Defying gravity

Updated: 2015-04-24 07:27

By Andrew Moody(China Daily Europe)

|

|||||||||||

Chinese investors ignore gloomy macro data and send stock market soaring on back of optimism about economic restructuring

The Chinese stock market has been described by at least one analyst as being "on fire".

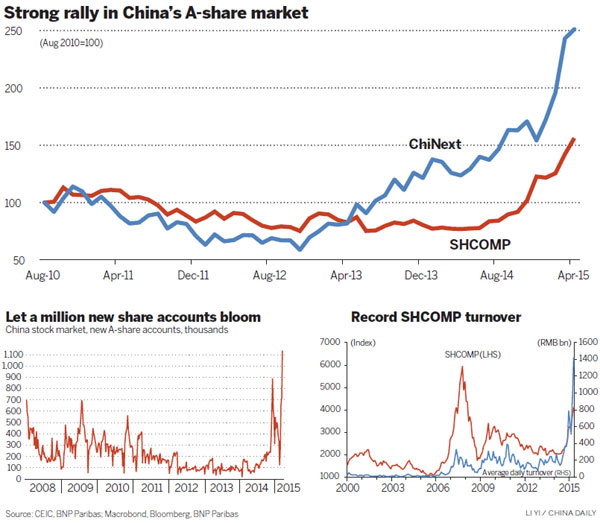

The Shanghai Composite Index, the country's main stock index, has recently been the fastest growing in the world and has doubled since July last year.

|

The Shanghai Stock Exchange building. The Shanghai Composite Index has doubled since July last year. Provided to China Daily |

|

Hao Hong, chief China strategist of Bocom International Holdings in Hong Kong . Edmond Tang / China Daily |

It rose by 1,000 points in February alone from 3,000 to 4,000 and stood at 4414.51 at close of trading on April 23.

Many investors around the world will have already noticed the impact of this on the pension and other investments that are exposed to the market through Asian or China-related funds.

Why China's market should have suddenly taken off is something of a paradox. Much of China's macro data over the past year has been relentlessly gloomy, particularly headline GDP growth, which hit a six-year low of 7 percent in the first quarter.

Few have been taken more by surprise by the sudden rise in the market than the Chinese themselves.

The equity market had become something of an open joke among many Chinese looking to invest their money, with its chart resembling that of a failing company or a dying patient. After peaking at 6124 in October 2007, it fell to below 2000 in 2012 and largely flatlined until the current bull run started last year.

The Chinese have been piling into property instead, sending values soaring. However, the focus of attention has now shifted to shares, according to some, because real estate prices nationwide have fallen, on average 6 percent over the past year.

The main bourses in Shanghai and Shenzhen, the southern Chinese megacity close to Hong Kong, are unusually dominated by small private investors because China lacks major investment institutions.

These make up some 70 percent of those who buy shares and other securities, in contrast to neighboring Hong Kong, where around 70 percent of the investors are institutions, which is also typical of the New York and London stock exchanges.

This, according to some, gives the market something of a casino feel with people literally gambling money.

Many private individuals have recently been borrowing money to invest in the market.

Some have even being selling second or third apartments they own to make a quick profit.

All this prompted the authorities to try to damp down speculation. The China Securities Regulatory Commission, which regulates the stock market, moved on April 17 to prohibit margin trading through so-called umbrella trusts, through which investors can borrow money to invest in shares.

It also announced on the same day after the markets closed that it would give the green light to short-selling (allowing investors to make money out of a falling market), which some saw as an attempt to take the froth off the market.

The moves came a day after the chairman of the commission, Xiao Gang, saying investors should "fully evaluate risk in stock market investment", which was interpreted by some media as him reasserting the principle that what goes up must come down.

The big question remains why China is having such a bull run when many of the companies listed on the Chinese stock markets are finding their earnings squeezed as a result of the slowing economy.

Helen Zhu, head of China equities at global asset manager BlackRock in Hong Kong, believes the runaway market optimism is a reflection of confidence in the government's determination to reform and rebalance the economy.

"I don't think the market would react like this if the government wasn't putting in fundamental changes that were sustainable and will not be reversed in future," she says.

"If you look at the past three to five years the economy was pretty buoyant, growing at between 7 and 10 percent, and the earnings growth of companies was in double digits as well. Yet until last year the market returns were actually quite muted. I think this was because investors were more worried about the quality rather than the quantity of growth. They thought the government was going to resort all the time to turning the tap on and off on credit growth and not take the fundamental measures it has."

Zhu Ning, deputy director of the Shanghai Advanced Institute of Finance, who was on a lecture trip to Tokyo, believes that a rising stock market is good news for the government so long as it does not overheat.

He believes the April 20 move by the People's Bank of China, the central bank, to cut the reserve requirement ratio by 100 basis points - increasing liquidity in the economy, some of which inevitably will end up in shares - reflects that.

"I think this suggests the government is very happy for the market to go up. The recent economic numbers have been so disappointing that you need some bright spot like this," he says.

"I think the general sentiment is that it will create a general wealth effect that will benefit the real economy by creating consumption and bringing activity back into the economy."

But why is all this happening, while the economy is going through a painful period of restructuring, moving toward being more consumption and services-led than relying on manufacturing and exports?

Western markets behaved similarly in the aftermath of the global financial crisis when stock markets soaked much of the money circulating as a result of quantitative easing, particularly since interest rates on deposits were near zero.

Chris Weston, chief market strategist, IG, the financial spread betting group, based in Melbourne, Australia, is one who believes there is nothing unusual about this.

"You show me a market out there that actually reflects economics. These are crazy times we live in. Everything that is going on has to some extent been controlled by central banks.

"There is a massive correlation between the Federal Reserve balance sheet and the S&P 500 Index and now the same thing is happening in China."

Frank Tian, investment manager at Aberdeen International Fund Managers, based in Hong Kong, believes there has been a disconnect between the real economy and the Chinese stock market for some time.

"I think it has always been there. GDP growth hasn't necessarily been reflected in the market. I think what triggered this particular upturn was the government's decision to lower interest rates in the second half of last year. That really turned sentiment around."

Chen Xingdong, chief China strategist at BNP Paribas, based in Beijing, says some of the market behavior has been perverse.

He cites April 13, when China's General Administration of Customs reported a 15 percent drop in exports in March compared with the previous year and the Shanghai Composite Index rose by 2.1 percent the same day.

"China's real economic performance has not only been lackluster, but is deteriorating. This isn't deterring vast swaths of investors, however, who seem happy to ignore China's poor economic data," he says.

What is alarming some observers are the valuations of some of Chinese smaller companies listed on ChiNext, China's equivalent of the Nasdaq. Some are trading with price to earnings ratios or PE, of more than 100 times.

China's bigger companies on the A-50 Index are trading at a more modest - but still relatively high - 40 to 50 times earnings.

Hao Hong, chief China strategist of Bocom International Holdings in Hong Kong, says it is the high values of the smaller companies that cause the most concern.

"The composition of the market is very different from the last time the market peaked, and that fell because then you don't have a very large representation of small caps.

"I would say the PEs of the larger caps are quite reasonable but the ChiNext ones are quite hefty," he says.

"Another big difference from the last time the market fell is that the stock market size is now some 40 trillion yuan (6.03 trillion euros, $6.45 trillion) plus, compared with 8 trillion when it was last at its peak. So you need five times as much money to push the market up."

Gary Liu, executive director of CEIBS Lujiazui Institute of International Finance in Shanghai, agrees it is difficult to make comparisons with the last time the market crashed.

"When we try to work out whether this is a bubble or not we cannot compare it with the past peak, that is not fair. The right way to measure the bubble is to simply look at the price earnings ratios, and you have to be concerned about companies on the ChiNext trading at more than 100 times earnings."

Liu is also worried the behavior of some listed companies resembles that of Enron, the US energy company that collapsed in 2001. It claimed massive revenues it did not have. A number of ChiNext companies have already been investigated.

"I am afraid there is a lot of financial cheating going on in the market," Liu says. "In some cases if you compare the average financial data before a company goes to IPO (initial public offering) and then afterward, you see a significant decrease in a company's performance.

"This to me is significant proof there is fraud going on. The problem is that the auditing firms in China are not fully independent and help companies to lie."

One of the factors behind the rise in the Shanghai Composite Index was the launch in November of the Stock Connect between Hong Kong and Shanghai, which has allowed global investors greater access to buy shares on the Shanghai market.

They could previously only invest through QFII (Qualified Foreign Insitutional Investors) and RQFII (Renminbi Qualified Foreign Institutional Investors) quotas. These have also been recently relaxed.

This has created a major arbitrage opportunity because some Chinese companies have dual listings, and their A-share listing in Shanghai has often been at discount to their H-share listing in Hong Kong. So investors have been buying up A shares and therefore closing the price differential between the separately listed shares.

"The reason for the gap in price was the restrictions in the quota with foreign investors needing a QFII quota," adds Tian at Aberdeen.

"If you look at the fundamentals, the shares are exactly the same but they are just listed in different places. This has been one of the factors in the rise of the Shanghai market."

The launch of Stock Connect has also created a "southbound channel" where mainland investors can invest more freely in Hong Kong. The Hang Seng index closed 2.7 percent up on a single day on April 9, reaching 26944.39, its highest level in seven years.

"The Connect channel has certainly been a key driver of positive sentiment in Hong Kong, and it has been very liquidity driven, which is essentially what you are seeing also on the mainland," Tian says.

"The underlying fundamental problem is that within the mainland investment opportunities remain fairly limited, whereas you have so many asset classes in Hong Kong. Until recently you have had all this money trapped in the mainland."

It is the slightly manic behavior of Chinese investors which has attracted a lot of attention.

In March alone a record 1.14 million A-share trading accounts were opened in one week, whereas for most of the past few years the number opened has ranged from just 100,000 to 200,000. There have been a number of similar big spikes this year.

"I have done a lot of work on behavioral aspects of finance, and it is quite clear that a lot of Chinese investors aren't familiar with concepts of investment," says Zhu at the Shanghai Advanced Institute of Finance.

"Many of them are often very young and know very little about the stock market. They pay very little attention to fundamentals but just how well the market is doing, and they just want a piece of the action."

Tian at Aberdeen says there is a risk of the markets becoming one big casino.

"There is a gambling culture in China and I say that as a Chinese. Whereas in developed markets you have got long-term professional investors, in China you have young people and even moms and pops gambling their retirement money. It is all deeply embedded in the culture."

All this is likely to create opportunities for institutions and professional investors because whatever the medium-term trajectory there will be short-term ups and downs as the market overshoots and undershoots as a result of this wild investor behavior.

There remains a debate as to whether the government does want to quell some of this excess with its recent moves against margin lending and encouraging selling earlier this month.

Zhu at BlackRock believes this is a fundamental misreading of what its intentions are.

"I don't think these are a short-term response to what is happening now. The reforms the government announced are more designed for the medium to long term. It is perhaps better to announce them in a bull market, rather than a bear one.

"I think this buoyant market actually suits the government. It allows private and other enterprises that have had limited access to financing to have access to other forms of capital and increase their options."

The big question is how long this bull run has to go before a major reverse or a bust.

Many observers believe that if listed companies can demonstrate they can deliver enhanced earnings despite the downturn of the economy through making their operations more efficient or taking advantage of competitors going by the wayside the run may have some way to go.

Chen at BNP Paribas is one who thinks we have not seen the end of the upward curve. "Sentiment is upbeat and investors are confident largely thanks to three main factors: ample liquidity, high expectations the government will undertake further policy easing to counter the deterioration of growth and a strong belief the financial risks are well under control."

Tian at Aberdeen also says he has a gut feeling the rally has quite a long way to go.

"I don't actually have a crystal ball as to whether the market will go up or down but my feeling is that this is a prolonged upward trend. I think there might be some 1,200-point downward adjustment at some point if the macro numbers are not looking good or there is a temporary problem with liquidity but I think it will continue to climb."

Zhu at the Shanghai Advanced Institute of Finance is not so sure. He is concerned that some 100 million Chinese have now opened A-share accounts, which is about the same figure as before the 2007 crash.

"It is the lack of sophistication of these retail investors that worries me. We could end up with some of the most highly valued securities in the world and there will be a lot of people facing huge losses if the market bursts."

However, Zhu at BlackRock, insists that what will ultimately drive the market will be when the investors worldwide develop the belief that the government's reform agenda is for real this time.

"You have to remember we are only at the beginning of this major reform agenda. I think there is quite a lot of skepticism out there among investors. Many who could invest in the market are still underweight in China.

"I think if the government sticks to this agenda and doesn't resort to short-term measures to re-accelerate growth, then the stock market could continue its run for a further three to five years."

andrewmoody@chinadaily.com.cn

( China Daily European Weekly 04/24/2015 page1)

Today's Top News

China and Russia to start search for Soviet soldiers' remains

Kim likely to visit Russia in May for war victory ceremony

Specialists discuss hot topics in China-EEC relations

Europe gaining importance in China's foreign investment

EU leaders to restore rescue operations after migrant boat disaster

EU, Cuba to hold political dialogue meeting in June

Britain celebrates Queen Elizabeth II 's 89th birthday

Cuban FM visits France over relations

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|