Firms pin hopes on winds of change

Updated: 2015-06-12 06:41

By Chen Yingqun(China Daily Europe)

|

|||||||||||

China's economy is a big preoccupation, european business leaders study finds

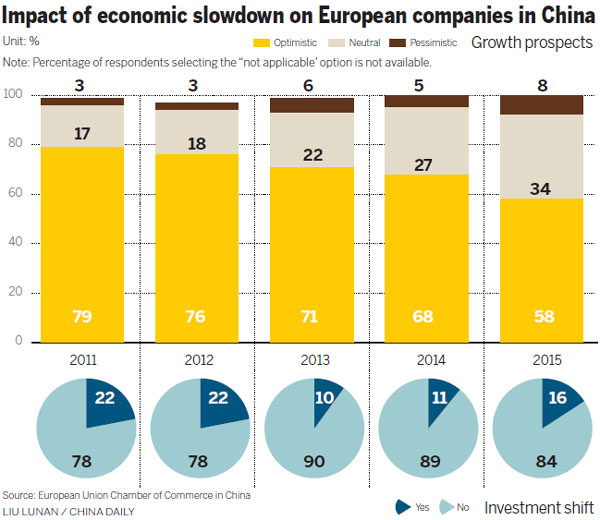

China's economic slowdown is significantly affecting the performance of European business in China, according to a survey, but it says that more than half the respondents are optimistic about their prospects in the country.

The Business Confidence Survey 2015, published by the European Union Chamber of Commerce and Roland Berger Strategy Consultants in Beijing on June 9, says the percentage of European companies that ranked concerns about Chinese economic headwinds as one of their top three business challenges is almost double that of any other challenge.

|

Visitors look at a light aircraft at the European Union pavilion of the 15th Western China International Fair in Chengdu. A survey has found many European companies are still optimistic about their prospects in China. Xue Yubin / Xinhua |

"European businesses have done OK in the past year, but the outlook is a bit pessimistic," says Joerg Wuttke, president of the EU Chamber of Commerce in China.

"People are withholding investment and are more cautious about investment."

The more than half of European companies expressing optimism about their growth prospects in China is 10 points lower than it was last year. Nearly one-fourth expressed pessimism about profitability over the next two years, and 40 percent said they plan to cut costs, compared with less than 25 percent last year, and most said they plan to lay off staff.

The Chinese economy is facing "a paradigm shift", Wuttke says.

It wants to discard the "old toolbox" of high, fixed-asset investment and export-driven growth, which has created overcapacity and debt in most industries. The Chinese leadership has articulated its vision of moving the economy to the so-called new normal, an era of lower but higher-quality economic growth, he says.

"The new toolbox for this growth is still to be put in place, meaning that while the growth pattern has already slowed, the shift up the value chain to more quality growth has yet to be realized. The transition will be difficult."

The pain brought by the economic slowdown has been felt more by European companies that have operated in China for more than 10 years, the survey found.

While on average 58 percent of European companies expressed optimism about growth, 76 percent of those that have operated for less than five years in China expressed such optimism, the survey says.

Wuttke says European companies that have been in the country longer are mainly in manufacturing, and the newer arrivals are catering to the newer China.

"The smaller the company, the newer the company, the better. The larger, the older, the more pessimistic."

However, since there is no other market as big as China, European companies are still keen on investing in it, and it is in services such as education, engineering, health and logistics that growth opportunities should appear, he says. However, it is in these areas that foreign businesses say they feel constrained by regulations, and they want more market access.

Fifty-five percent of European companies said foreign-invested enterprises tend to be treated unfavorably compared with Chinese firms in their respective industries.

Nevertheless, "there is no substitute for China", Wuttke says, and the European businesses simply want the Chinese government to press on with its reform agenda.

In talking of the government's reform agenda, one-third of European companies said it has helped to create an even playing field for foreign investors in China, one-third said it has not, and the rest said they were uncertain.

Seventy-eight percent of companies said they regarded better implementation of the rule of law as the top driver for China's economic growth in the coming years. Half the companies said they regard efforts of the country's leadership in improving the rule of law as meeting their expectations, and 85 percent applauded the anti-corruption campaign.

More than two-thirds of the companies surveyed that engage in research and development said they have no R&D center in China, and those with such a presence said they tend to use them to localize products. They would become more involved in China if they had better intellectual property rights protection, they said.

Complex visa policies impede the country's development of R&D, Wuttke says.

He points to the fact that foreigners account for just 0.6 percent of Beijing's population, while in his hometown of Berlin the figure is about 20 percent. The percentage of foreigners in Beijing is far less than in other big international cities, he says.

Xu Hongcai, a senior economist at the China Center for International Economic Exchanges, a government think tank, says that while China's economy is slowing, overseas direct investment and foreign direct investment are growing quickly. In addition, the Belt and Road Initiative holds great potential for the economy, he says.

European companies that have been in China for a long time will find that because of the rising cost of labor and materials and overcapacity, their competitiveness will be weakened, he says, so it is important that they keep bringing in the latest technology.

Prospects are brighter for newcomers more likely to adapt to the times, he says.

Over the past two years, after the Third Plenum of the 18th Central Committee of Communist Party of China in 2013, a great deal of effort has been put into streamlining administration and delegating powers to lower levels, he says.

"The pace of reform over the past two years has been faster than in the previous 10 years." While reform of stated-owned enterprises is a great concern to Western companies, who feel too little progress is being made, this year the government will issue a comprehensive report detailing the way ahead, he says.

Wang Huiyao, president and founder of the China Center for Globalization, a think tank in Beijing, says that China's research and development and production are sometimes disconnected, and Chinese firms often compare unfavorably with their Western counterparts in implementing research in their products.

CCG is now researching how multinationals could be more involved in China's R&D, he says.

There are about 1,300 research institutes attached to multinational companies in China that should look for more access to Chinese government funds, and the government should also loosen restraints in some areas and treat them as local companies, Wang says.

"Foreign companies could work with Chinese companies. For example, Microsoft's research center has incubated dozens of Chinese companies."

China should scout for more skilled people and retain them, he says, which means it needs to make the process easier.

On June 8, the Ministry of Public Security said China has lowered the threshold for permanent residency for foreigners serving in some government-affiliated institutes and scientific and research centers.

The newly added sectors include state laboratories and engineering research centers, technology centers of key companies and foreign-funded research and development centers. Foreigners who are vice-professors and researchers or above, who have worked for at least four years in China and whose tax affairs are in order, will be able to apply for permanent residency permits.

The ministry said on June 9 that from July permanent residency permits will be easier to obtain for foreigners working in Shanghai.

chenyingqun@chinadaily.com.cn

( China Daily European Weekly 06/12/2015 page19)

Today's Top News

Zhou Yongkang sentenced to life in prison

Kiev announces new round of peace talks on Ukraine crisis

Greece, EU powers agree to step up debt talks as crunch looms

EU sanctions hamper Italian-Russian commercial ties: Putin

Suu Kyi begins groundbreaking visit

G7 'ignore the facts over South China Sea'

British PM hails 'golden year' in UK-China relations

China's new rail giant bags first overseas deal from India

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|