in London last year involved foreign buyers, with transactions totaling 14.6 billion pounds. China ranked second only to the United States in terms of the nationality of buyers in the British capital, with American investors putting 3.4 billion pounds into the market compared with Chinese investors' 2.2 billion pounds.

"London has always been a magnet for overseas investment, whether it was from the Middle East, the US or from around Europe. Chinese investment is the newcomer," says Eric Pang, head of the China desk at Jones Lang LaSalle Inc, an investment management company specializing in real estate.

Offices, hotels, apartments and mixed developments have proven so far to be the most attractive assets for Chinese buyers. For example, Dalian Wanda Group, one of China's largest conglomerates, invested 700 million pounds in June 2013 to build a five-star hotel beside the River Thames, which runs through the city center.

Chinese state-owned developer Greenland Holding Group announced early last year it will invest 1.2 billion pounds in two overseas development projects in London. They include a residential building on the historic Ram Brewery site and a high-end residential project in Canary Wharf.

China's banks also like London. Last June, China Construction Bank paid 110 million pounds to acquire No 111 Old Broad St in the city's financial district, known locally as the City.

And it is not only a British phenomenon. "Interest from Chinese investors in European property has been constantly rising for the past two, three years," says Sebastian Fischer, managing partner at estate agency Engel & Voelkers in Berlin. "Institutional buyers are mainly looking for large investment properties, while private individuals generally want apartments.

"European property has always been a well-functioning asset and is highly attractive from a Chinese portfolio management standpoint. Interest has risen due to the weaker euro and insecurities on Chinese stock markets."

Paloma Perez Bravo at E&V's office in Madrid adds that there has also been an increase in Chinese investment in Spain.

"Three percent of overseas buyers were from China in 2013. The following year it was 3.4 percent. We don't have the statistics for this year yet, but we expect it to be about 4 percent. So Chinese buyers are increasing year-on-year," she says. "In Q2 this year, we had many Chinese buying houses in Madrid. In Q4 2014, it was a very good time, as a lot of Chinese people came to ask about properties."

As in London, Dalian Wanda showed its ambitions to go global last year by acquiring the Edificio Espana, a Madrid landmark that was Europe's tallest building when it was completed in 1953. The company paid Grupo Santander 260 million euros ($282 million) to secure the historic structure.

While the recent stock market turmoil could see more Chinese money flow into European property markets, industry insiders say the trend over the past few years has come about from a complex set of factors. Chief among them are China's enormous overcapacity and the sluggish domestic property market, which have prompted wealthy people to diversify with offshore assets.

Walter Boettcher, research director and economist at global realtors Colliers International, based in the UK, says: "When we (Europe) went into the financial downturn, there was a lot of uncertainty, so obviously the Chinese, like many other foreign investors, were looking for safe places to invest. There was a bit of a push factor, too. The Chinese (companies) realized they were very exposed to dollar-denominated economies, and in some measure they were looking at the UK, and even Europe, as a means of diversifying their exposure to various currencies."

Air pollution and health and social services issues have also led many Chinese individuals to buy property in the developed countries to which they may eventually emigrate.

"What's more, the Chinese government is encouraging companies to go out and invest in overseas markets," adds Rasheed Hassan, director of cross-border investment at Savills.

Insurance giant China Life is one of the biggest corporations to follow that advice, buying No 10 Upper Bank St - an iconic skyscraper in London's Canary Wharf - for 795 million pounds last year.

Simon Barrowcliff, executive director of central London capital markets at CBRE, a commercial real estate company, explains that, initially, the acquisitions were for occupational reasons, such as Chinese banks that had expanded into the UK buying their own headquarters in the City.

"From there," he says, "that developed more into mainstream investment, mostly by institutional investors, until what we have today, which is a position where we're seeing a number of different streams of investment coming from China: the developers, the property companies, the institutions (particularly insurance companies) and the quasi-sovereign wealth."

The appreciation of the yuan in recent years has also made overseas assets more affordable.

Nick Braybrook, head of City investment at Knight Frank, says there are push and pull factors for the flow of money into European property markets. The pull factors for London, he says, largely come from the state of the market, "which is one that has originally seen a lot of outward yield movement, with yields looking quite competitive compared with a lot of other competing cities".

However, one thing that sets the British capital apart from other markets, according to Eric Zhao, head of China desk for cross-border investment at Savills, is that the city has such a large concentration of overseas buyers.

"Because about 70 percent of trade (in London) involves overseas investors, they don't stand out," he says. "In other markets - Paris, Berlin - you have a much bigger percentage of domestic purchases, and therefore overseas buyers, be they Chinese or from anywhere else, are a smaller percentage and tend to have less choice perhaps of things they can look at."

The influx of Chinese capital into London and other major European cities that is expected to follow the stock market crash in China will have a dramatic effect, some analysts say. They believe the investment will potentially attract even more money to the real estate industry and create tens of thousands of jobs.

However, critics argue that foreign investors have already had a detrimental effect, with locals blaming them for the soaring house prices in many cities.

The government in the UK has made a series of changes to the country's tax system in the past three years aimed at discouraging wealthy foreign buyers from entering the London housing market. The crackdown focused particularly on homes bought using offshore companies, which make it hard to trace a property's ownership.

Another challenge comes from the fact that commercial properties do not come with a guaranteed, steady rent flow or price appreciation in all European cities.

Ping An Insurance Group, based in the southern city of Shenzhen, bought the landmark City of London headquarters of the Lloyd's insurance market for 261 million pounds last year, becoming the first Chinese insurer to buy a property in the UK. However, it has been reported that Lloyd's is considering a move out of the building. According to sources, the company's management has grown tired of the high cost of the site and could activate an option in their lease to leave in 2021.

Lloyd's pays nearly 17 million pounds a year in rent, but service charges are twice as high as buildings elsewhere in the city's financial district.

Losing a tenant means a yield of zero percent for the building's owner. And if they have a loan to repay, the situation can be even worse.

Regulations in Europe relating to the renovation, restoration and repurposing of buildings can also be troublesome for foreign investors unfamiliar with the rules.

Shanghai developer Zhongrong Property Group Co Ltd unveiled a 500-million-pound proposal in 2013 to build a replica of London's famed Crystal Palace, which was destroyed by fire in 1936. The project was abandoned in February after Bromley Council, the local authority, issued a statement saying a 16-month exclusivity agreement had lapsed and would not be renewed, as there was "no realistic prospect" of reaching a deal.

Industry insiders say a comprehensive understanding of the local market, regulations and business culture is crucial for Chinese newcomers investing in real estate abroad.

"The market in London is complicated, even though it is transparent," warns Nick Braybrook, head of City investment at Knight Frank. "Certainly in terms of planning, it is important to get the right level of advice before buying."

Chinese buyers should follow the example set by European investors, experts say: Gain more experience in negotiating with local institutions, make use of local advice, and ensure any investment is conducted in a transparent way.

"Take your time to research the market properly, get good advice, and make sure you have a proper professional team advising you," suggests Zhao at Savills. "Follow local market tactics and factors. Get your tax structuring right. Make sure you have a very good team of property advisors and lawyers around you with local experience, especially in planning and delivery."

Despite the risks in property investment, most analysts agree that Chinese money will continue to flow into European markets at a significant rate.

"We have already seen the top Chinese firms make a statement in London," Zhao adds, "and we expect a lot more to follow."

Daniel Assab and Fu Yi contributed to this story.

zhangchunyan@chinadaily.com.cn

|

Foundation stone laying ceremony of Greenland London Ram Quarter. Photos provided to China Daily |

( China Daily European Weekly 07/24/2015 page6)

Today's Top News

Japan's Nikkei buys Financial Times in $1.3 bln deal

Greek parliament passes crucial bailout bill

Ministry: No date set for nationwide two-child policy

'Spartans' detained by Beijing police for disturbing order

Shanghai says no futures trading manipulation in FTZ

More Chinese companies become world top 500

Another month, another global heat record broken

Forbidden City enters Secret Garden for different shade

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|