Clash of the titans

Updated: 2015-06-19 06:52

By Joseph Catanzaro, Chen Yingqun and Tan Yingzi(China Daily Europe)

|

|||||||||||

Its high-speed trains and built-in-an-instant skyscrapers have stunned the world. now, robots born in China threaten to steal a march on their rivals

On a factory floor in western China, where 2,000 workers hammer and drill at a line of half-built cars that stretches away like a traffic jam without end, a lone robot tirelessly applies sealant to windscreens.

It is the first robotic worker in this part of Changan Automotive's Chongqing production base, a sprawling complex in the municipality that churns out almost 1.5 million of the 2.6 million cars the Chinese company sells worldwide annually.

|

Technicians test robots in Harbin, Heilongjiang province. Photos provided to China Daily |

Able to do roughly the work of 10 people in a single eight-hour shift, the robotic arm heralds the transformation of traditional factories such as this one across China. It also presages an almighty battle - not between humans and their soulless replacements, but between the world's robot manufacturers as they wrestle for lucrative market share.

China is the perfect battleground for this tussle, given that it is already the world's largest market for industrial robots.

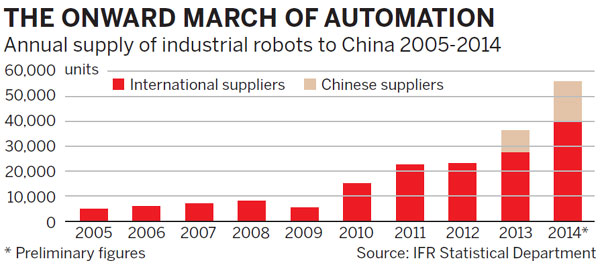

Since 2009, robot makers from Europe, Japan and the US have been reaping the rewards of a boom in Chinese demand that has been increasing at an average of nearly 60 percent a year.

Now the country that has adopted robots like no one else wants to be the one that gives birth to more robots than anyone else, too.

In case anyone doubts the seriousness of these ambitions, Chinese officials threw down the gauntlet recently at the annual meeting of the China Robot Industry Alliance in Yongchuan, Chongqing, declaring that by 2030 their country would be one of the biggest robot manufacturers.

Last year, 57,000 robots, one-fourth of the robots sold worldwide, were sold in China. That figure represents a 55-percent increase in sales in the world's second-largest economy since 2013.

Foreign companies made about 40,000 of the robots sold in China last year - 70 percent of total sales -but Chinese domestic manufacturers now have serious skin in the game, says Pan Wei, an analyst for China's Ofweek Industrial Research Center.

The telling factor on where market share is heading is not current sales, he says, but growth trends.

"Foreign robot (sales) growth in the Chinese market rose from 2 percent in 2012 to 48 percent last year. Chinese robot sales are growing about 60 percent a year."

In March, Pan says, 815 Chinese robot companies were operating in nine provinces and cities: Guangdong, Zhejiang, Jiangxi, Shandong, Shanghai, Beijing, Anhui, Liaoning and Chongqing.

"Most have been set up this year. Take Dongguan, Guangdong province, as an example," Pan says. "Before last year, the city had 41 robot companies; now it has another 53."

However, despite promising gains, Pan says Chinese robotics manufacturers are still playing catch up.

China's development of its robotics industry started more than three decades after Japan's did, he says. "In 1982, Japan produced 24,000 robots; in 2012, China produced only 23,000. China's robot industry faces problems such as the lack of a good industrial foundation, lack of technology about core robot components, and a lack of talent."

He Guotian, a professor with the Chinese Academy of Social Sciences, says Chinese robot companies will catch up with their foreign counterparts technologically "in 10 to 15 years".

To speed up the rise of Chinese robots, the government is spending millions of dollars in areas including education and research and development, he says.

"China needs 10 to 15 years to be the global industry leader," He says.

"The competition has already begun. Chinese companies can provide good-quality products at lower prices. Eventually China will be the future of the robotics industry, worldwide."

Industrial robot manufacturing is one of 10 key sectors that will receive a push under a new national plan launched by the government.

The plan, Made in China 2025, falls under the direct supervision of Premier Li Keqiang. It is designed to make breakthroughs in bottleneck areas so the country can play an even more important role in the global manufacturing chain.

Song Xiaogong, secretary-general of China's robot industry alliance, says strong policy support and huge market potential makes him confident.

"We predict that China can become one of the strongest industrial robot makers by 2030," he says.

By that time, Song says, the country will have a complete industrial chain and will be a world-leading research and development center, as well as a high-end manufacturing base for robot bodies and key components.

Arturo Baroncelli, president of the International Federation of Robotics, says that 10 to 15 years is an entirely "reasonable" estimate for the time it will take China to technologically catch up to established industry leaders such as Germany and Japan.

The potential for market growth in China is huge, Baroncelli says.

"China is already a big part of industrial robotics. They have overtaken step by step the US, Europe as a whole, Japan and South Korea. Today they are the biggest consumer in the world, and they are developing their own Chinese industry. Of the 56,000 robots (sold in China last year), 16,000 were made by Chinese producers."

One of the key indicators that Baroncelli says shows the growth potential in China is something the International Federation of Robotics calls robot density.

"Robot density is the number of robots divided by workers (in any given country). The worldwide average is 60 robots per 10,000 workers. In the US it's 152 robots per 10,000 workers; in Germany it's 182 robots per 10,000 workers; in Japan and South Korea it's more than 300 robots per 10,000 workers. How many are there in China? Thirty robots per 10,000 workers. One does not need a PhD in mathematics to understand what this means.

Robot density in China will increase, because it increases with industrialization in any country. And since this is the ratio between robots and workers, and there are a huge number of workers in China, there is huge potential in the country."

Pan says there are a number of reasons why China's government and industry are pushing for more robot integration and development, but ultimately it boils down to economic survival.

With China's workforce shrinking steadily since 2012, and dire estimates that one-fourth of the nation's population will be of retirement age or older by the early 2030s, automation is increasingly becoming both cost-viable and necessary for many businesses.

In Dongguan, where authorities say industry is suffering from a shortfall of 800,000 workers, the shifts that are taking place in China's manufacturing are of tectonic proportions.

More than 505 Dongguan factories have invested 4.2 billion yuan ($1.9 billion; 1.6 billion euros) to replace more than 30,000 human workers with robots. The most recent, electronics giant Shenzhen Evenwin Precision Technology Co, announced last month that it is installing 1,000 robots to cut its human workforce of 1,800 by 90 percent.

In the once-cheap labor heartland of the nation, Guangdong provincial capital Guangzhou, government officials recently set a target of having 80 percent of manufacturing done by robots by 2020.

Pan says at the low end of manufacturing China is now losing business to Southeast Asian countries, where production costs are lower. At the other end of the spectrum, high-end manufacturing is being dominated by the likes of Germany and the US.

"China's robot industry started booming around 2010, when the growth of China's population of those aged 15 to 64 started to slow down," Pan says.

"In 2012, the number of workers actually decreased (by 3.45 million). The demographic dividend of China's manufacturing industry is gradually weakening. China's manufacturing industry not only faces the challenge of many companies transferring their business to Southeast Asian countries with lower costs, they also face competition from Western countries in high-end manufacturing."

Robots may be the answer to the squeeze on China's manufacturing sector, he says.

Zhang Xiangmu, director of the equipment department at the Ministry of Industry and Information Technology, says Chinese robot manufacturers cannot afford to develop gradually.

"We have time pressure, as the foreign makers are occupying not only the high-end market, but also the low-to-medium market. Chinese companies must make some breakthroughs otherwise we will always trail others."

But wresting market share from countries with established robotics industries will not be easy.

Last year, the German robotics and automation sector had a record turnover of 11.4 billion euros ($12.8 billion), a 9-percent increase on 2013.

This year, further growth of 5 percent is expected, says Hans-Dieter Baumtrog, chairman of VDMA Robotics and Automation, one of Europe's biggest industrial federations.

"Prospects are good that the industry will reach the turnover mark of 12 billion euros by the end of the year," Baumtrog said recently.

VDMA says that most of that growth in the Germany robotics industry came in the form of increasing sales in China.

Exports accounted for 55 percent of sales last year. In the first four months of this year, demand from abroad jumped a further 11 percent.

Last year, the number of new robots installed grew 4 percent in Europe and 8 percent in North America. In Asia, robot installations rose 42 percent, and Baumtrog says most of that growth was in China.

"China does not content itself with employing robots," he says. "It is the express strategy of the Chinese government to become a strong and innovative robot country."

Li Guang, chief economist and executive director of Liangjiang New Area in Chongqing, agrees that this is exactly what China hopes to become.

In the past two years, Yongchuan district in Chongqing has attracted 65 robot makers to its Phoenix Lake Industrial Park, and it plans to have 200 robot companies by 2020.

Li says that the timing is right for China to push ahead.

"China is going through an economic restructuring process. It's difficult. The key is readjusting the technological systems (of Chinese industries), to rebuild them using intelligent manufacturing and automation. This is being driven by both the market situation and the government. Labor costs are rising, so we don't have that advantage anymore, but at the same time the costs for making robots are falling, so many companies can now afford them."

With about 2.6 million cars and 120 million laptops being made in Chongqing each year, the business environment is perfect for encouraging further growth in robotics manufacturing, Li says.

"The development of the robot industry is actually market driven here."

But beyond rhetoric, how does China plan to help local producers gain more market share? Education is part of the plan, Li says.

In Chongqing, several universities are preparing to launch master's degrees in robotics. In addition, a robot training college, funded by the local government, will open this year with an initial intake of 500 students.

"Many companies want to adopt a robot system in their factories, but they lack the human talent to operate and maintain it, so we are opening a robot training college," Li says.

"We plan eventually to increase the number of students to 3,000."

Finance is another area where the government is prepared to pitch in.

Li Hongjun, vice-president of Chongqing Liangjiang Robots Leasing Co, says his company offers leasing options for companies keen to automate their operations, helping businesses that lack the capital necessary to secure a bank loan in China to get the robots they need. Customers are charged a higher repayment rate compared with standard bank loans, but do eventually own the robots they lease.

Jointly financed by the government and private shareholders, in addition to increasing demand for local robot producers, CLRL also provides loans to domestic companies keen to expand their operations. Again, the onerous capital requirements demanded by the banks are waived.

"We have signed leasing agreements with three companies, and 20 other companies have applied and are now being assessed," Li says.

"There is one company that we helped in Chongqing that had 52 workers," Li says. "It is a company that makes screens for phones and laptops. They bought 20 million yuan of equipment with our help and were able to cut their workforce by 38 people and triple their production.

"Many cities across China are following in our footsteps with this model. Shenzhen is one that will have this model very soon."

Established in December 2013, Chongqing Huashu Robotics Co Ltd is among the first wave of local manufacturers hoping to make an impact in the western municipality.

On the company's factory floor, a senior worker casts a critical eye over two squat robotic arms that rear up and down in a test pattern like a pair of metal cobras.

"These types of robots are generally used in the auto manufacturing, electronics and plastics industries," he says. "We sold a lot of robots here in Chongqing last year."

He gestures at the robotic arms. "These can each do the work of three people," he says. "We're testing them for spotwelding. In 18 months, a company that buys these has made its money back."

Non-industrial robots, which the industry refers to as domestic, are also growing in popularity across China. At the Dalu Robot restaurant in Jinan, Shandong province, customers are served hotpot meals by motion sensor-activated droids that circle the eatery on a conveyor belt.

It is a far cry from the latest breakthrough in Japan, where Yaskawa Electric Corp's new sword-wielding robot, Motoman-MH24, this month reportedly dueled and defeated the renowned swordsmen Isao Machii. But it is still early days for Chinese researchers.

Back in Changan's Chongqing factory, in an area far from the clamor of the company's giant human workforce, the future has already arrived.

In a vacuum-sealed room, 36 robotic appendages spring to life, ferrous, arachnid limbs and blocky, nozzle studded obelisk-like machines closing in on cars trundling along a conveyor belt, painting each car's exterior at blistering speed.

Guo Yuehua, 25, is one of four employees responsible for maintaining the machines.

He is the new generation of Chinese worker: The robot wrangler.

A common fear is that robots will replace humans and cause mass unemployment, but Guo believes robots will ultimately benefit Chinese workers.

"My father had to squat on the ground all day and weld these long struts which were used in machinery," Guo says. "My mother was a cleaner. I think it's a good thing these types of jobs are being done by robots now."

As to whose robots, local or foreign, will be doing the work in China, Baroncelli says it will probably be both, with an increasing number of joint ventures.

"China wants foreign direct investment from robotics and manufacturing companies," he says. "Many, many European companies are now present (manufacturing) in China. You produce the robots there, they are already there. You're closer to the market."

On the Changan factory floor, the lone robot continues to apply sealant to windscreens. It is clear that one day this robot will have a legion of mechanical co-workers - even if their nationality remains in doubt.

Contact the writers through josephcatanzaro@chinadaily.com.cn

|

Above: Robotic waiters serve at a restaurant in Weifang, Shandong province. Below: A boy examines a cellphone-controlled robotic hand in Tianjin. Photos provided to China Daily |

(China Daily European Weekly 06/19/2015 page1)

Today's Top News

HK lawmakers reject election reform proposal

Lies and false hopes entrap Xinjiangers

EU seeks to ban animal cloning

European panda fans travel to Sichuan, China

Huawei committed to UK expansion

Europe on alarm after first MERS death in Germany

Vote to begin on Hong Kong's election reform

Greek PM tears into lenders as euro zone prepares for 'Grexit'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|